1. Calhoun Discount Drugs Sales: $382,000 Cost of goods sold: $106,000 Gross profit: ? Operating expenses: $129,000 Net profit: ? 3. Webb's Photo Shop Sales: $93,000 Cost of goods sold: $21,000 Gross profit: ? Operating expenses: $59,000 Net profit: ?

1. Calhoun Discount Drugs Sales: $382,000 Cost of goods sold: $106,000 Gross profit: ? Operating expenses: $129,000 Net profit: ? 3. Webb's Photo Shop Sales: $93,000 Cost of goods sold: $21,000 Gross profit: ? Operating expenses: $59,000 Net profit: ?

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 38E: Sundahl Companys income statements for the past 2 years are as follows: Refer to the information for...

Related questions

Question

1-8

Transcribed Image Text:Exercises

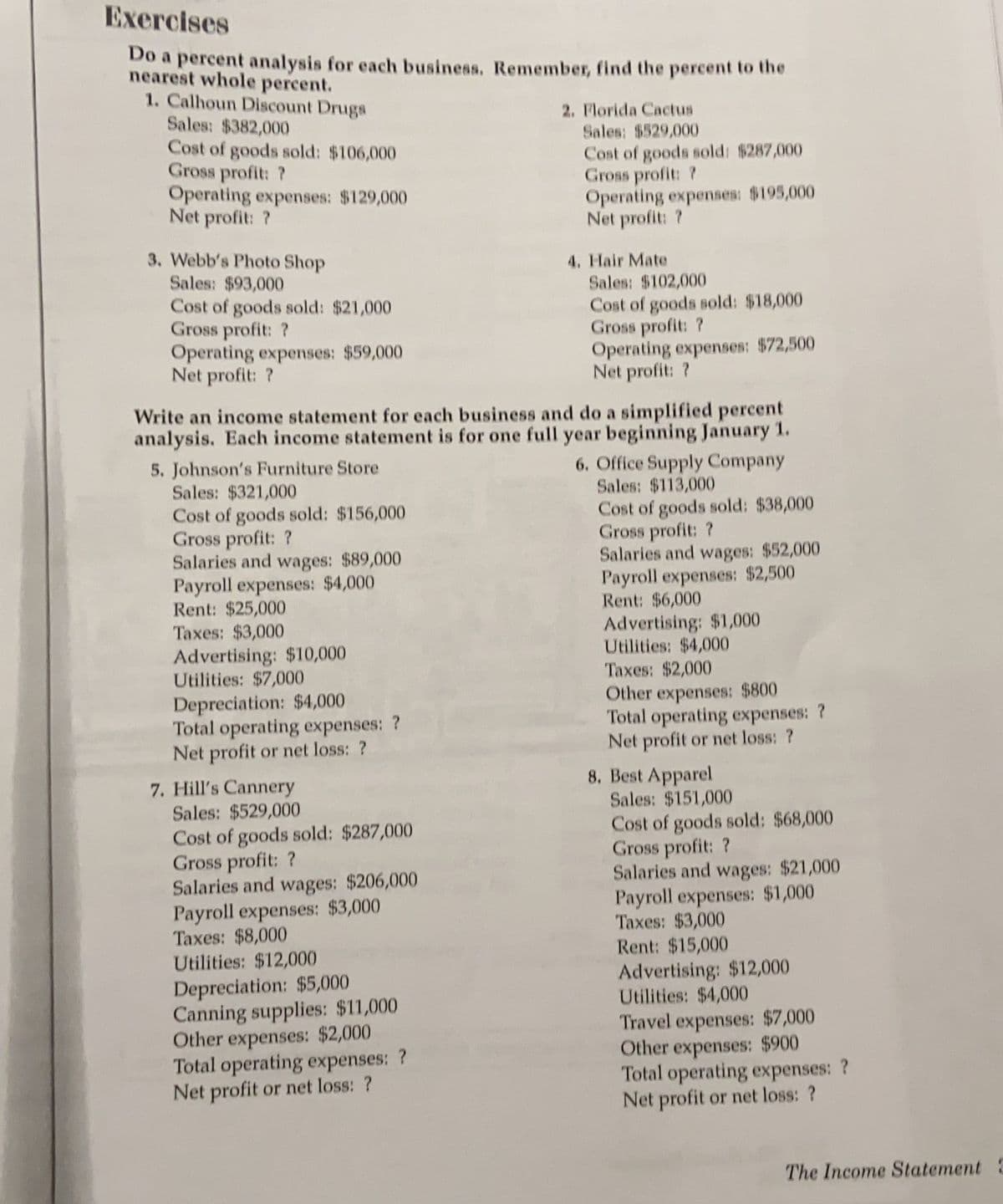

Do a percent analysis for each business. Remember, find the percent to the

nearest whole percent.

1. Calhoun Discount Drugs

Sales: $382,000

Cost of goods sold: $106,000

Gross profit: ?

Operating expenses: $129,000

Net profit: ?

2. Florida Cactus

Sales: $529,000

Cost of goods sold: $287,000

Gross profit: ?

Operating expenses: $195,000

Net profit: ?

3. Webb's Photo Shop

4. Hair Mate

Sales: $93,000

Sales: $102,000

Cost of goods sold: $21,000

Gross profit: ?

Operating expenses: $59,000

Net profit: ?

Cost of goods sold: $18,000

Gross profit: ?

Operating expenses: $72,500

Net profit: ?

Write an income statement for each business and do a simplified percent

analysis. Each income statement is for one full year beginning January 1.

6. Office Supply Company

5. Johnson's Furniture Store

Sales: $321,000

Sales: $113,000

Cost of goods sold: $156,000

Gross profit: ?

Salaries and wages: $89,000

Payroll expenses: $4,000

Rent: $25,000

Taxes: $3,000

Cost of goods sold: $38,000

Gross profit: ?

Salaries and wages: $52,000

Payroll expenses: $2,500

Rent: $6,000

Advertising: $1,000

Utilities: $4,000

Taxes: $2,000

Other expenses: $800

Total operating expenses: ?

Net profit or net loss: ?

Advertising: $10,000

Utilities: $7,000

Depreciation: $4,000

Total operating expenses: ?

Net profit or net loss: ?

8. Best Apparel

Sales: $151,000

7. Hill's Cannery

Sales: $529,000

Cost of goods sold: $287,000

Gross profit: ?

Salaries and wages: $206,000

Payroll expenses: $3,000

Taxes: $8,000

Utilities: $12,000

Cost of goods sold: $68,000

Gross profit: ?

Salaries and wages: $21,000

Payroll expenses: $1,000

Taxes: $3,000

Rent: $15,000

Advertising: $12,000

Utilities: $4,000

Depreciation: $5,000

Canning supplies: $11,000

Other expenses: $2,000

Total operating expenses: ?

Net profit or net loss: ?

Travel expenses: $7,000

Other expenses: $900

Total operating expenses: ?

Net profit or net loss: ?

The Income Statement

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College