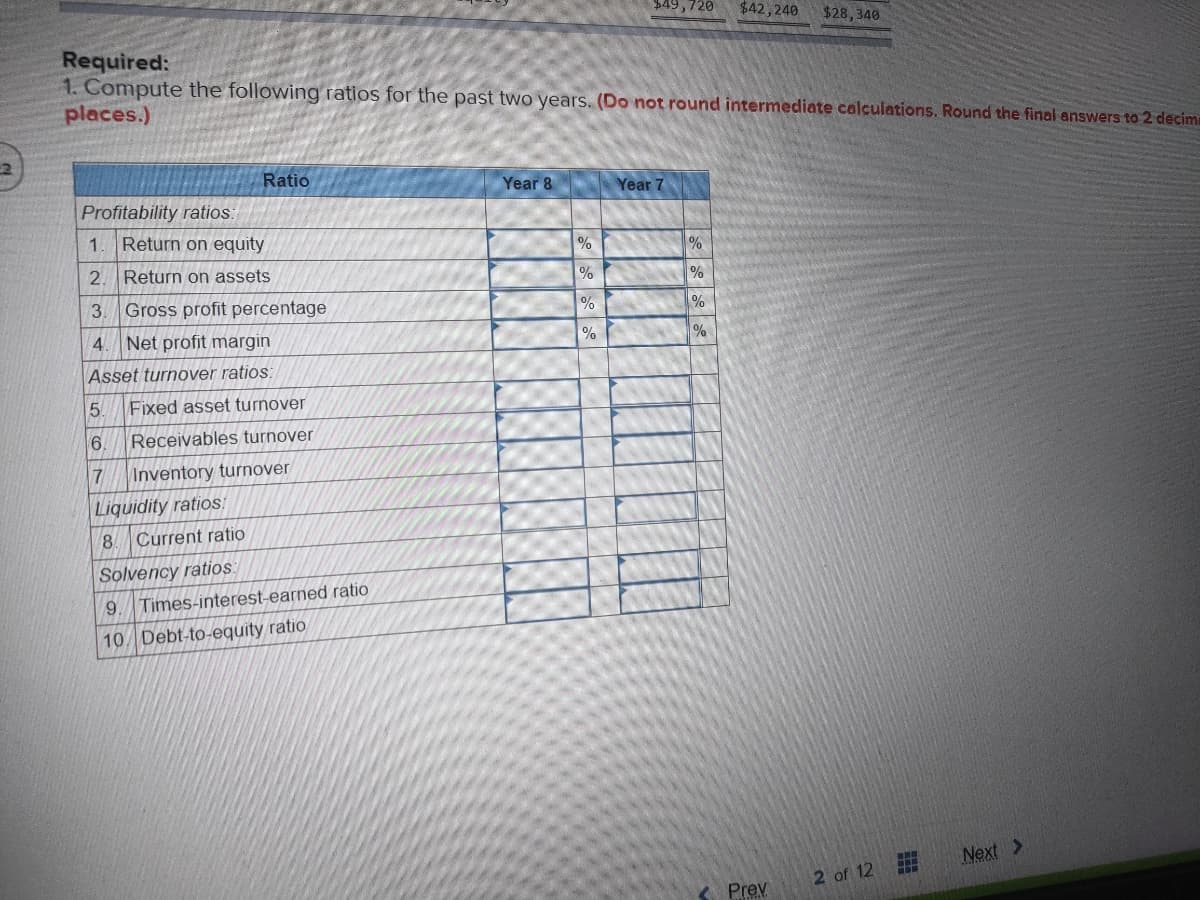

1. Compute the following ratios for the past two years. (Do not round intermediate calculations. Round the final answers places.) Ratio Year 8 Year 7 Profitability ratios: 1. Return on equity 2. Return on assets 3. Gross profit percentage 4. Net profit margin Asset turnover ratios: 5 Fixed asset turnover Receivables turnover 6 7 Inventory turnover Liquidity ratios 8 Current ratio % % % % % % % %

1. Compute the following ratios for the past two years. (Do not round intermediate calculations. Round the final answers places.) Ratio Year 8 Year 7 Profitability ratios: 1. Return on equity 2. Return on assets 3. Gross profit percentage 4. Net profit margin Asset turnover ratios: 5 Fixed asset turnover Receivables turnover 6 7 Inventory turnover Liquidity ratios 8 Current ratio % % % % % % % %

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter13: Financial Statement Analysis

Section: Chapter Questions

Problem 13.18MCE

Related questions

Question

Transcribed Image Text:$49,720 $42,240 $28,340

Required:

1. Compute the following ratios for the past two years. (Do not round intermediate calculations. Round the final answers to 2 decima

places.)

Ratio

Year 8

Year 7

Profitability ratios:

1. Return on equity

2. Return on assets

3. Gross profit percentage

4 Net profit margin

Asset turnover ratios:

5

6

7

Liquidity ratios!

8

Current ratio

Solvency ratios:

9. Times-interest-earned ratio

10 Debt-to-equity ratio

Next >

Fixed asset turnover

Receivables turnover

Inventory turnover

%

%

%

%

%

%

%

%

Prev

2 of 12

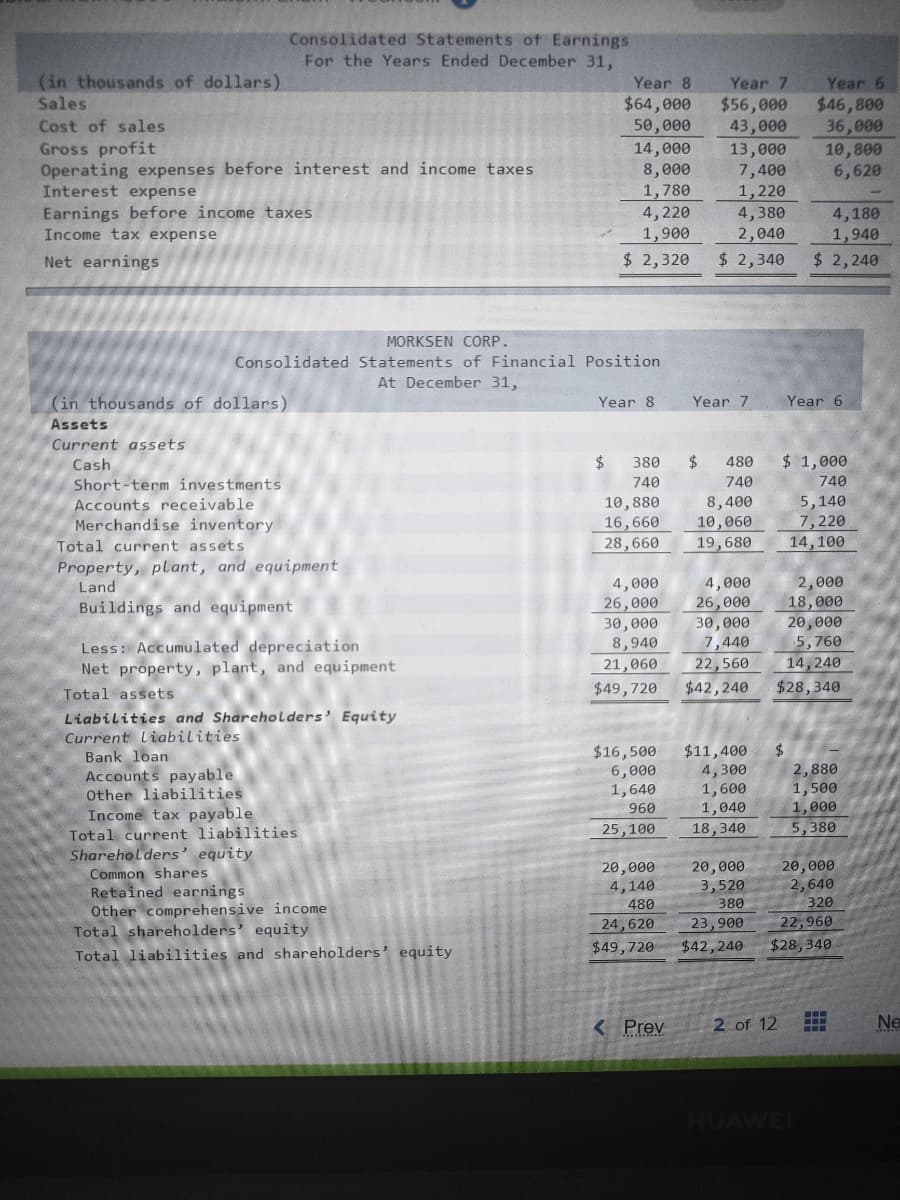

Transcribed Image Text:Consolidated Statements of Earnings

For the Years Ended December 31,

(in thousands of dollars)

Year 8

Sales

$64,000

Cost of sales.

50,000

Gross profit

14,000

Operating expenses before interest and income taxes

8,000

Interest expense

1,780

Earnings before income taxes

4,220

Income tax expense

1,900

Net earnings

$ 2,320

MORKSEN CORP.

Consolidated Statements of Financial Position

At December 31,

(in thousands of dollars)

Year 8

Year 7

Assets

Current assets

Cash

$ 480

$ 380

740

10,880

Short-term investments

Accounts receivable

740

8,400

Merchandise inventory

16,660

10,060

Total current assets

28,660 19,680

Property, plant, and equipment

Land

4,000

4,000

Buildings and equipment

26,000

26,000

30,000

30,000

8,940

7,440

Less: Accumulated depreciation.

Net property, plant, and equipment

21,060

22,560

Total assets

$49,720

$42, 240

Liabilities and Shareholders' Equity

Current Liabilities

Bank loan

$16,500

$11,400

Accounts payable

6,000

4,300

Other liabilities

1,640

1,600

Income tax payable

960

1,040

Total current liabilities

25,100

18,340

Shareholders' equity

mmon shares

20,000

20,000

Retained earnings

4,140

3,520

Other comprehensive income

380

480

24,620

Total shareholders' equity

23,900

Total liabilities and shareholders' equity

$49,720

$42,240

< Prev

Year 7

Year 6

$56,000

$46,800

43,000

36,000

13,000

10,800

7,400

6,620

1,220

4,380

4,180

2,040

1,940

$ 2,340 $ 2,240

Year 6

$1,000

740

5,140

7,220

14,100

2,000

18,000

20,000

5,760

14,240

$28,340

$

2,880

1,500

1,000

5,380

20,000

2,640

320

22,960

$28,340

2 of 12

Ne

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning