1. Au-Yeung is a research analyst at BAMBOO, a registered broker/dealer and investment adviser. While employed with BAMBOO, Au-Yeung established Priority Trade Investments Limited and acts as that firm's investment adviser. Au-Yeung is responsible for formulating Priority's investment strategy and directs all trades on behalf of Priority. Over the course of several days, Au-Yeung purchases 50,000 shares of China- Pin stock and 1,978 China-Pin call options for his personal account at BAMBOO. Shortly thereafter, Au- Yeung uses $29.8 million of Priority's funds to purchase more than 3 million shares of China-Pin stock. A) Please discussion the following: . B) Explain whether each of I, II, III & IV below is correct or incorrect separately with respect to the relevant Standard. State the key points of the case that relate to the relevant Standard in your own words. Au-Yeung's actions are: acceptable because Au-Yeung's personal investments are not in conflict with the investment advice being given to his clients at Priority. acceptable as long as BAMBOO is aware of and consents to Au-Yeung establishing and working for Priority as a separate entity. III. acceptable as long as Priority clients are not negatively affected by Au-Yeung's prior purchase of China-Pin securities through his account at BAMBOO. IV. unacceptable. I. Which CFA Standard(s) of Professional Conduct do(es) the case relate to? II.

1. Au-Yeung is a research analyst at BAMBOO, a registered broker/dealer and investment adviser. While employed with BAMBOO, Au-Yeung established Priority Trade Investments Limited and acts as that firm's investment adviser. Au-Yeung is responsible for formulating Priority's investment strategy and directs all trades on behalf of Priority. Over the course of several days, Au-Yeung purchases 50,000 shares of China- Pin stock and 1,978 China-Pin call options for his personal account at BAMBOO. Shortly thereafter, Au- Yeung uses $29.8 million of Priority's funds to purchase more than 3 million shares of China-Pin stock. A) Please discussion the following: . B) Explain whether each of I, II, III & IV below is correct or incorrect separately with respect to the relevant Standard. State the key points of the case that relate to the relevant Standard in your own words. Au-Yeung's actions are: acceptable because Au-Yeung's personal investments are not in conflict with the investment advice being given to his clients at Priority. acceptable as long as BAMBOO is aware of and consents to Au-Yeung establishing and working for Priority as a separate entity. III. acceptable as long as Priority clients are not negatively affected by Au-Yeung's prior purchase of China-Pin securities through his account at BAMBOO. IV. unacceptable. I. Which CFA Standard(s) of Professional Conduct do(es) the case relate to? II.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter10: Decentralization: Responsibility Accounting, Performance Evaluation, And Transfer Pricing

Section: Chapter Questions

Problem 19E

Related questions

Question

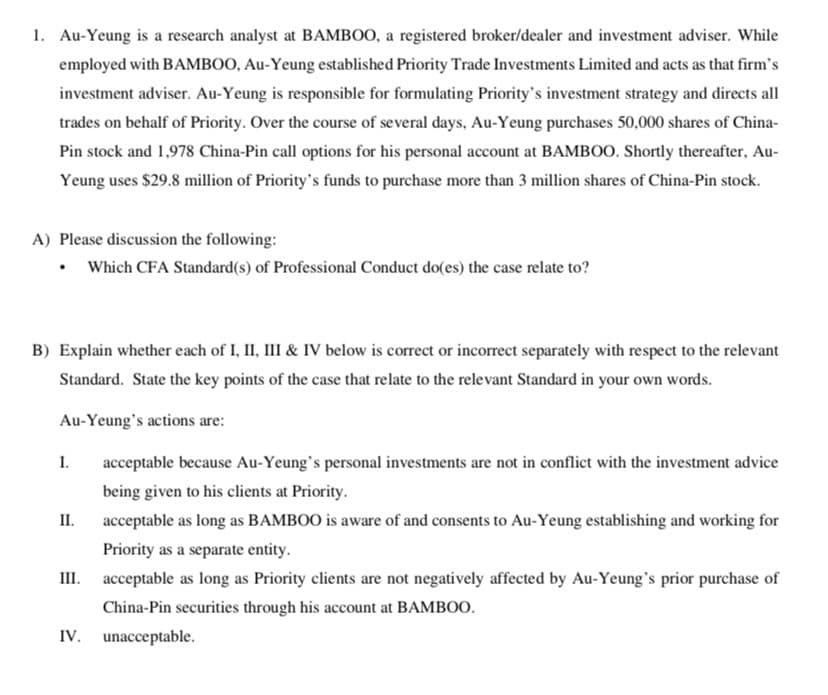

Transcribed Image Text:1. Au-Yeung is a research analyst at BAMBOO, a registered broker/dealer and investment adviser. While

employed with BAMBOO, Au-Yeung established Priority Trade Investments Limited and acts as that firm's

investment adviser. Au-Yeung is responsible for formulating Priority's investment strategy and directs all

trades on behalf of Priority. Over the course of several days, Au-Yeung purchases 50,000 shares of China-

Pin stock and 1,978 China-Pin call options for his personal account at BAMBOO. Shortly thereafter, Au-

Yeung uses $29.8 million of Priority's funds to purchase more than 3 million shares of China-Pin stock.

A) Please discussion the following:

• Which CFA Standard(s) of Professional Conduct do(es) the case relate to?

B) Explain whether each of I, II, III & IV below is correct or incorrect separately with respect to the relevant

Standard. State the key points of the case that relate to the relevant Standard in your own words.

Au-Yeung's actions are:

acceptable because Au-Yeung's personal investments are not in conflict with the investment advice

being given to his clients at Priority.

acceptable as long as BAMBOO is aware of and consents to Au-Yeung establishing and working for

Priority as a separate entity.

III. acceptable as long as Priority clients are not negatively affected by Au-Yeung's prior purchase of

China-Pin securities through his account at BAMBOO.

IV. unacceptable.

I.

II.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,