b. What is the change in net working capital for year t? Change in net working capital c. In year t, Parrothead Enterprises had capital expenditure of £1,350. How much in non-current assets did Parrothead Enterprises sell? Non-current assets sold d. What is the cash flow from investing activities for the year? (The tax rate is 28 per cent.) Cash flow from investing activities

b. What is the change in net working capital for year t? Change in net working capital c. In year t, Parrothead Enterprises had capital expenditure of £1,350. How much in non-current assets did Parrothead Enterprises sell? Non-current assets sold d. What is the cash flow from investing activities for the year? (The tax rate is 28 per cent.) Cash flow from investing activities

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 3MC: The following is selected financial data from Block Industries: How much does Block Industries have...

Related questions

Question

b. What is the change in net

c. In year t, Parrothead Enterprises had capital expenditure of £1,350. How much in non-current assets did Parrothead Enterprises sell? Non-current assets sold

d. What is the cash flow from investing activities for the year? (The tax rate is 28 per cent.) Cash flow from investing activities

During year t, Parrothead Enterprises raised £270 in new long-term debt. How much long-term debt must Parrothead Enterprises have paid off during the year? Long-term debt paid off

What is the cash flow from financing activities? Cash flow from financing activities

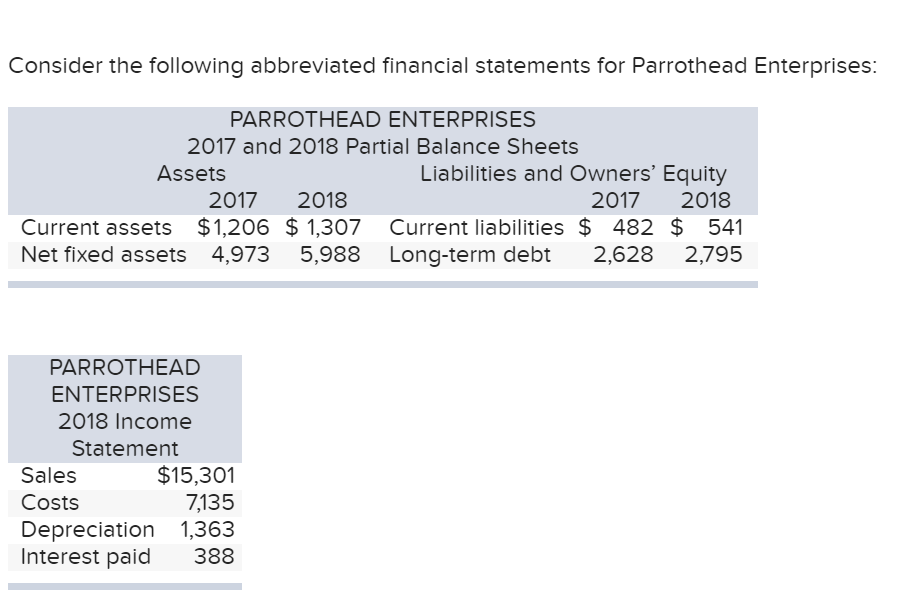

Transcribed Image Text:Consider the following abbreviated financial statements for Parrothead Enterprises:

PARROTHEAD ENTERPRISES

2017 and 2018 Partial Balance Sheets

Assets

Liabilities and Owners' Equity

2017

2018

2017

2018

Current assets $1,206 $ 1,307 Current liabilities $ 482 $ 541

5,988 Long-term debt

Net fixed assets 4,973

2,628

2,795

PARROTHEAD

ENTERPRISES

2018 Income

Statement

$15,301

7,135

Depreciation 1,363

Sales

Costs

Interest paid

388

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning