1. Consider the monthly sales data given in Table 1. Month Sales (in thousands) Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 1212 1321 1278 1341 1257 1287 1189 1111 1145 1150 1298 1331 These are monthly sales (in thousands of dollars) for a one-year period. Sales forecasts for the next several months are needed in order to plan for raw material purchases, factory labour and plant equipment utilization and financial projections. The simplest forecasts based on past data would be to calculate the average monthly sales and us that average value ($1243.33) as a forecast for future months. However, as time passes

1. Consider the monthly sales data given in Table 1. Month Sales (in thousands) Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 1212 1321 1278 1341 1257 1287 1189 1111 1145 1150 1298 1331 These are monthly sales (in thousands of dollars) for a one-year period. Sales forecasts for the next several months are needed in order to plan for raw material purchases, factory labour and plant equipment utilization and financial projections. The simplest forecasts based on past data would be to calculate the average monthly sales and us that average value ($1243.33) as a forecast for future months. However, as time passes

College Algebra

7th Edition

ISBN:9781305115545

Author:James Stewart, Lothar Redlin, Saleem Watson

Publisher:James Stewart, Lothar Redlin, Saleem Watson

Chapter5: Systems Of Equations And Inequalities

Section: Chapter Questions

Problem 14P: Annual interest yield refer to problem 13 .suppose the investor decides to increase the maximum...

Related questions

Question

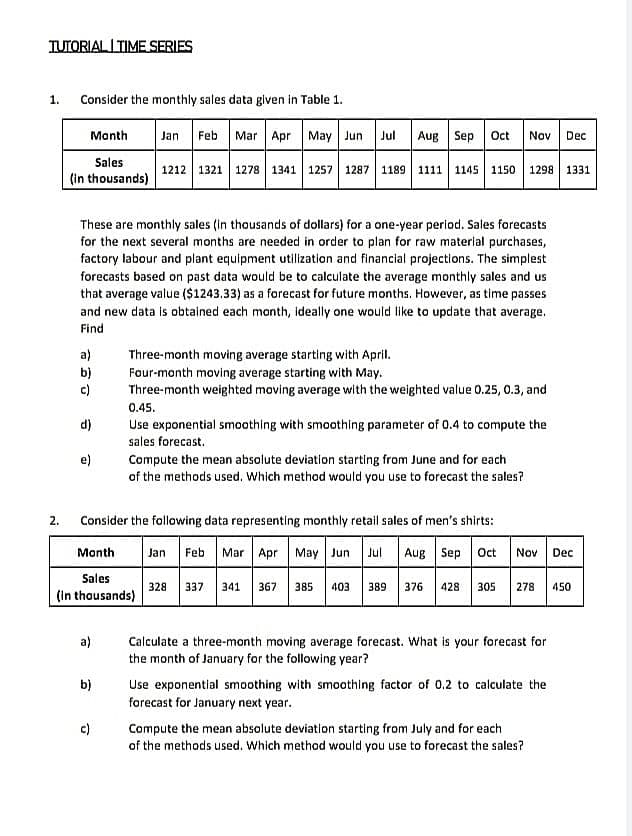

Transcribed Image Text:TUTORIAL I TIME SERIES

1.

Consider the monthly sales data given in Table 1.

2.

Month

Sales

(in thousands)

a)

b)

c)

d)

These are monthly sales (in thousands of dollars) for a one-year period. Sales forecasts

for the next several months are needed in order to plan for raw material purchases,

factory labour and plant equipment utilization and financial projections. The simplest

forecasts based on past data would be to calculate the average monthly sales and us

that average value ($1243.33) as a forecast for future months. However, as time passes

and new data is obtained each month, ideally one would like to update that average.

Find

e)

a)

Jan Feb Mar Apr May Jun Jul Aug Sep Oct

b)

c)

1212 1321 1278 1341 1257 1287 1189 1111 1145 1150 1298 1331

Consider the following data representing monthly retail sales of men's shirts:

Month

Sales

(in thousands)

Nov Dec

Three-month moving average starting with April.

Four-month moving average starting with May.

Three-month weighted moving average with the weighted value 0.25, 0.3, and

0.45.

