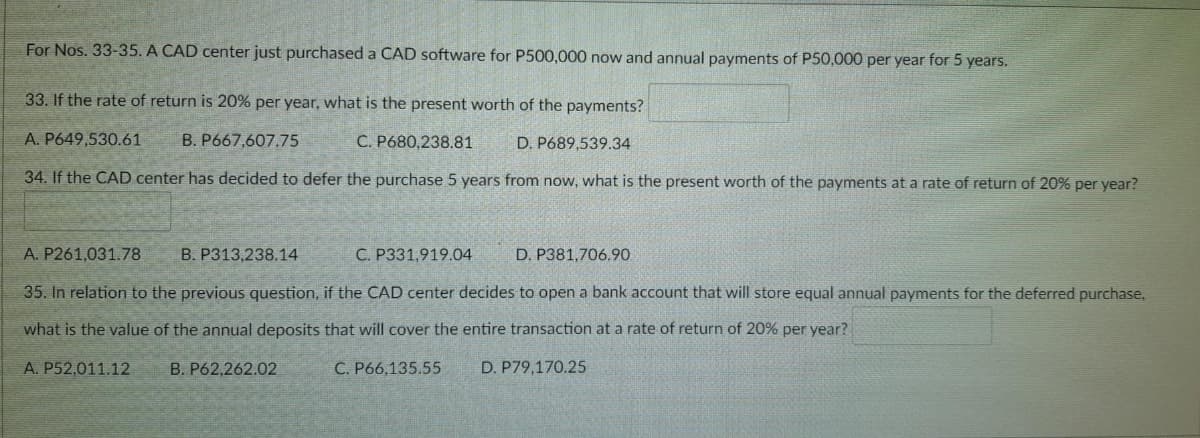

For Nos. 33-35. A CAD center just purchased a CAD software for P500,000 now and annual payments of P50,000 per year for 5 years. 33. If the rate of return is 20% per year, what is the present worth of the payments? A. P649,530.61 B. P667,607.75 C. P680,238.81 D. P689,539.34 34. If the CAD center has decided to defer the purchase 5 years from now, what is the present worth of the payments at a rate of return of 20% per year? A. P261,031.78 B. P313,238.14 C. P331,919.04 D. P381,706.90 35. In relation to the previous question, if the CAD center decides to open a bank account that will store equal annual payments for the deferred purchase, what is the value of the annual deposits that will cover the entire transaction at a rate of return of 20% per year? A. P52,011.12 B. P62,262.02 C. P66,135.55 D. P79,170.25

For Nos. 33-35. A CAD center just purchased a CAD software for P500,000 now and annual payments of P50,000 per year for 5 years. 33. If the rate of return is 20% per year, what is the present worth of the payments? A. P649,530.61 B. P667,607.75 C. P680,238.81 D. P689,539.34 34. If the CAD center has decided to defer the purchase 5 years from now, what is the present worth of the payments at a rate of return of 20% per year? A. P261,031.78 B. P313,238.14 C. P331,919.04 D. P381,706.90 35. In relation to the previous question, if the CAD center decides to open a bank account that will store equal annual payments for the deferred purchase, what is the value of the annual deposits that will cover the entire transaction at a rate of return of 20% per year? A. P52,011.12 B. P62,262.02 C. P66,135.55 D. P79,170.25

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 1PA: Your company is planning to purchase a new log splitter for is lawn and garden business. The new...

Related questions

Question

Please help me

Transcribed Image Text:For Nos. 33-35. A CAD center just purchased a CAD software for P500,000 now and annual payments of P50,000 per year for 5 years.

33. If the rate of return is 20% per year, what is the present worth of the payments?

A. P649,530.61

B. P667,607.75

C. P680,238.81

D. P689,539.34

34. If the CAD center has decided to defer the purchase 5 years from now, what is the present worth of the payments at a rate of return of 20% per year?

A. P261,031.78

B. P313,238.14

C. P331,919.04

D. P381,706.90

35. In relation to the previous question, if the CAD center decides to open a bank account that will store equal annual payments for the deferred purchase,

what is the value of the annual deposits that will cover the entire transaction at a rate of return of 20% per year?

A. P52,011.12

B. P62,262.02

C. P66,135.55

D. P79,170.25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT