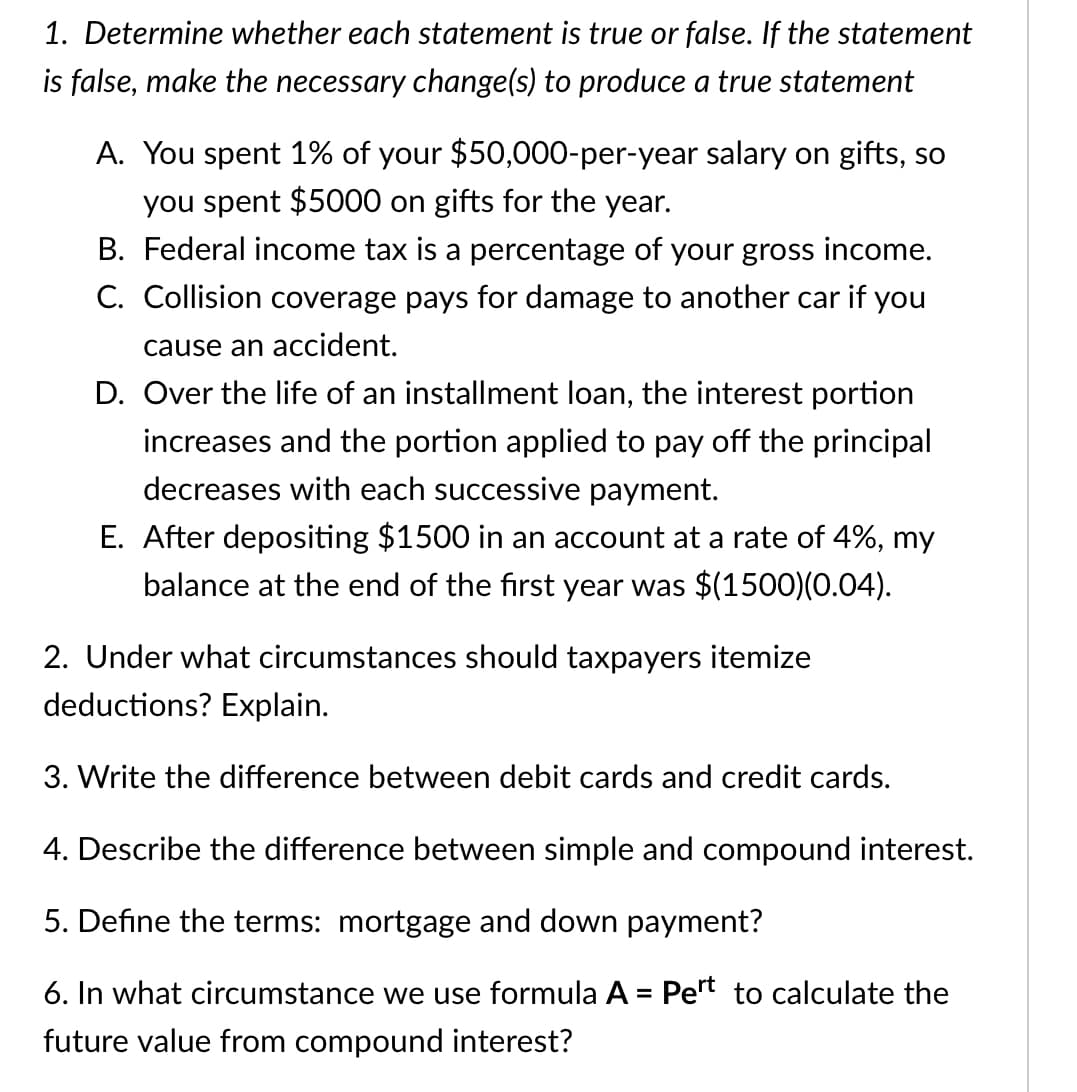

1. Determine whether each statement is true or false. If the statement is false, make the necessary change(s) to produce a true statement A. You spent 1% of your $50,000-per-year salary on gifts, so you spent $5000 on gifts for the year. B. Federal income tax is a percentage of your gross income. C. Collision coverage pays for damage to another car if you cause an accident. D. Over the life of an installment loan, the interest portion increases and the portion applied to pay off the principal decreases with each successive payment. E. After depositing $1500 in an account at a rate of 4%, my balance at the end of the first year was $(1500)(0.04).

1. Determine whether each statement is true or false. If the statement is false, make the necessary change(s) to produce a true statement A. You spent 1% of your $50,000-per-year salary on gifts, so you spent $5000 on gifts for the year. B. Federal income tax is a percentage of your gross income. C. Collision coverage pays for damage to another car if you cause an accident. D. Over the life of an installment loan, the interest portion increases and the portion applied to pay off the principal decreases with each successive payment. E. After depositing $1500 in an account at a rate of 4%, my balance at the end of the first year was $(1500)(0.04).

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 40P

Related questions

Question

Transcribed Image Text:1. Determine whether each statement is true or false. If the statement

is false, make the necessary change(s) to produce a true statement

A. You spent 1% of your $50,000-per-year salary on gifts, so

you spent $5000 on gifts for the year.

B. Federal income tax is a percentage of your gross income.

C. Collision coverage pays for damage to another car if you

cause an accident.

D. Over the life of an installment loan, the interest portion

increases and the portion applied to pay off the principal

decreases with each successive payment.

E. After depositing $1500 in an account at a rate of 4%, my

balance at the end of the first year was $(1500)(0.04).

2. Under what circumstances should taxpayers itemize

deductions? Explain.

3. Write the difference between debit cards and credit cards.

4. Describe the difference between simple and compound interest.

5. Define the terms: mortgage and down payment?

6. In what circumstance we use formula A = Pert to calculate the

future value from compound interest?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT