1. Cardinal Financing lent an engineering company Php 500,000 to retrofit an environmentally unfriendly building. The loan is for 5 years at 10 % per year simple interest. How much money will the firm repay at the end of 5 years?

1. Cardinal Financing lent an engineering company Php 500,000 to retrofit an environmentally unfriendly building. The loan is for 5 years at 10 % per year simple interest. How much money will the firm repay at the end of 5 years?

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 21PROB

Related questions

Question

Answer please the topic is

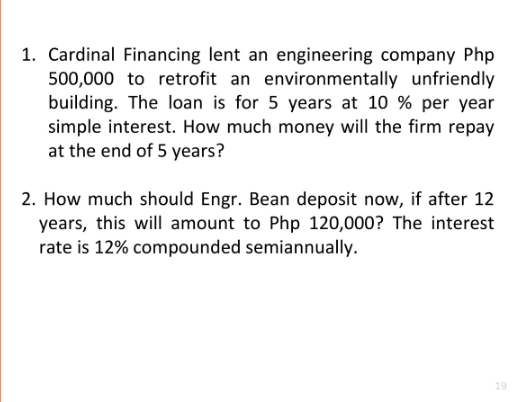

Transcribed Image Text:1. Cardinal Financing lent an engineering company Php

500,000 to retrofit an environmentally unfriendly

building. The loan is for 5 years at 10 % per year

simple interest. How much money will the firm repay

at the end of 5 years?

2. How much should Engr. Bean deposit now, if after 12

years, this will amount to Php 120,000? The interest

rate is 12% compounded semiannually.

19

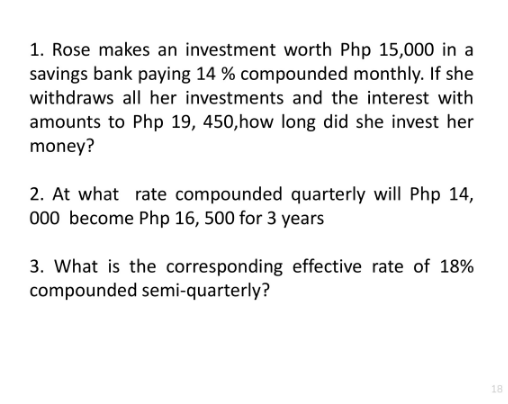

Transcribed Image Text:1. Rose makes an investment worth Php 15,000 in a

savings bank paying 14 % compounded monthly. If she

withdraws all her investments and the interest with

amounts to Php 19, 450,how long did she invest her

money?

2. At what rate compounded quarterly will Php 14,

000 become Php 16, 500 for 3 years

3. What is the corresponding effective rate of 18%

compounded semi-quarterly?

18

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning