1. As from 1 January 2021, it has been decided to decrease the price of meals by 5%, which is anticipated to result in a 10% increase in the volume of turnover for the year ending 31 December 2021. 2. Sixty percent (60%) of the kitchen and dining hall overheads are fixed, 55% of which are committed fixed costs. 3. Administrative expenses consist of the salaries of the administrative staff working in the catering service of the hotel, as well as costs of head office accounting staff and management, amounting to R90 000, that are allocated to the various hotels based on catering turnover. Due to the fact that the accounting staff at head office are responsible for the accounting records of more than one hotel, the latter cost will not cease to exist should the hotel catering service be terminated. The administrative staff working in the catering service of the hotel would have to be retrenched should the catering service be terminated. Selling expenses are fixed and include weekly advertisements in local newspapers and menus, which are all discretionary costs. An amount of R12 000 per annum, being part of the salary of the public relations officer of the hotel which is allocated to the catering service, is also included. Required: Advise the management of the hotel group on whether, purely from a profit point of view, the hotel staff should continue with the catering service or if the offer of Mrs Fusion should be accepted in the long term as well as in the short to medium term. State a reason for every cost item not taken into account.

1. As from 1 January 2021, it has been decided to decrease the price of meals by 5%, which is anticipated to result in a 10% increase in the volume of turnover for the year ending 31 December 2021. 2. Sixty percent (60%) of the kitchen and dining hall overheads are fixed, 55% of which are committed fixed costs. 3. Administrative expenses consist of the salaries of the administrative staff working in the catering service of the hotel, as well as costs of head office accounting staff and management, amounting to R90 000, that are allocated to the various hotels based on catering turnover. Due to the fact that the accounting staff at head office are responsible for the accounting records of more than one hotel, the latter cost will not cease to exist should the hotel catering service be terminated. The administrative staff working in the catering service of the hotel would have to be retrenched should the catering service be terminated. Selling expenses are fixed and include weekly advertisements in local newspapers and menus, which are all discretionary costs. An amount of R12 000 per annum, being part of the salary of the public relations officer of the hotel which is allocated to the catering service, is also included. Required: Advise the management of the hotel group on whether, purely from a profit point of view, the hotel staff should continue with the catering service or if the offer of Mrs Fusion should be accepted in the long term as well as in the short to medium term. State a reason for every cost item not taken into account.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:1.

As from 1 January 2021, it has been decided to decrease the price of meals by

5%, which is anticipated to result in a 10% increase in the volume of turnover for the year

ending 31 December 2021.

2.

Sixty percent (60%) of the kitchen and dining hall overheads are fixed, 55% of which are

committed fixed costs.

3.

Administrative expenses consist of the salaries of the administrative staff working in the

catering service of the hotel, as well as costs of head office accounting staff and

management, amounting to R90 000, that are allocated to the various hotels based on

catering turnover. Due to the fact that the accounting staff at head office are responsible for

the accounting records of more than one hotel, the latter cost will not cease to exist should

the hotel catering service be terminated. The administrative staff working in the catering

service of the hotel would have to be retrenched should the catering service be terminated.

Selling expenses are fixed and include weekly advertisements in local newspapers and

4.

menus, which are all discretionary costs. An amount of R12 000 per annum, being part of

the salary of the public relations officer of the hotel which is allocated to the catering

service, is also included.

Required:

Advise the management of the hotel group on whether, purely from a profit point of view, the hotel

staff should continue with the catering service or if the offer of Mrs Fusion should be accepted in the

long term as well as in the short to medium term. State a reason for every cost item not taken into

account.

![QUESTION TWO

[25]

Hilty Hotel is one of many hotels owned by a large hotel group. Guests are booked into the hotel

for accommodation only. All guests wanting to enjoy meals, arrange payment of the meals directly at

the dining hall.

In the past few months, head office has found that the catering service, which is currently being run

by hotel staff, appears to be incurring substantial losses, especially during out of season periods.

The catering service has traditionally been a profitable part of the hotel.

In an attempt at finding a solution, management of the hotel group are looking at the

possibility of contracting out the catering service of the hotel to a private person.

Mrs Fusion, a private caterer, has approached the management of the hotel offering to pay R5 000

rental per month to rent the kitchen and dining hall from the hotel. The offer, if accepted by the hotel,

will result in Mrs Fusion taking over the whole catering service, including the purchasing, the

preparation, the advertising and the selling of the food.

You have been supplied with the following information with regard to the catering service run by the

hotel staff for the year ended 31 December 20201

R

R

Food sales

900 000

Less Cost of sales

(800 000)

Direct groceries and supplies

440 000

Direct labour

264 000

Kitchen and dining hall overheads

96 000

Gross Profit

100 000

Less Expenses

(174 000)

Administration expenses

156 000

Selling expenses

18 000

Net Loss

(74 000)](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Feacce431-0bd8-438b-bc9b-5432d036b9a3%2Ff2acae26-a114-40e9-8546-5c7a4062d603%2F8m1wyo_processed.jpeg&w=3840&q=75)

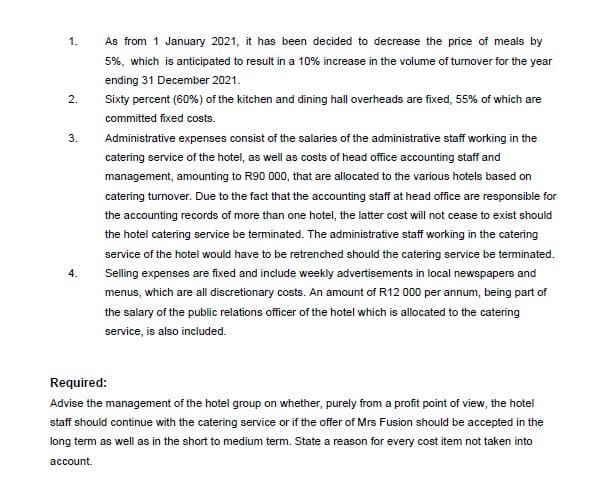

Transcribed Image Text:QUESTION TWO

[25]

Hilty Hotel is one of many hotels owned by a large hotel group. Guests are booked into the hotel

for accommodation only. All guests wanting to enjoy meals, arrange payment of the meals directly at

the dining hall.

In the past few months, head office has found that the catering service, which is currently being run

by hotel staff, appears to be incurring substantial losses, especially during out of season periods.

The catering service has traditionally been a profitable part of the hotel.

In an attempt at finding a solution, management of the hotel group are looking at the

possibility of contracting out the catering service of the hotel to a private person.

Mrs Fusion, a private caterer, has approached the management of the hotel offering to pay R5 000

rental per month to rent the kitchen and dining hall from the hotel. The offer, if accepted by the hotel,

will result in Mrs Fusion taking over the whole catering service, including the purchasing, the

preparation, the advertising and the selling of the food.

You have been supplied with the following information with regard to the catering service run by the

hotel staff for the year ended 31 December 20201

R

R

Food sales

900 000

Less Cost of sales

(800 000)

Direct groceries and supplies

440 000

Direct labour

264 000

Kitchen and dining hall overheads

96 000

Gross Profit

100 000

Less Expenses

(174 000)

Administration expenses

156 000

Selling expenses

18 000

Net Loss

(74 000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education