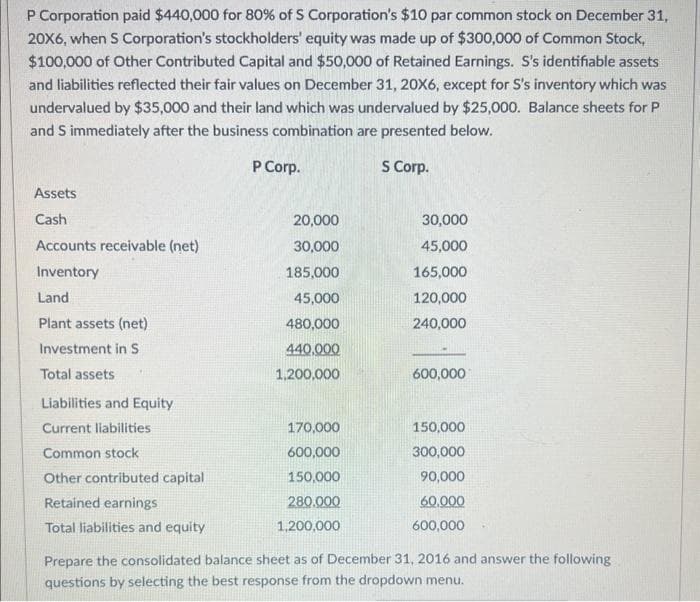

P Corporation paid $440,000 for 80% of S Corporation's $10 par common stock on December 31, 20X6, when S Corporation's stockholders' equity was made up of $300,000 of Common Stock, $100,000 of Other Contributed Capital and $50,000 of Retained Earnings. S's identifiable assets and liabilities reflected their fair values on December 31, 20X6, except for S's inventory which was undervalued by $35,000 and their land which was undervalued by $25,000. Balance sheets for P and S immediately after the business combination are presented below. P Corp. S Corp. Assets Cash Accounts receivable (net) Inventory Land Plant assets (net) Investment in S Total assets 20,000 30,000 185,000 45,000 480,000 440,000 1,200,000 30,000 45,000 165,000 120,000 240,000 170,000 600,000 150,000 280.000 1,200,000 600,000 Liabilities and Equity Current liabilities Common stock Other contributed capital Retained earnings Total liabilities and equity Prepare the consolidated balance sheet as of December 31, 2016 and answer the following 150,000 300,000 90,000 60.000 600,000

P Corporation paid $440,000 for 80% of S Corporation's $10 par common stock on December 31, 20X6, when S Corporation's stockholders' equity was made up of $300,000 of Common Stock, $100,000 of Other Contributed Capital and $50,000 of Retained Earnings. S's identifiable assets and liabilities reflected their fair values on December 31, 20X6, except for S's inventory which was undervalued by $35,000 and their land which was undervalued by $25,000. Balance sheets for P and S immediately after the business combination are presented below. P Corp. S Corp. Assets Cash Accounts receivable (net) Inventory Land Plant assets (net) Investment in S Total assets 20,000 30,000 185,000 45,000 480,000 440,000 1,200,000 30,000 45,000 165,000 120,000 240,000 170,000 600,000 150,000 280.000 1,200,000 600,000 Liabilities and Equity Current liabilities Common stock Other contributed capital Retained earnings Total liabilities and equity Prepare the consolidated balance sheet as of December 31, 2016 and answer the following 150,000 300,000 90,000 60.000 600,000

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter13: Earnings Per Share (eps)

Section: Chapter Questions

Problem 1R: Ponce Towers, Inc., had 50,000 shares of common stock and 10,000 shares of 100 par value, 8%...

Related questions

Question

tt2.

Transcribed Image Text:P Corporation paid $440,000 for 80% of S Corporation's $10 par common stock on December 31,

20X6, when S Corporation's stockholders' equity was made up of $300,000 of Common Stock,

$100,000 of Other Contributed Capital and $50,000 of Retained Earnings. S's identifiable assets

and liabilities reflected their fair values on December 31, 20X6, except for S's inventory which was

undervalued by $35,000 and their land which was undervalued by $25,000. Balance sheets for P

and S immediately after the business combination are presented below.

P Corp.

S Corp.

Assets

Cash

Accounts receivable (net)

Inventory

Land

Plant assets (net)

Investment in S

Total assets

Liabilities and Equity

Current liabilities

Common stock

Other contributed capital

Retained earnings

Total liabilities and equity

20,000

30,000

185,000

45,000

480,000

440,000

1,200,000

170,000

600,000

150,000

280.000

1,200,000

30,000

45,000

165,000

120,000

240,000

600,000

150,000

300,000

90,000

60.000

600,000

Prepare the consolidated balance sheet as of December 31, 2016 and answer the following

questions by selecting the best response from the dropdown menu.

![• Total assets of the consolidated entity shoul

[Select]

$0

✓ $100,000

$88,000

$110,000

Tata

interest on th

ansaction woul](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F8d0e6bf9-348c-40ab-ae4c-488cbc0bf710%2F9ac0dd9a-2470-4924-939a-843af5a72760%2Fzlu4z7a_processed.jpeg&w=3840&q=75)

Transcribed Image Text:• Total assets of the consolidated entity shoul

[Select]

$0

✓ $100,000

$88,000

$110,000

Tata

interest on th

ansaction woul

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning