Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter15: Aggregate Demand And Aggregate Supply

Section: Chapter Questions

Problem 1PA

Related questions

Question

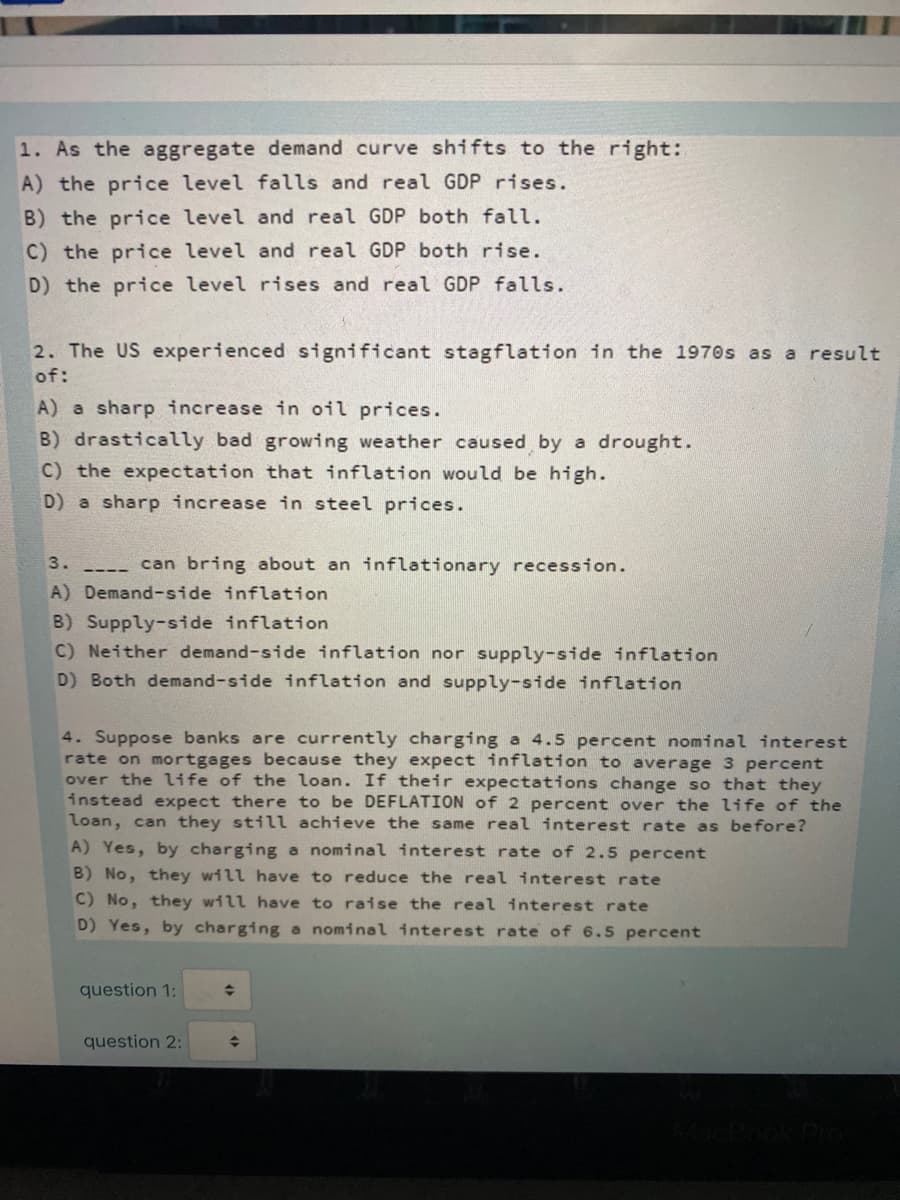

Transcribed Image Text:1. As the aggregate demand curve shifts to the right:

A) the price level falls and real GDP rises.

B) the price level and real GDP both fall.

C) the price level and real GDP both rise.

D) the price level rises and real GDP falls.

2. The US experienced significant stagflation in the 1970s as a result

of:

A) a sharp increase in oil prices.

B) drastically bad growing weather caused by a drought.

C) the expectation that inflation would be high.

D) a sharp increase in steel prices.

3.

can bring about an inflationary recession.

A) Demand-side inflation

B) Supply-side inflation

C) Neither demand-side inflation nor supply-side inflation

D) Both demand-side inflation and supply-side inflation

4. Suppose banks are currently charging a 4.5 percent nominal interest

rate on mortgages because they expect inflation to average 3 percent

over the life of the loan. If their expectations change so that they

instead expect there to be DEFLATION of 2 percent over the life of the

loan, can they still achieve the same real interest rate as before?

A) Yes, by charging a nominal interest rate of 2.5 percent

B) No, they will have to reduce the real interest rate

C) No, they will have to raise the real interest rate

D) Yes, by charging a nominal interest rate of 6.5 percent

question 1:

question 2:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning