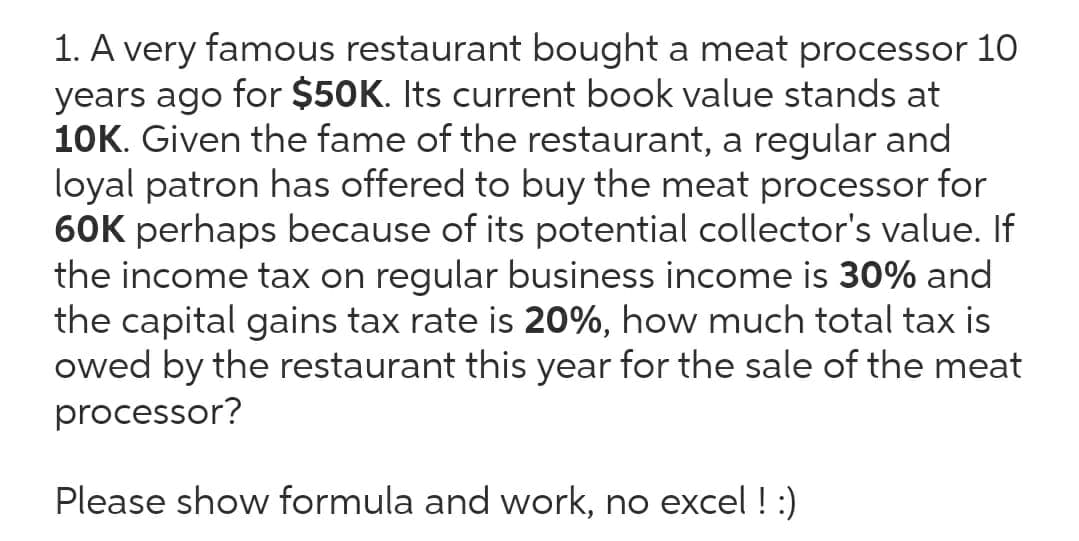

1. A very famous restaurant bought a meat processor 10 years ago for $50K. Its current book value stands at 10K. Given the fame of the restaurant, a regular and loyal patron has offered to buy the meat processor for 60K perhaps because of its potential collector's value. If the income tax on regular business income is 30% and the capital gains tax rate is 20%, how much total tax is owed by the restaurant this year for the sale of the meat processor? Please show formula and work, no excel ! :)

1. A very famous restaurant bought a meat processor 10 years ago for $50K. Its current book value stands at 10K. Given the fame of the restaurant, a regular and loyal patron has offered to buy the meat processor for 60K perhaps because of its potential collector's value. If the income tax on regular business income is 30% and the capital gains tax rate is 20%, how much total tax is owed by the restaurant this year for the sale of the meat processor? Please show formula and work, no excel ! :)

Principles of Microeconomics (MindTap Course List)

8th Edition

ISBN:9781305971493

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter12: The Design Of The Tax System

Section: Chapter Questions

Problem 2PA

Related questions

Question

Transcribed Image Text:1. A very famous restaurant bought a meat processor 1O

years ago for $50K. Its current book value stands at

10K. Given the fame of the restaurant, a regular and

loyal patron has offered to buy the meat processor for

60K perhaps because of its potential collector's value. If

the income tax on regular business income is 30% and

the capital gains tax rate is 20%, how much total tax is

owed by the restaurant this year for the sale of the meat

processor?

Please show formula and work, no excel ! :)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax