1. All of the following are assets except a. unearned revenue b. cash c equipment d. inventory 2. Entries recorded in the right side of any account are called. c. decreases a. increases 3. Credits are used to record a. decreases in liabilities c. increases in expenses b. credits d. debits b. decreases in owner's equity d. increases in income 4. The withdrawal account of a sole proprietorship is debited when a. the owner invest cash b. the owner withdraws cash c an expense is paid d. a liability is paid

1. All of the following are assets except a. unearned revenue b. cash c equipment d. inventory 2. Entries recorded in the right side of any account are called. c. decreases a. increases 3. Credits are used to record a. decreases in liabilities c. increases in expenses b. credits d. debits b. decreases in owner's equity d. increases in income 4. The withdrawal account of a sole proprietorship is debited when a. the owner invest cash b. the owner withdraws cash c an expense is paid d. a liability is paid

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter1: Starting A Proprietorship: Changes That Affect The Accounting Equation

Section1.2: How Business Activities Change The Accounting Equation

Problem 1WT

Related questions

Question

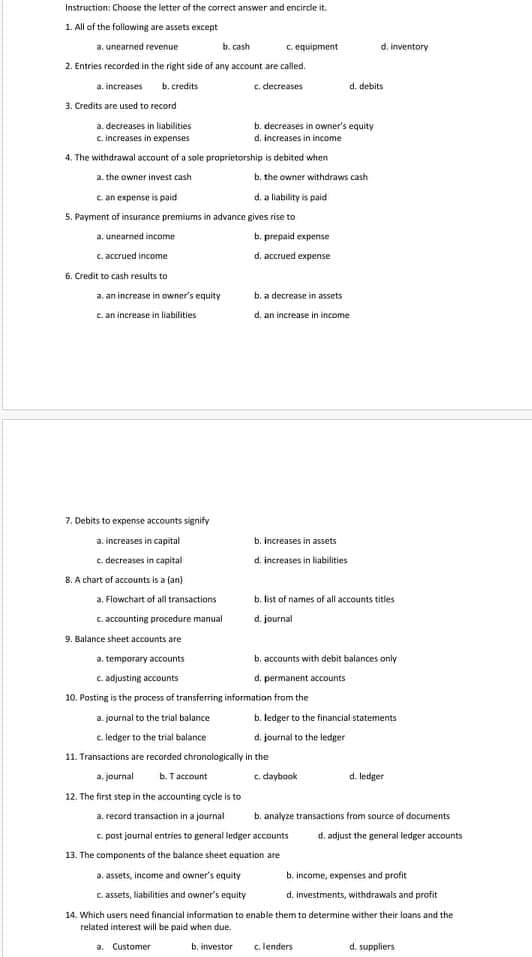

Transcribed Image Text:Instruction: Choose the letter af the correct answer and encirde it.

1. All of the following are assets except

a. unearned revenue

b. cash

C. equipment

d. inventory

2. Entries recorded in the right side of any account are called.

a. increases b. credits

c. decreases

d. debits

3. Credits are used to record

a. decreases in liabilities

b. decreases in owner's equity

d, increases in income

c. increases in expenses

4, The withdrawal account of a sole proprietorship is debited when

a. the owner invest cash

b, the owner withdraws cash

c an expense is paid

d. a liability is paid

5. Payment of insurance premiums in advance gives rise to

a, unearned income

b. prepaid expense

C. accrued income

d, accrued expense

6. Credit to cash results to

a. an increase in owner's equity

b, a decrease in assets

c. an increase in liabilities

d. an increase in income

7. Debits to expense accounts signify

a. increases in capital

b. increases in assets

c. decreases in capital

d. increases in liabilities

8. A chart of accounts is a (an)

a. Flowchart of all transactions

b. list of names of all accounts titles

c. accounting procedure manual

d. journal

9. Balance sheet accounts are

a. temporary accounts

b, accounts with debit balances only

c. adjusting accounts

d. permanent accounts

10. Posting is the process of transferring information from the

a. journal to the trial balance

b. ledger to the financial statements

c ledger to the trial balance

d. journal to the ledger

11. Transactions are recorded chronalogically in the

a, journal

b. Taccount

c. daybook

d. ledger

12. The first step in the accounting cycle is to

a. record transaction in a jaurnal

b. analyze transactions from source of documents

c. past journal entries to general ledger accounts

13. The components of the balance sheet equation are

d, adjust the general ledger accounts

a. assets, income and owner's equity

b. income, expenses and profit

c. assets, liabilities and owner's equity

d. investments, withdrawals and profit

14. Which users need financial information to enable them to determine wither their ioans and the

related interest will be paid when due.

a. Customer

b. investor

c. lenders

d. suppliers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning