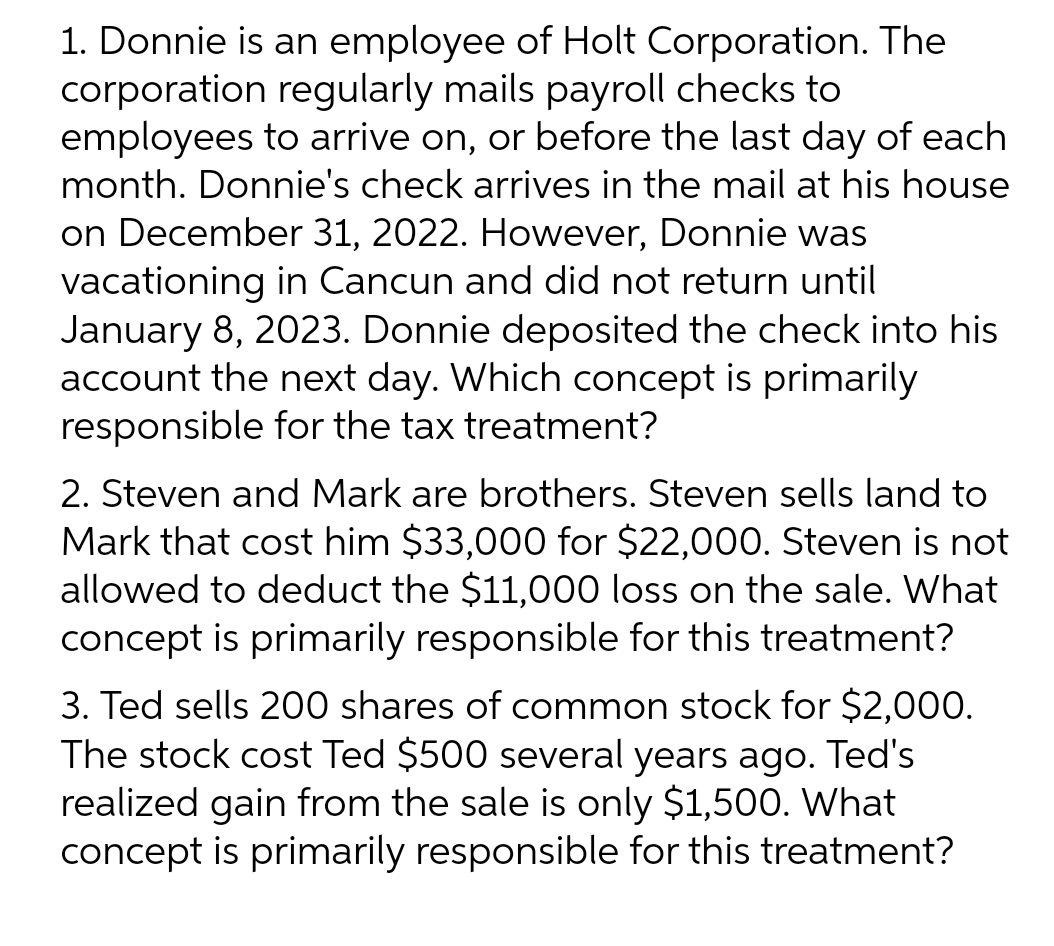

1. Donnie is an employee of Holt Corporation. The corporation regularly mails payroll checks to employees to arrive on, or before the last day of each month. Donnie's check arrives in the mail at his house on December 31, 2022. However, Donnie was vacationing in Cancun and did not return until January 8, 2023. Donnie deposited the check into his account the next day. Which concept is primarily responsible for the tax treatment?

1. Donnie is an employee of Holt Corporation. The corporation regularly mails payroll checks to employees to arrive on, or before the last day of each month. Donnie's check arrives in the mail at his house on December 31, 2022. However, Donnie was vacationing in Cancun and did not return until January 8, 2023. Donnie deposited the check into his account the next day. Which concept is primarily responsible for the tax treatment?

Chapter2: Income Tax Concepts

Section: Chapter Questions

Problem 48P

Related questions

Question

please answer all parts within 30 minutes...

Transcribed Image Text:1. Donnie is an employee of Holt Corporation. The

corporation regularly mails payroll checks to

employees to arrive on, or before the last day of each

month. Donnie's check arrives in the mail at his house

on December 31, 2022. However, Donnie was

vacationing in Cancun and did not return until

January 8, 2023. Donnie deposited the check into his

account the next day. Which concept is primarily

responsible for the tax treatment?

2. Steven and Mark are brothers. Steven sells land to

Mark that cost him $33,000 for $22,000. Steven is not

allowed to deduct the $11,000 loss on the sale. What

concept is primarily responsible for this treatment?

3. Ted sells 200 shares of common stock for $2,000.

The stock cost Ted $500 several years ago. Ted's

realized gain from the sale is only $1,500. What

concept is primarily responsible for this treatment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT