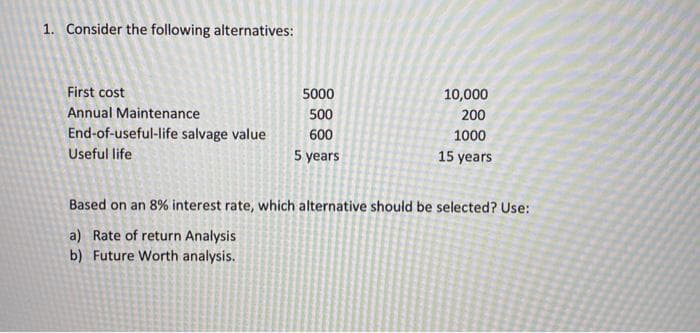

1. Consider the following alternatives: First cost 5000 10,000 Annual Maintenance 500 200 End-of-useful-life salvage value 600 1000 Useful life 5 years 15 years Based on an 8% interest rate, which alternative should be selected? Use: a) Rate of return Analysis b) Future Worth analysis.

Q: Please determine the present value of the total cost of the project for a given cash flow indicated…

A: The present value can be calculated by using this equation Present value =CF1-1(1+r)nr Where CF…

Q: Given a Project with the following data: First (initial) cost = JD 7000; Annual Operating cost= JD…

A: The following calculations are done to calculate the equivalent single value of the project.

Q: Determine the FW of the following engineering project when the MARR is 14% per year. Is the project…

A:

Q: Consider palletizer at a bottling plant that has a first cost of $134,338, has operating and…

A: Given data, Initial investment = $134,338 Operating and maintenance cots= $17,980 Net salvage value…

Q: Two alternatives have been identified. Alternative A has a first cost of $10,000 and benefits of…

A: Payback period: It can be defined as the time taken by an investment before it starts providing…

Q: Consider a new machine at a packaging plant that has a first cost of $100000, operating and…

A: The annual cost of owning, operating, and maintaining an asset is the same as the annual cost of…

Q: Blue Spruce, Inc. is considering purchasing equipment costing $84000 with a 6-year useful life. The…

A: The question is multiple choice question and related with Capital Budgeting. Required Choose the…

Q: The expected average rate of return for a proposed investment of $6,000,000 in a fixed asset, using…

A: SOLUTION- Avg. rate of return= Avg. Annual income/ Avg. Investment Avg. Investment= cost +…

Q: Determine the B/C ratio for the following project. First Cost P100, 000 Project life, years 5…

A: Benifits = present value of cash inflows Net annual cash inflows = 60000 - 22000 = 38000 PV of…

Q: You are looking at an investment which has an initial cost of $400,000 and a salvage value of zero…

A: Average accounting return is calculated by dividing average net income by average investment.…

Q: Consider the following altematives for a heating system: Alternative A: Rent a heating system at a…

A: Here, Here, we will use Net Present Worth to choose the best alternative.

Q: Some particulars for a project are as follows. Initial Capital Cost in year 0 ($Mn) Follow-up…

A: The overall cost of an asset across its life cycle, including original capital expenses, maintenance…

Q: You are given the following estimated information about a proposed project: Investment cost $ 66,000…

A: Economic life of the project means the duration for which the project will remain operational.…

Q: Evaluate the two alternatives A and B and decide the economic justified alternative using: Present…

A: Investment appraisal is the branch of financial management which deals with evaluating potential…

Q: A project with 10-year life requires an initial investment of $30000. The annual cost of the project…

A: Initial investment (I) = $30000 CF1 to CF4 = $17500 - $6300 = $11200 CF5 = $17500 - $6300 - $8000 =…

Q: In comparing alternatives, I and J by the present worth method, the equation that yields the present…

A: Present worth will be the difference between total present worth of cash inflows and total present…

Q: For the cash flows shown, use an annual worth comparison and an interest rate of 8% per year and…

A: Annual worth is the equivalent & uniform annual value of all the cash flows of an investment.

Q: Calculate the rate of return for an investment that meets the criteria listed below: initial cost…

A: Internal Rate of Return ( IRR) is a Capital budgeting technique which help decision making and also…

Q: Please determine the present value of the project for a given cash flow indicated below using the…

A: Present value of the project is the present worth of future cashflows

Q: An investment project requires an initial expenditure of $160 000.00 with a salvage value of $30…

A: Calculate NPV of the project to determine whether project should be undertaken or not.

Q: A project requires you to invest $10,000 now, will generate annual revenues of $1500 for 10 years…

A: Capital budgeting techniques are the methods that are used to evaluate various alternatives of…

Q: A project requires you to invest $10,000 now, will generate annual revenues of $1500 for 10 years…

A: Present worth (PW) is a capital budgeting approach that helps in evaluating and comparing the…

Q: Determine the annual cost of a structure that requires P15M to build with a salvage value of P2M…

A: The annual cost will be the estimate of the equal periodic cost throughout the life of the project

Q: In comparing alternatives, I and J by the present worth method, the equation that yields the present…

A: Given in this question is the information regarding the Alternatives I and J . capitalized worth…

Q: Para Co. is reviewing the following data relating to an energy saving investment proposal: Cost…

A: The projected worth of a fixed asset after the end of its lease term or usable life is known as the…

Q: expenses is P6T. I

A: Initial cost (C) = P 120000 Salvage value (S) = P 20000 Annual profit (P) = P 40000 - P 6000 = P…

Q: What is the value of the FW for an alternative which is at an interest rate of 8% per year if first…

A: Future Worth Analysis is the method for determining the future value of present cash flows invested…

Q: Consider the following two investment alternatives. Determine the range of investment costs for…

A: Annual Worth analysis is the estimation of discounted cash flows generated or incurred over the…

Q: 10. Choose the best alternative among the three alternatives given in the table below. Use of annual…

A: Equivalent Annual Cost = Annual worth Benefit – Annual Worth of cost. Annual worth is calculated…

Q: Compare the alternatives C and D on the basis of a present worth analysis using an interest rate of…

A: The calculation is:

Q: Determine the FW of the following engineering project when the MARR is 16% per year. Is the project…

A: The future worth analysis is a kind of quantitative analysis that helps in evaluating the capital…

Q: Calculate the present worth of a machine which costs $74000 initially and will have a $14000 salvage…

A: Present of operating cost is calculated by present value of growing annuity. Effective annual rate…

Q: Compare the alternatives C and D on the basis of a present worth analysis using an in rate of 10%…

A: Alternate C Year Cash flow PVF @10% PVCF 1 11,000.0 0.9091 10,000.00 2…

Q: Compare the alternatives C and D on the basis of a present worth analysis using an interest rate of…

A: Present Worth of any project is combined present value(PV) of all costs related to that project…

Q: Two mutually exclusive alternatives have the estimates shown below. Use annual worth analysis to…

A: Mutual exclusive alternative: The first stage in doing an economic analysis of two or more…

Q: If produced by Plan A, a producer’s initial capital cost will be $120,000, its annual operating cost…

A: NPV or PW means PV of net benefits which will be arises from the project in coming years. It is…

Q: With the estimates shown below, Sarah needs to determine the trade-in (replacement) value of machine…

A: We need to find the value of the annual worth of machine Y equivalent annual cost (EAC) of cost…

Q: Compare the alternatives C and D on the basis of a present worth analysis using an interest rate of…

A: Interest rate = 15% Study period = 10 years

Q: Consider the six indivisible investment alternatives shown below. The planning horizon is 8 years.…

A: A B C D E F Year Cash Flow Cash Flow Cash Flow Cash Flow Cash Flow Cash Flow 0 -8000 -15,000…

Q: Pina Colada, Inc. is considering purchasing equipment costing $42000 with a 6-year useful life. The…

A: Net present value is an investment analysis technique based on the time value of money. It is…

Q: 2. Data for two alternatives are as follows: Alternative A Investment P 35,000 Annual Benefits…

A: The IRR help in evaluating the profitability of the potential investment. It provides insight into…

Q: Compare the following investment alternatives using PW analysis and an annual interest rate of %12,…

A: Effective interest rate is the one which caters the compounding periods during a payment plan. It is…

Q: Consider the following alternatives: B Initial cost $300000 $400000 $700000 Life 5 years 7 yeаrs 13…

A: Project A Initial cost = $300000 Life=5 Project B Initial cost=$400000 Life=7 Project C Initial…

Q: Alternative R has a first cost of $94,000, annual M&O costs of $66,000, and a $20,000 salvage value…

A: Introduction:- An alternative cost is a probable benefit that could have been acquired but wasn’t…

Q: Determine the B/C ratio for the following project. First Cost = P100, 000 Project life, years = 5…

A: B/C ratio means present value of benefits divided by the Present value of costs. B/C ratio = Present…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Compare the following alternatives based on the rate of return analysis assuming that the MAAR is 15% per year. Project A Project B Initial Cost $60.000 $90.000 Annual cost of operation 15.000 8.000 Annual cost of reparation 5.000 2.000 Annual increase of the repair 1.000 1.500 Salvage value 8.000 12.000 Life, years 15 15Compare the following alternatives based on the equivalent uniform annual value analysis, using a 15% annual interest rate with continuous capitalization. Alternative A Alternative B Initial Cost $18000 $25000 Annual Cost $4000 $3600 Salvage Value $3000 $2500 Life (years) 3 4Two alternatives are being considered for installation. Which should be selected based on an interest rate of 5.6% per year ? Alternative A Alternative B First Cost, $ 135,000 462,000 Annual Operating Cost, $/yr 76,000 34,600 Salvage value, $ 71,200 n/a Life, years 9 ∞

- Three mutually exclusive projects are being considered.First cost 2000 3000 4000uniform annual benefit 200 300 0salvage value 1000 2700 5600useful life in years 5 6 7when each project reached the end of its useful life, it would be sold for its salvage value and there would be no replacement. if 8% is the desired rate of return, which project should be selected? use future worth analysis.A firm is considering three mutually exclusive alternatives as a part of an upgrade to an existing transportation network. If the MARR is 10% per year, which alternative(if any) should be chosen using the IRR analysis procedure? Use trial & error and show your calculations. A B C Initial Cost 40000 30000 20000 Annual Revenue 10400 8560 7750 Annual Cost 4000 3000 2500 Salvage Value 3000 2500 2000 Useful Life 20 20 10Compare the alternatives C and D on the basis of a present worth analysis using an interest rate of 10% per year and a study period of 10 years. Alternative C D First cost, $ −40,000 −32,000 AOC, $/year −7,000 −3,000 Annual increase in operating cost, $/year −1,000 — Salvage value, $ 9,000 500 Life, years 10 5

- Compare two alternatives, A and B, on the basis of a present worth evaluation using i = 10% per year and a study period of 8 years. Alternative A B First cost, $ −15,000 −28,000 Annual operating cost, $/year −6,000 −9,000 Overhaul in year 4, $ — −2000 Salvage value, $ 3,000 5,000 Life, years 4 8Alternative X has a first cost of 19000 an annual operating cost of 3500 , and a salvage value of 5325 after 18 year. Alternative Y has a first cost of 20000 an annual operating cost of 3600 , and a salvage value of 7800 after 18 year. If MARR of 18% per year, approximately what is the PW of each alternative?Pina Colada, Inc. is considering purchasing equipment costing $42000 with a 6-year useful life. The equipment will provide annual cost savings of $12000 and will be depreciated straight-line over its useful life with no salvage value. Pina Colada requires a 10% rate of return. Present Value of an Annuity of 1 Period 8% 9% 10% 11% 12% 15% 6 4.623 4.486 4.355 4.231 4.111 3.784 What is the approximate net present value of this investment? A. $30000 B. $11832 C. $8772 D. $10260

- Three machines are being considered for purchase. If the interest rate is 10%, which machine should be bought? a) Select the best alternative using annual worth analysis. b) Select the best alternative using present worth analysis. A B CInitial cost 150000 210000 300000 Annual operating cost 20000 15000 8000 Repairs will have to be made every 5 years 20000 50000 38000 Salvage value 40000 60000 80000 Useful life 10 years 15 years 20 years5. A mechanical engineer is considering two machines for a lathe. Machine A will have an initial cost of $82,000, annual maintenance and operating (M&O) costs of $32,000, and a salvage value of $60,000. Machine B will have an initial cost of $97,000, annual M&O costs of $27,000, and a salvage value of $30,000. Which alternative should be chosen based on a comparison of future value with an interest rate of 15% per year? Use a 3 year study period A. Machine A B. B machine C. Both alternatives are equally profitable D. There is no economically feasible solution if the alternatives are mutually exclusive Please solve based the option max 20 minutes ASAPColaw Company is considering buying equipment for $240,000 with a useful life of five years and an estimated salvage value of $12,000. If annual expected income is $21,000, the denominator in computing the annual rate of return is Group of answer choices $120,000. $252,000. $240,000. $126,000.