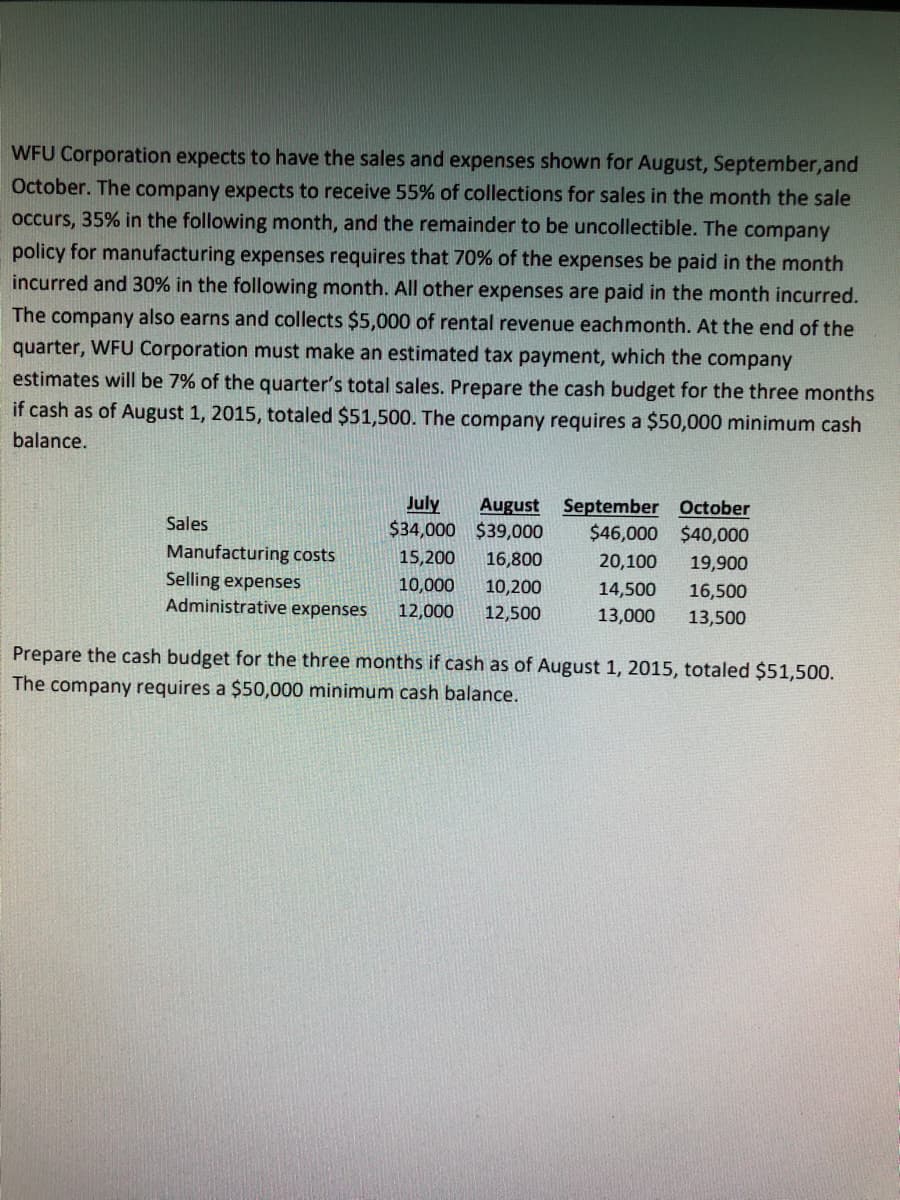

WFU Corporation expects to have the sales and expenses shown for August, September,and October. The company expects to receive 55% of collections for sales in the month the sale occurs, 35% in the following month, and the remainder to be uncollectible. The company policy for manufacturing expenses requires that 70% of the expenses be paid in the month incurred and 30% in the following month. All other expenses are paid in the month incurred. The company also earns and collects $5,000 of rental revenue eachmonth. At the end of the quarter, WFU Corporation must make an estimated tax payment, which the company estimates will be 7% of the quarter's total sales. Prepare the cash budget for the three months if cash as of August 1, 2015, totaled $51,500. The company requires a $50,000 minimum cash balance. July $34,000 $39,000 August September October $46,000 $40,000 Sales Manufacturing costs Selling expenses Administrative expenses 15,200 16,800 20,100 19,900 10,000 10,200 14,500 16,500 12,000 12,500 13,000 13,500 Prepare the cash budget for the three months if cash as of August 1, 2015, totaled $51,500. The company requires a $50,000 minimum cash balance.

WFU Corporation expects to have the sales and expenses shown for August, September,and October. The company expects to receive 55% of collections for sales in the month the sale occurs, 35% in the following month, and the remainder to be uncollectible. The company policy for manufacturing expenses requires that 70% of the expenses be paid in the month incurred and 30% in the following month. All other expenses are paid in the month incurred. The company also earns and collects $5,000 of rental revenue eachmonth. At the end of the quarter, WFU Corporation must make an estimated tax payment, which the company estimates will be 7% of the quarter's total sales. Prepare the cash budget for the three months if cash as of August 1, 2015, totaled $51,500. The company requires a $50,000 minimum cash balance. July $34,000 $39,000 August September October $46,000 $40,000 Sales Manufacturing costs Selling expenses Administrative expenses 15,200 16,800 20,100 19,900 10,000 10,200 14,500 16,500 12,000 12,500 13,000 13,500 Prepare the cash budget for the three months if cash as of August 1, 2015, totaled $51,500. The company requires a $50,000 minimum cash balance.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 15E: Palmgren Company produces consumer products. The sales budget for four months of the year is...

Related questions

Question

Transcribed Image Text:WFU Corporation expects to have the sales and expenses shown for August, September,and

October. The company expects to receive 55% of collections for sales in the month the sale

occurs, 35% in the following month, and the remainder to be uncollectible. The company

policy for manufacturing expenses requires that 70% of the expenses be paid in the month

incurred and 30% in the following month. All other expenses are paid in the month incurred.

The company also earns and collects $5,000 of rental revenue eachmonth. At the end of the

quarter, WFU Corporation must make an estimated tax payment, which the company

estimates will be 7% of the quarter's total sales. Prepare the cash budget for the three months

if cash as of August 1, 2015, totaled $51,500. The company requires a $50,000 minimum cash

balance.

July

$34,000 $39,000

August September October

$46,000 $40,000

Sales

Manufacturing costs

Selling expenses

Administrative expenses

15,200

16,800

20,100

19,900

10,000

10,200

14,500

16,500

12,000

12,500

13,000

13,500

Prepare the cash budget for the three months if cash as of August 1, 2015, totaled $51,500.

The company requires a $50,000 minimum cash balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning