1. Identify what type of investment the Yearling stock is for Staub. 2. Journalize the transactions related to Staub's investment in the Yearling stock during 2024. 3. In what category and at what value would Staub's report the investment on the December 31, 2024, balance sheet?

1. Identify what type of investment the Yearling stock is for Staub. 2. Journalize the transactions related to Staub's investment in the Yearling stock during 2024. 3. In what category and at what value would Staub's report the investment on the December 31, 2024, balance sheet?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 18E: Monona Company reported net income of 29,975 for 2019. During all of 2019, Monona had 1,000 shares...

Related questions

Question

1.Please Complete Solution With Details

2.Final Answer Clearly Mentioned

3.Do not give solution in image format

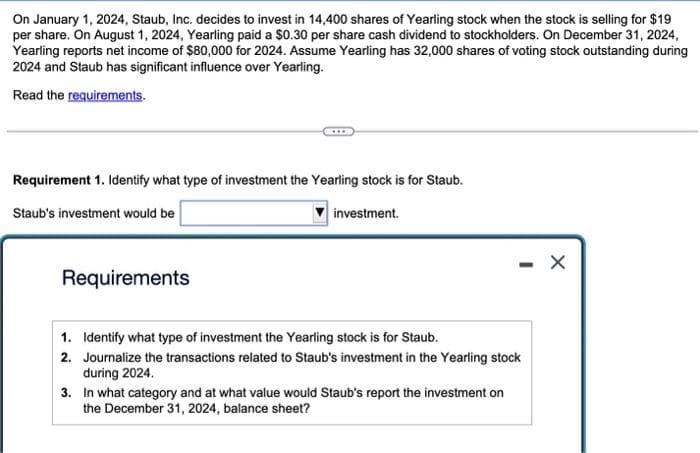

Transcribed Image Text:On January 1, 2024, Staub, Inc. decides to invest in 14,400 shares of Yearling stock when the stock is selling for $19

per share. On August 1, 2024, Yearling paid a $0.30 per share cash dividend to stockholders. On December 31, 2024,

Yearling reports net income of $80,000 for 2024. Assume Yearling has 32,000 shares of voting stock outstanding during

2024 and Staub has significant influence over Yearling.

Read the requirements.

Requirement 1. Identify what type of investment the Yearling stock is for Staub.

Staub's investment would be

investment.

Requirements

1. Identify what type of investment the Yearling stock is for Staub.

2. Journalize the transactions related to Staub's investment in the Yearling stock

during 2024.

3. In what category and at what value would Staub's report the investment on

the December 31, 2024, balance sheet?

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning