1. If a firm's net income (profits before taxes) is $120,000 and it has total assets of $1.5 million, what is its return on assets?

1. If a firm's net income (profits before taxes) is $120,000 and it has total assets of $1.5 million, what is its return on assets?

Chapter5: Evaluating Operating And Financial Performance

Section: Chapter Questions

Problem 1EP

Related questions

Question

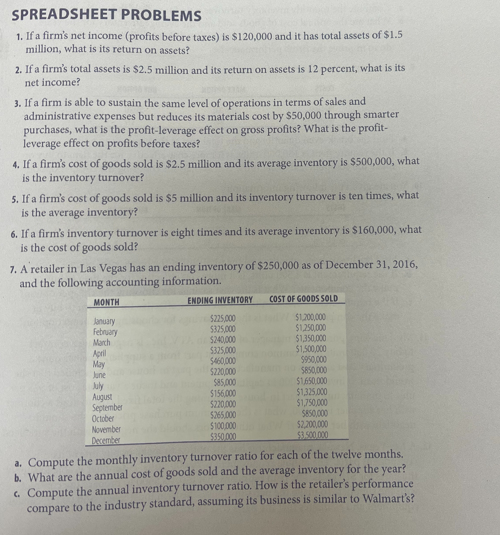

Transcribed Image Text:SPREADSHEET PROBLEMS

1. If a firm's net income (profits before taxes) is $120,000 and it has total assets of $1.5

million, what is its return on assets?

2. If a firm's total assets is $2.5 million and its return on assets is 12 percent, what is its

net income?

3. If a firm is able to sustain the same level of operations in terms of sales and

administrative expenses but reduces its materials cost by $50,000 through smarter

purchases, what is the profit-leverage effect on gross profits? What is the profit-

leverage effect on profits before taxes?

4. If a firm's cost of goods sold is $2.5 million and its average inventory is $500,000, what

is the inventory turnover?

5. If a firm's cost of goods sold is $5 million and its inventory turnover is ten times, what

is the average inventory?

6. If a firm's inventory turnover is eight times and its average inventory is $160,000, what

is the cost of goods sold?

7. A retailer in Las Vegas has an ending inventory of $250,000 as of December 31, 2016,

and the following accounting information.

ENDING INVENTORY

COST OF GOODS SOLD

MONTH

January

February

March

April

May

June

July

August

September

October

November

December

$225,000

$325,000

$240,000

$325,000

$460,000

$220,000

S85,000

$156.000

$220,000

$265,000

$100,000

$350.000

$1.200,000

$1.250,000

$1,350,000

$1,500,000

$950,000

$850,00

$1.650,000

$1,325,000

$1,750,000

$850,000

$2,200,000

$3.500.000

a. Compute the monthly inventory turnover ratio for each of the twelve months,

b. What are the annual cost of goods sold and the average inventory for the year?

c. Compute the annual inventory turnover ratio. How is the retailer's performance

compare to the industry standard, assuming its business is similar to Walmart's?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning