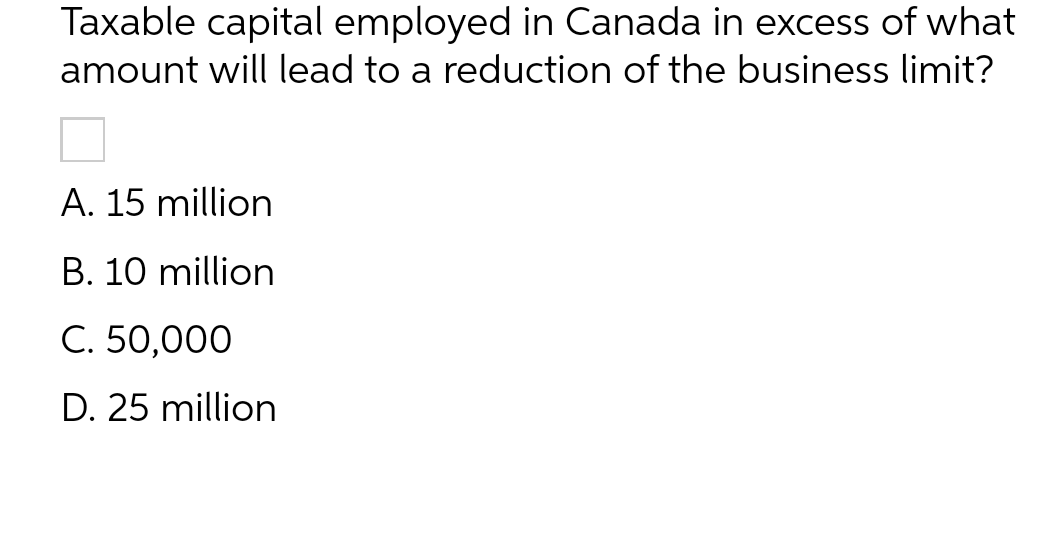

Taxable capital employed in Canada in excess of what amount will lead to a reduction of the business limit? A. 15 million B. 10 million

Q: On July 1, 2021, the Canada Bank lent $37,000 to Sheffield Limited. The 18-month loan bears interest…

A: For bank, issue of loan results in reduction in cash balance and increase in receivable balance

Q: 10,000 24,000

A: Activity Rate is budgeted activity divided by Total Activity - Base Usage

Q: Type only your answer in the space provided with no spaces between the $ or the % and the number. In…

A: A) She owes no FICA tax because her income is not from wages. She had no adjustments to her gross…

Q: Glasgow Enterprises started the period with 60 units in beginning inventory that cost $2.20 each.…

A: COST OF GOODS SOLD Cost of goods sold is the total amount your business paid as a cost directly…

Q: View History Bookmarks Window Help education.wiley.com 1 WP NWP Assessment Player UI Application…

A: Lets understand the basics. Financial statement is dividend in two parts which are, (1) Income…

Q: Data table The Velocities Corporation (June 2017) Number of centrifuges assembled and sold Hours of…

A: Formula for Variable Overhead Spending Variance = Actual Cost - (Actual Quantity * Budgeted Rate)…

Q: Problem 1: Candyman Company is a wholesale distributor of candy. The company services grocery…

A: Since you have asked for parts 3 to 5, we have answered the same for you. Break even point in…

Q: I need help woth req 4

A: Under weighted average method, cost per equivalent unit is calculated by adding the beginning work…

Q: Thad Morgan, a motorcycle enthusiast, has been exploring the possibility of relaunching the Western…

A: Break Even Point (BEP) :— It is the point where total revenue is equal to total cost. It is the…

Q: Department M had 2,400 units 54% completed in process at the beginning of June, 11,000 units…

A: The idea of equivalent units of production is utilized to calculate how much money partly finished…

Q: Roget Factory has budgeted factory overhead for the year at $15,500,000. It plans to produce…

A: Budgeted Factory Overhead = 15500000 Budgeted Direct Labor Hours = 1050000

Q: 84 QUESTION 15 The following entry would be used to record the transfer of $40,000 of direct…

A: Direct materials are those materials which are used directly for production and manufacturing of…

Q: The closing price of a U.S. Treasury bond with a face value of $1400 is quoted as 105.45 points, for…

A:

Q: The extract of statement of financial position for the year ended 30 June 2022 for Pears Ltd and…

A: Goodwill refers to the intangible asset which could be related to the value of the purchased brand…

Q: Balance sheet computations. (Balance Sheet) Presented below is the trial balance of Hightower…

A: Since you have posted a question with multiple sub-parts, we will solve the first three parts for…

Q: Davis Inc. uses the gross method for recording purchase and sales discounts. They had the following…

A: Periodic Method :— It is one of the method of inventory valuation which uses the physical counting…

Q: Pedregon Corporation has provided the following information: Direct materials Direct labor Variable…

A: According to the given question, we are required to compute the total variable cost at the activity…

Q: Little Things manufactures toys. For each item listed, identify whether it is a product cost, a…

A: Product Cost :— It is the cost that is incurred in the manufacturing of product during the…

Q: Jasper Company accepted a check from Harp Company as payment for services rendered. Jasper's bank…

A: Accounting equation basically consists of laibilties and assets and equity. Any change in one will…

Q: Sunspot Beverages, Limited, of Fiji uses the weighted-average method in its process costing system.…

A: Weighted Average Method :— Under this method, equivalent units is calculated using units transferred…

Q: JJ Company produces a variety of products. The company's project income statement for the coming…

A: Lets understand the basics. Contribution margin is a margin generated from the sales made on each…

Q: Question: Buffalo Company manufactures equipment. Buffalo's products range from simple automated…

A: recording of journal entry with necessary calculation are as follows

Q: The following information applies to the questions displayed below.] Warnerwoods Company uses a…

A: Cost of goods available for sale is the maximum amount or quantity of inventory which a company can…

Q: Gorky-Park amends the plan to provide certain dental benefits in addition to previously provided…

A: Retirement benefits are those benefits and expenses which needs to be paid out to employees after…

Q: QUESTION 10 In activity-based costing, the total activity in an activity cost pool can be computed…

A: ACTIVITY BASED COSTING Activity Based Costing is a Powerful tool for Measuring Performance,…

Q: Vibrant Company had $1,000,000 of sales in each of Year 1, Year 2, and Year 3, and it purchased…

A: Determination of gross profit and preparation of comparative income statement are as follows

Q: Shannon Company segments its income statement into its North and South Divisions. The company's…

A: Workings :- 1) Calculation of contribution margin of total company :- Sales * contribution margin…

Q: Using this information from Planters, Inc., what is the cost per unit under absorption costing?…

A: Cost per unit under absorption costing includes the fixed manufacturing overhead, variable…

Q: COLUMN A Accumulated 1 depreciation 2 3 5 6 7 8 Depreciable amount 10 Depreciation Initial…

A: Depreciation is the amount deccrease in the value of asset over its useful life due to use of asset,…

Q: The invoice price of goods purchased is $10,000 with purchase terms of 4/7, n/30 and FOB shipping…

A: Net Purchases :— It is calculated by deducting purchase discount, return and allowances from gross…

Q: Assembly Department Total Direct Labor Hours per Unit 2 5.5 dlh 3.5 5.5 dlh a. Determine the…

A: Plant wide factory Overhead Rate :— It is the rate used to allocate the overall manufacturing…

Q: How do you find the gross profit as a percent of sales and income from operations as a percent of…

A: Gross Profit :— It is the difference between the sales revenue and cost of goods sold. Gross Profit…

Q: Prepare journal entries to record the following transactions for Emerson Corporation. (If no entry…

A: Dividend: The board of directors of a corporation is the entity that is responsible for determining…

Q: A process engineer is considering two options for a new product line. One of the options must be…

A: Relevant cost is the cost which is incurred specifically for a project or a product and is…

Q: Bigblue Corporation manufactures paint that goes through three processes - cracking, mixing, and…

A:

Q: When treasury shares are resold at a price above cost: a. Paid-in capital is reduced. b. Paid-in…

A:

Q: Explain the initial & subsequent recognition of interest-bearing long-term notes receivable.

A: Long term notes receivables are those receivables which are to be receivable to the company at a…

Q: Which Expense account is usually shown as the last Expense item on the Income Statement, regardless…

A: INCOME STATEMENT income Statement is one of the Important Financial Statement of the Company. It…

Q: ( a ) calculate the cost that should be allocated to each asset purchased ( b ) Jounal the purchase…

A: ALLOCATION OF COST . Cost allocation is the distribution of one cost across multiple entities,…

Q: CO Leather manufactures leather purses. Each purse requires 2 pounds of direct materials at a cost…

A: The production budget is prepared using the sales budget. The direct materials and direct labor…

Q: 1. Prepare the journal entry to record Tamas Company's issuance of 5,100 shares of $100 par value,…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: Kasey's Cake Shop made $30,000 in sales of wedding cakes in July. All of these sales were on bank…

A: Credit Card Sales - Credit Card Sales is the sales earned and collected through Credit card. A…

Q: For which of the following cost flow methods does generally accepted accounting principles require…

A: Ans. In case of Inventories, it is generally accepted accounting principles is to measure at cost or…

Q: Bal., 6,000 units, 25% completed Direct materials, 141,000 units @ $2.10 Direct labor Factory…

A: The equivalent units of production are the number of units that are completed during the period. The…

Q: Supply the missing data in the following cases, each case is independent of the others. Schedule…

A: INCOME STATEMENT Income Statement is One of the important part of the Financial statement of the…

Q: A technician makes an annual check on an oil burner. The charges for itemsand services are:1 gun…

A: In this question given blank bill asked to be completed but we are not allowed to photoshop the…

Q: At the end of the Year 2 accounting period, DeYoung Company determined that the market value of its…

A: Introduction:- DeYoung Company determined that the market value of its inventory was $79,800…

Q: Kelly is a self-employed tax attorney whose practice primarily involves tax planning. During the…

A: Tax deductions are deductions made by taxpayers to lower their taxable income as a result of certain…

Q: The current zero-coupon yield curve for risk-free bonds is as follows: What is the price per $100…

A: The time value of money is the concept that is widely used by companies and individuals to determine…

Q: While performing the monthly bank reconciliation, Avon Company adjusted for a bank service charge of…

A: Points to be noted: Bank service charge is not a decrease in revenue, it is an increase in expense.…

please answer within 30 minutes..

Step by step

Solved in 2 steps

- 54. In relation to transaction #1, How much is the capital gains tax due, if any? A. PO C. P300,000 B. P360,000. D. P450,000D6) If the corporate tax rate in a foreign country is 20%and the tax rate in the home country is 30%, when calculating NPV a.you must account for paying the additional 10% in corporate taxes. b.you do NOT adjust NPV for taxes c.you should account for paying an additional 30% in corporate taxes. d.you should increase the NPV of the project by 10%.25. Yumi Corporation had a total gross income of PHP 4,800,000 and deductible expenses of PHP 3,600,000. If the total asset of the corporation (excluding the land on which the building which houses its office, plant and equipment) is PHP 80,000,000 how much is the income tax due in 2022 assuming Yumi Corporation is a nonresident foreign corporation? a. 330,000 b. 1,200,000 c. 300,000 d. 1,440,000

- Qalvin Corporation, a large corporation, reported the following in 2023: in 2022: Related Unrelated Total Gross income P300,000 P200,000 P500,000 Deductions 100,000 100,000 200,000 Taxable income P200,000 P100,000 P300,000 Compute the income tax due if Qalvin is exempt non-profit corporation Qalvin Corporation, a MSME, reported the following in 2023: in 2022: Philippines Abroad Total Gross income P500,000 P200,000 P700,000 Direct Deductions 200,000 300,000 500,000 Common Expenses 150,000 Compute the income tax due if Qalvin is a resident foreign corporationUNILEVER CARIBBEAN LIMITED Statement of Financial Position December 31, 2022 (Expressed in Trinidad and Tobago Dollars) Notes 2022 2021 $'000 $'000 ASSETS Non-current assets Property, plant and equipment 8 4,285 8,943 Retirement benefit asset 9(i) 99,142 137,039 Deferred tax asset 10 14,250 6,459 117,677 152,441 Current assets Inventories 11 29,250 26,808 Taxation recoverable…UNILEVER CARIBBEAN LIMITED Statement of Financial Position December 31, 2022 (Expressed in Trinidad and Tobago Dollars) Notes 2022 2021 $'000 $'000 ASSETS Non-current assets Property, plant and equipment 8 4,285 8,943 Retirement benefit asset 9(i) 99,142 137,039 Deferred tax asset 10 14,250 6,459 117,677 152,441 Current assets Inventories 11 29,250 26,808 Taxation recoverable…

- USCo incurred $100,000 in interest expense for the current year. The tax book value of USCo’s assets generating foreign-source income is $5,000,000. The tax book value of USCo’s assets generating U.S.-source income is $45,000,000. How much of the interest expense is allocated and apportioned to foreign-source income?If a branch of a foreign corporation (resident foreign corporation) derives net income of P20,000,000.00 to be remitted to the foreign head office, how much is the branch profits remittance tax? Group of answer choices P1,500,000.00 P2,000,000.00 P3,000,000.00 P2,250,000.004. XYZcorporation reported the following gross income and expenses: Gross income in the Philippines is 38,000,000 while deductions is 15,000,000 for a total taxable income of 23,000,000. Abroad, the gross income is 14,000,000 while the deduction is 3,000,000 for a total taxable income of 11,000,000. Compute the income tax due for 2021 if XYZ is a domestic corporation. P10,200,000 P6,900,000 P8,500,000 P6,800,000

- What is the taxable income for the year 2020? A. P25,000 B. P75,000 C. P280,620 D. P300,000Amount in excess of P490,000.00 taxable income is to be multiplied to_______to compute for the graduated tax due a. 30% b. 32% c. 35%Based on the below data, answer as required: WITHIN OUTSIDE Gross income 8,000,000 4,000,000 Business expenses 5,000,000 3,000,000 Sale of land and warehouse (cost 2m) 3,000,000 - a. If X is a domestic corporation, how much is the taxable income and income tax due in the Philippines per annual ITR? b. If X is a resident foreign corporation, how much is the taxable income and income tax due in the Philippines per annual ITR?