Alternative Initial Investment Annual Return Salvage Value M $8,000 $3,200 $1,000 N $15,000 $4,750 $1,750 $10,000 $3,070 $1,100 $20,000 $5,950 $2,000 Q $19,000 $5,150 $2,100 R $12,000 $4,250 $1,200

Alternative Initial Investment Annual Return Salvage Value M $8,000 $3,200 $1,000 N $15,000 $4,750 $1,750 $10,000 $3,070 $1,100 $20,000 $5,950 $2,000 Q $19,000 $5,150 $2,100 R $12,000 $4,250 $1,200

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 5BE

Related questions

Question

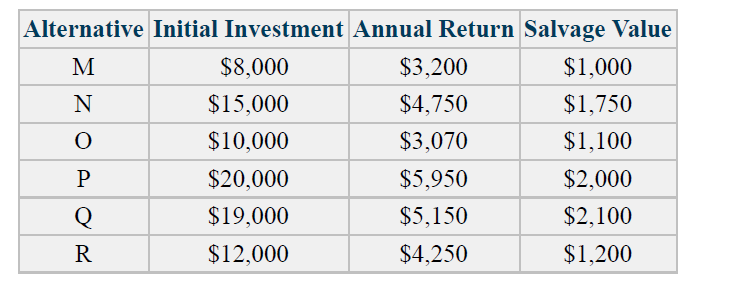

Consider the six indivisible investment alternatives shown below. The planning horizon is 8 years. The MARR is 15%. $60,000 is available for investment. a. Which investments should be made in order to maximize present worth? b. Solve part a when investments N and P are mutually exclusive and R is contingent on Q.

Transcribed Image Text:Alternative Initial Investment Annual Return Salvage Value

M

$8,000

$3,200

$1,000

N

$15,000

$4,750

$1,750

$10,000

$3,070

$1,100

$20,000

$5,950

$2,000

Q

$19,000

$5,150

$2,100

R

$12,000

$4,250

$1,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub