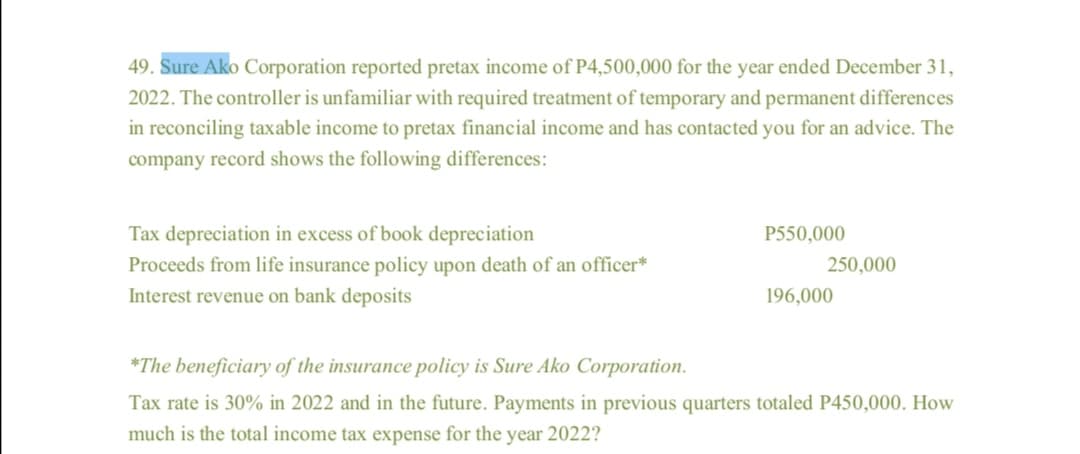

49. Sure Ako Corporation reported pretax income of P4,500,000 for the year ended December 31, 2022. The controller is unfamiliar with required treatment of temporary and permanent differences in reconciling taxable income to pretax financial income and has contacted you for an advice. The company record shows the following differences: Tax depreciation in excess of book depreciation P550,000 250,000 Proceeds from life insurance policy upon death of an officer* Interest revenue on bank deposits 196,000 *The beneficiary of the insurance policy is Sure Ako Corporation. Tax rate is 30% in 2022 and in the future. Payments in previous quarters totaled P450,000. How much is the total income tax expense for the year 2022?

49. Sure Ako Corporation reported pretax income of P4,500,000 for the year ended December 31, 2022. The controller is unfamiliar with required treatment of temporary and permanent differences in reconciling taxable income to pretax financial income and has contacted you for an advice. The company record shows the following differences: Tax depreciation in excess of book depreciation P550,000 250,000 Proceeds from life insurance policy upon death of an officer* Interest revenue on bank deposits 196,000 *The beneficiary of the insurance policy is Sure Ako Corporation. Tax rate is 30% in 2022 and in the future. Payments in previous quarters totaled P450,000. How much is the total income tax expense for the year 2022?

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 20CE

Related questions

Question

How much is the total income tax expense for the year 2022?

A. 1,381,200

B. 1,350,000

C. 1,051,200

D.1,216,200

Transcribed Image Text:49. Sure Ako Corporation reported pretax income of P4,500,000 for the year ended December 31,

2022. The controller is unfamiliar with required treatment of temporary and permanent differences

in reconciling taxable income to pretax financial income and has contacted you for an advice. The

company record shows the following differences:

Tax depreciation in excess of book depreciation

P550,000

250,000

Proceeds from life insurance policy upon death of an officer*

Interest revenue on bank deposits

196,000

*The beneficiary of the insurance policy is Sure Ako Corporation.

Tax rate is 30% in 2022 and in the future. Payments in previous quarters totaled P450,000. How

much is the total income tax expense for the year 2022?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning