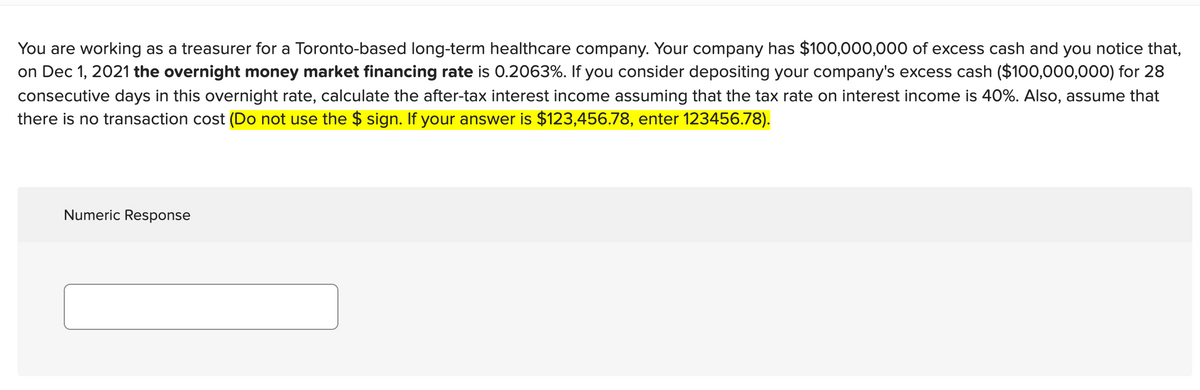

You are working as a treasurer for a Toronto-based long-term healthcare company. Your company has $100,000,000 of excess cash and you notice that, on Dec 1, 2021 the overnight money market financing rate is 0.2063%. If you consider depositing your company's excess cash ($100,000,000) for 28 consecutive days in this overnight rate, calculate the after-tax interest income assuming that the tax rate on interest income is 40%. Also, assume that there is no transaction cost (Do not use the $ sign. If your answer is $123,456.78, enter 123456.78).

You are working as a treasurer for a Toronto-based long-term healthcare company. Your company has $100,000,000 of excess cash and you notice that, on Dec 1, 2021 the overnight money market financing rate is 0.2063%. If you consider depositing your company's excess cash ($100,000,000) for 28 consecutive days in this overnight rate, calculate the after-tax interest income assuming that the tax rate on interest income is 40%. Also, assume that there is no transaction cost (Do not use the $ sign. If your answer is $123,456.78, enter 123456.78).

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 36P

Related questions

Question

40) can you please help with this question?

Transcribed Image Text:You are working as a treasurer for a Toronto-based long-term healthcare company. Your company has $100,000,000 of excess cash and you notice that,

on Dec 1, 2021 the overnight money market financing rate is 0.2063%. If you consider depositing your company's excess cash ($100,000,000) for 28

consecutive days in this overnight rate, calculate the after-tax interest income assuming that the tax rate on interest income is 40%. Also, assume that

there is no transaction cost (Do not use the $ sign. If your answer is $123,456.78, enter 123456.78).

Numeric Response

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College