Use exponential smoothing with smoothing parameter of 0.4 to compute the

sales forecast.

Compute the mean absolute deviation starting from June and for each

of the methods used. Which method would you use to forecast the sales?

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

328 337 341 367 385 403 389 376 428 305 278 450

Calculate a three-month moving average forecast. What is your forecast for

the month of January for the following year?

Use exponential smoothing with smoothing factor of 0.2 to calculate the

forecast for January next year.

Compute the mean absolute deviation starting from July and for each

of the methods used. Which method would you use to forecast the sales?

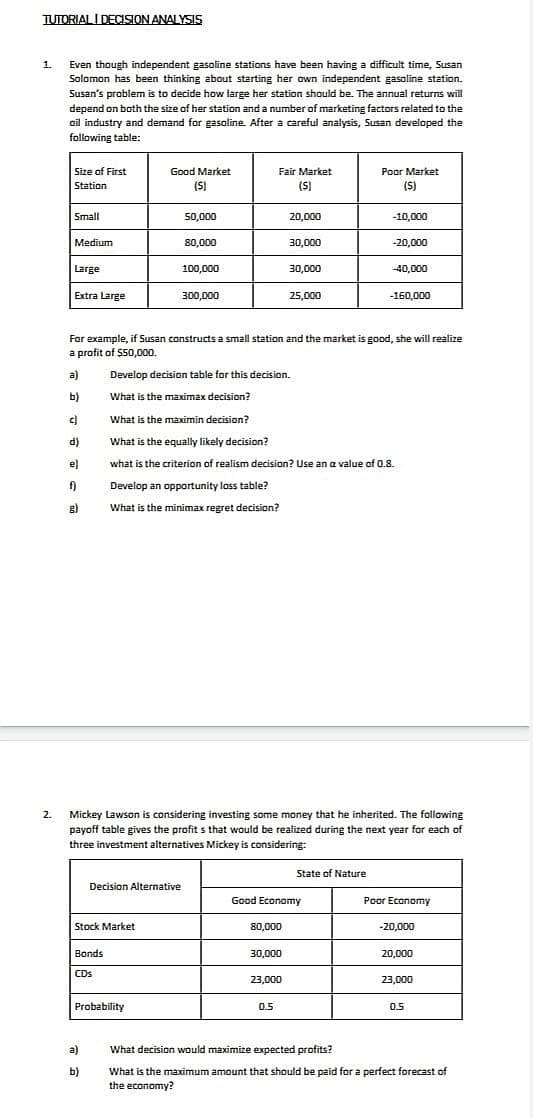

Transcribed Image Text:TUTORIAL I DECISION ANALYSIS

1.

2.

Even though independent gasoline stations have been having a difficult time, Susan

Solomon has been thinking about starting her own independent gasoline station.

Susan's problem is to decide how large her station should be. The annual returns will

depend on both the size of her station and a number of marketing factors related to the

oil industry and demand for gasoline. After a careful analysis, Susan developed the

following table:

Size of First

Station

Small

Medium

Large

Extra Large

cl

d)

e)

f)

Stock Market

Good Market

(S)

Bonds

CDs

Decision Alternative

Probability

a)

b)

50,000

80,000

100,000

300,000

Fair Market

(S)

For example, if Susan constructs a small station and the market is good, she will realize

a profit of $50,000.

a)

Develop decision table for this decision.

b)

What is the maximax decision?

What is the maximin decision?

What is the equally likely decision?

what is the criterion of realism decision? Use an a value of 0.8.

Develop an opportunity loss table?

What is the minimax regret decision?

80,000

20,000

30,000

30,000

Mickey Lawson is considering investing some money that he inherited. The following

payoff table gives the profits that would be realized during the next year for each of

three investment alternatives Mickey is considering:

23,000

0.5

30,000

25,000

Good Economy

Poor Market

(S)

State of Nature

-10,000

-20,000

-40,000

-160,000

Poor Economy

-20,000

20,000

23,000

0.5

What decision would maximize expected profits?

What is the maximum amount that should be paid for a perfect forecast of

the economy?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps with 13 images

Recommended textbooks for you

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning