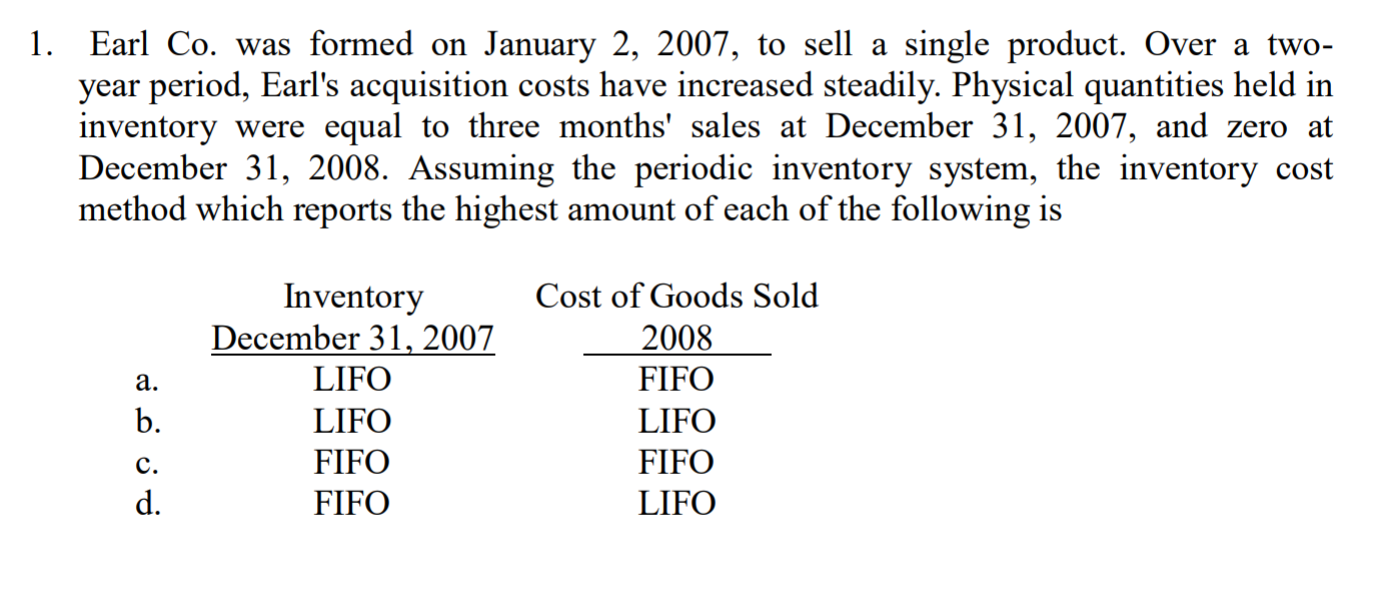

1. Earl Co. was formed on January 2, 2007, to sell a single product. Over a two- year period, Earl's acquisition costs have increased steadily. Physical quantities held in inventory were equal to three months' sales at December 31, 2007, and zero at December 31, 2008. Assuming the periodic inventory system, the inventory cost method which reports the highest amount of each of the following is Inventory December 31, 2007 LIFO LIFO FIFO FIFO Cost of Goods Sold 2008 FIFO LIFO FIFO LIFO

1. Earl Co. was formed on January 2, 2007, to sell a single product. Over a two- year period, Earl's acquisition costs have increased steadily. Physical quantities held in inventory were equal to three months' sales at December 31, 2007, and zero at December 31, 2008. Assuming the periodic inventory system, the inventory cost method which reports the highest amount of each of the following is Inventory December 31, 2007 LIFO LIFO FIFO FIFO Cost of Goods Sold 2008 FIFO LIFO FIFO LIFO

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 5RE: Dani Corporation signed a binding commitment on December 2 to purchase inventory for 300,000 cash on...

Related questions

Question

Transcribed Image Text:1. Earl Co. was formed on January 2, 2007, to sell a single product. Over a two-

year period, Earl's acquisition costs have increased steadily. Physical quantities held in

inventory were equal to three months' sales at December 31, 2007, and zero at

December 31, 2008. Assuming the periodic inventory system, the inventory cost

method which reports the highest amount of each of the following is

Inventory

December 31, 2007

LIFO

LIFO

FIFO

FIFO

Cost of Goods Sold

2008

FIFO

LIFO

FIFO

LIFO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning