1. $ land for the next year" should be capitalized in the Land How much of the "property taxes on the асcount? How should the "sale of salvaged materials" be recorded? 2. A. As an added cost of the land B. As a reduction of the cost of the land C. As an added cost to the building D. As a reduction of the cost of the building 3. $ What amount should be recorded to the Land account?

1. $ land for the next year" should be capitalized in the Land How much of the "property taxes on the асcount? How should the "sale of salvaged materials" be recorded? 2. A. As an added cost of the land B. As a reduction of the cost of the land C. As an added cost to the building D. As a reduction of the cost of the building 3. $ What amount should be recorded to the Land account?

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter10: Long-lived Tangible And Intangible Assets

Section: Chapter Questions

Problem 15E

Related questions

Question

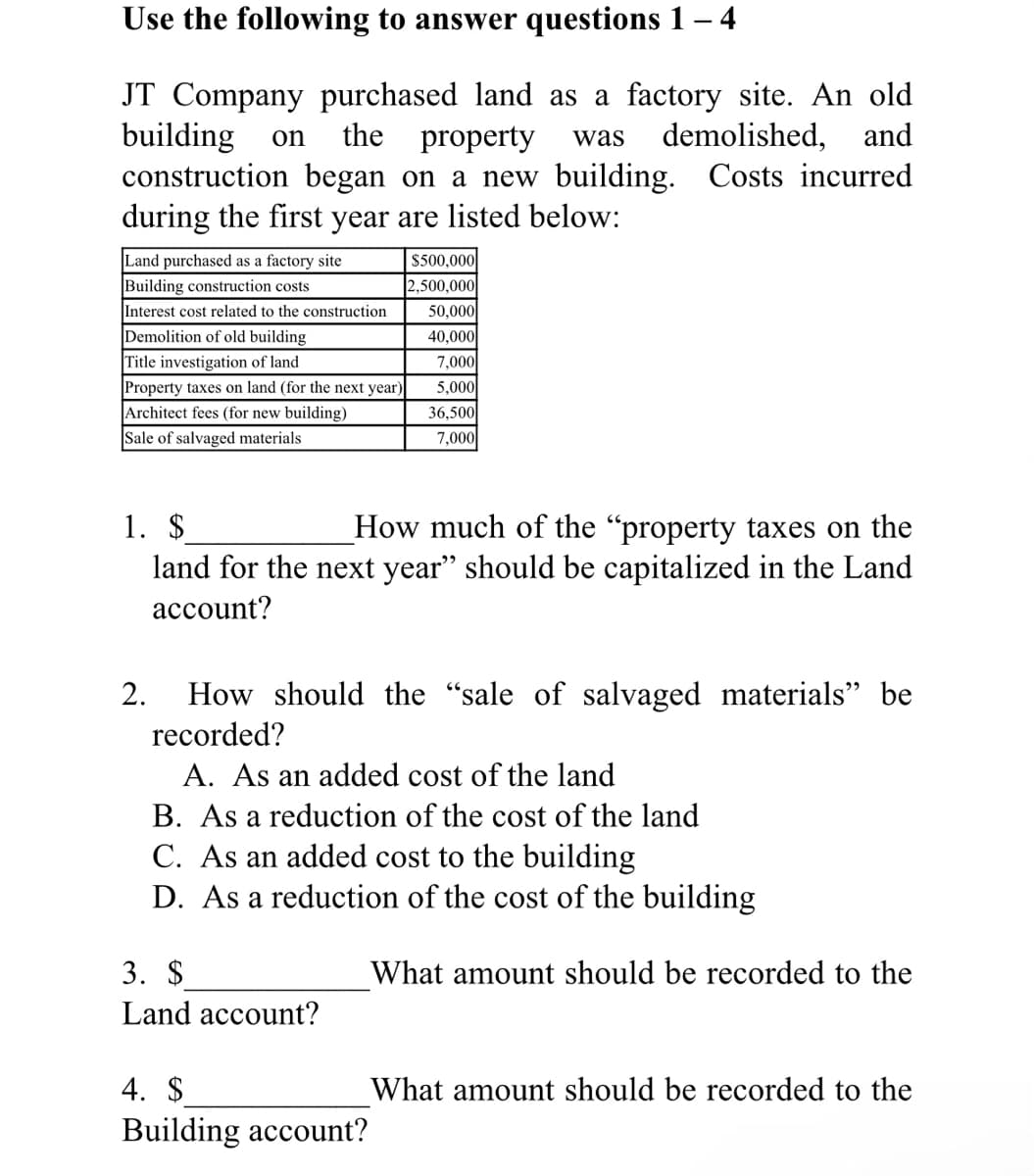

Transcribed Image Text:Use the following to answer questions 1 – 4

JT Company purchased land as a factory site. An old

building

construction began on a new building. Costs incurred

during the first year are listed below:

the

property

demolished, and

on

was

Land purchased as a factory site

Building construction costs

Interest cost related to the construction

Demolition of old building

|Title investigation of land

$500,000

2,500,000

50,000

40,000

7,000

5,000

Property taxes on land (for the next year)

Architect fees (for new building)

36,500

7,000

Sale of salvaged materials

1. $

land for the next year" should be capitalized in the Land

How much of the "property taxes on the

account?

How should the "sale of salvaged materials" be

recorded?

2.

A. As an added cost of the land

B. As a reduction of the cost of the land

C. As an added cost to the building

D. As a reduction of the cost of the building

3. $

What amount should be recorded to the

Land account?

4. $

What amount should be recorded to the

Building account?

Transcribed Image Text:4. $

What amount should be recorded to

the Building account?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College