Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

ChapterA: Appendix - Time Value Of Cash Flows: Compound Interest Concepts And Applications

Section: Chapter Questions

Problem 18E

Related questions

Question

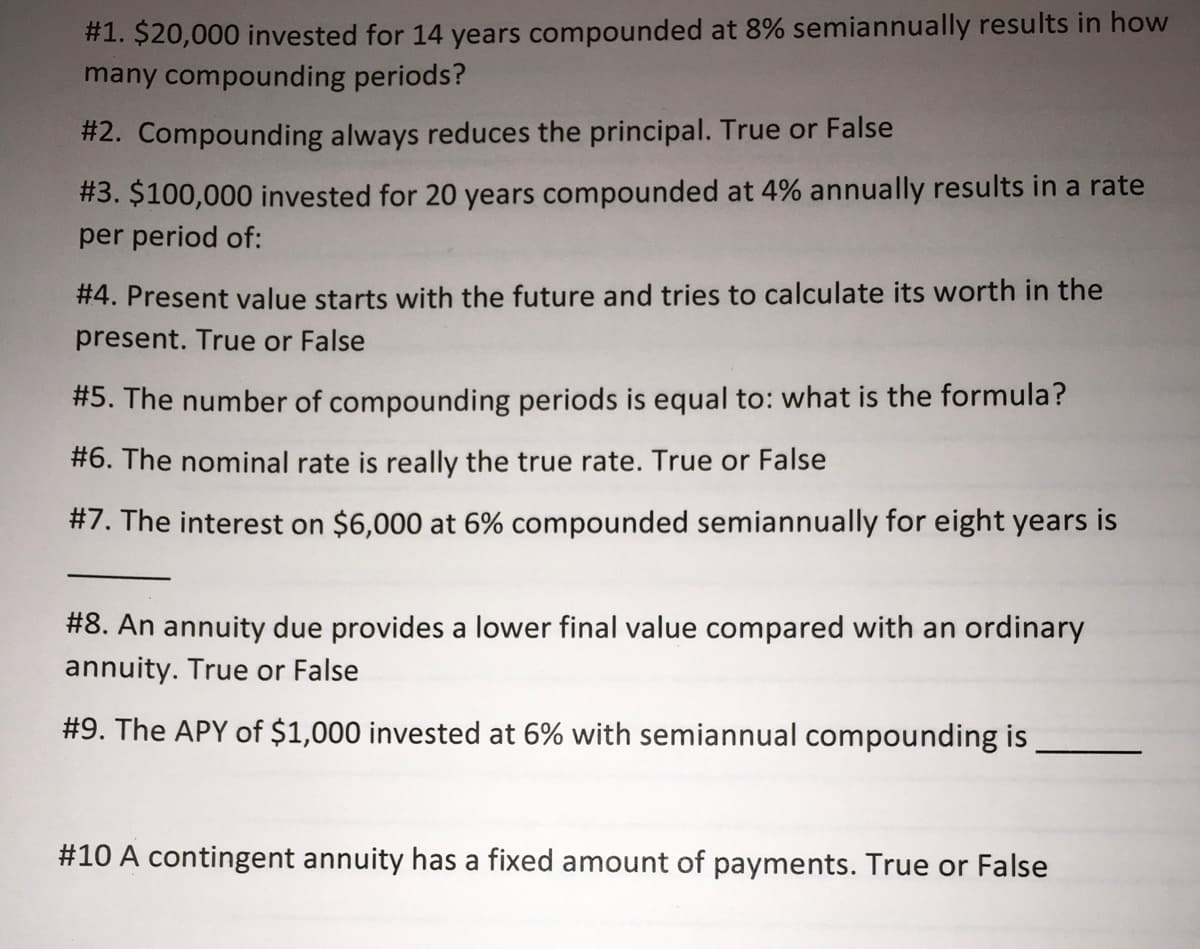

Transcribed Image Text:#1. $20,000 invested for 14 years compounded at 8% semiannually results in how

many compounding periods?

#2. Compounding always reduces the principal. True or False

#3. $100,000 invested for 20 years compounded at 4% annually results in a rate

per period of:

#4. Present value starts with the future and tries to calculate its worth in the

present. True or False

#5. The number of compounding periods is equal to: what is the formula?

#6. The nominal rate is really the true rate. True or False

#7. The interest on $6,000 at 6% compounded semiannually for eight years is

#8. An annuity due provides a lower final value compared with an ordinary

annuity. True or False

#9. The APY of $1,000 invested at 6% with semiannual compounding is

#10 A contingent annuity has a fixed amount of payments. True or False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning