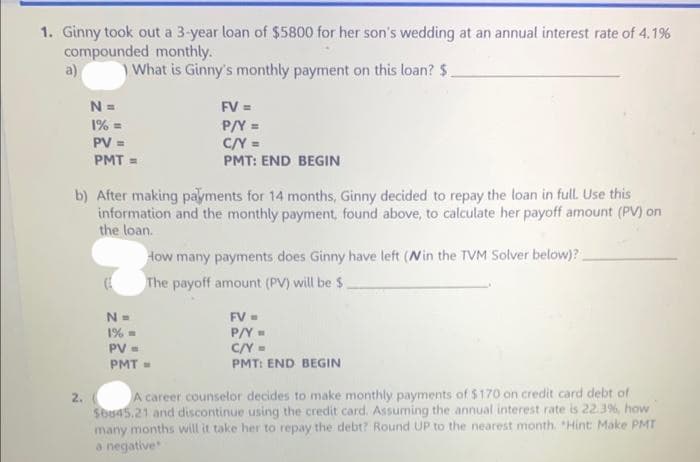

1. Ginny took out a 3-year loan of $5800 for her son's wedding at an annual interest rate of 4.1% compounded monthly. a) What is Ginny's monthly payment on this loan? $. N = 1% = PV = PMT= 2. b) After making payments for 14 months, Ginny decided to repay the loan in full. Use this information and the monthly payment, found above, to calculate her payoff amount (PV) on the loan. FV = P/Y = C/Y = PMT: END BEGIN How many payments does Ginny have left (Win the TVM Solver below)? The payoff amount (PV) will be $ N= 1% = PV = PMT= FV = P/Y = C/Y= PMT: END BEGIN A career counselor decides to make monthly payments of $170 on credit card debt of $6u45.21 and discontinue using the credit card. Assuming the annual interest rate is 22.3%, how many months will it take her to repay the debt? Round UP to the nearest month. "Hint: Make PMT a negative

1. Ginny took out a 3-year loan of $5800 for her son's wedding at an annual interest rate of 4.1% compounded monthly. a) What is Ginny's monthly payment on this loan? $. N = 1% = PV = PMT= 2. b) After making payments for 14 months, Ginny decided to repay the loan in full. Use this information and the monthly payment, found above, to calculate her payoff amount (PV) on the loan. FV = P/Y = C/Y = PMT: END BEGIN How many payments does Ginny have left (Win the TVM Solver below)? The payoff amount (PV) will be $ N= 1% = PV = PMT= FV = P/Y = C/Y= PMT: END BEGIN A career counselor decides to make monthly payments of $170 on credit card debt of $6u45.21 and discontinue using the credit card. Assuming the annual interest rate is 22.3%, how many months will it take her to repay the debt? Round UP to the nearest month. "Hint: Make PMT a negative

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter27: Time Value Of Money (compound)

Section: Chapter Questions

Problem 6E

Related questions

Question

Transcribed Image Text:1. Ginny took out a 3-year loan of $5800 for her son's wedding at an annual interest rate of 4.1%

compounded monthly.

a)

What is Ginny's monthly payment on this loan? $.

N =

1% =

PV =

PMT=

2.

b) After making payments for 14 months, Ginny decided to repay the loan in full. Use this

information and the monthly payment, found above, to calculate her payoff amount (PV) on

the loan.

FV =

P/Y =

C/Y =

PMT: END BEGIN

How many payments does Ginny have left (Win the TVM Solver below)?

The payoff amount (PV) will be $

N =

1% =

PV =

PMT=

FV =

P/Y=

C/Y =

PMT: END BEGIN

A career counselor decides to make monthly payments of $170 on credit card debt of

$6845.21 and discontinue using the credit card. Assuming the annual interest rate is 22.3%, how

many months will it take her to repay the debt? Round UP to the nearest month. "Hint: Make PMT

a negative

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning