1. In a loan amortization schedule, interest payments for each period would most probably a. Increase over time c. Remain the same b. Decrease overtime d. There are no interest payments in the schedule 2. The formula (1+ i)n is also called a. present value factor for lump-sum payment b. future value factor for lump-sum payment c. present value factor for ordinary annuity d. future value factor for ordinary annuity 3. An increase in the present value may be caused by a. increase in the discount rate b. decrease in the discount rate c. discount rate does not affect the present value d. none of the above 4. Interest payments that are based on the original principal and previous interest recognized is based on a. present value c. simple interest rate b. future value d. compound interest rate 5. The time value of money suggest that a peso received today is a peso received in the worth future. a. less than c. the same as b. more than d. none of the above

1. In a loan amortization schedule, interest payments for each period would most probably a. Increase over time c. Remain the same b. Decrease overtime d. There are no interest payments in the schedule 2. The formula (1+ i)n is also called a. present value factor for lump-sum payment b. future value factor for lump-sum payment c. present value factor for ordinary annuity d. future value factor for ordinary annuity 3. An increase in the present value may be caused by a. increase in the discount rate b. decrease in the discount rate c. discount rate does not affect the present value d. none of the above 4. Interest payments that are based on the original principal and previous interest recognized is based on a. present value c. simple interest rate b. future value d. compound interest rate 5. The time value of money suggest that a peso received today is a peso received in the worth future. a. less than c. the same as b. more than d. none of the above

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 1Q

Related questions

Question

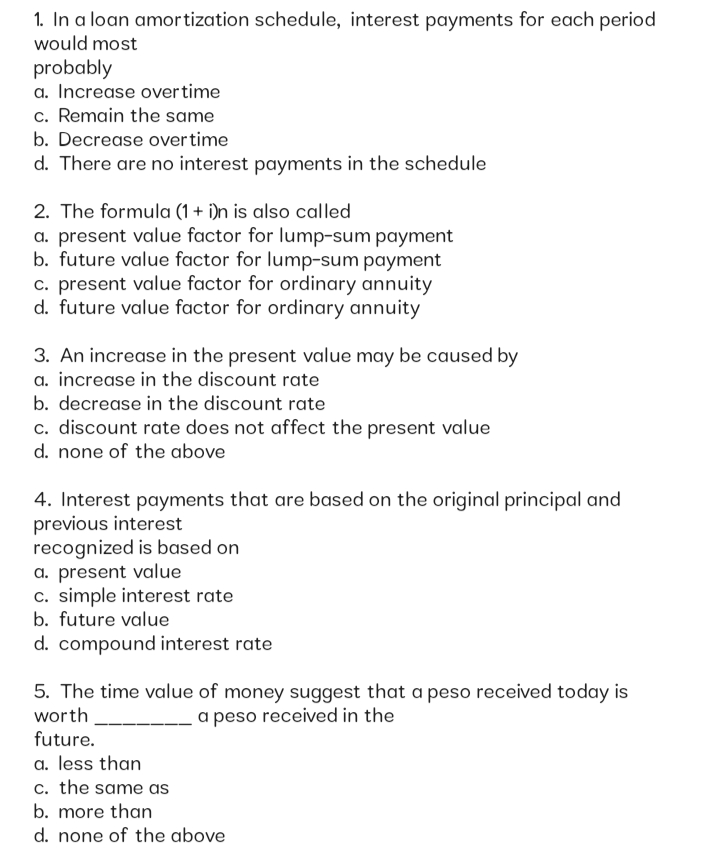

Transcribed Image Text:1. In a loan amortization schedule, interest payments for each period

would most

probably

a. Increase overtime

c. Remain the same

b. Decrease overtime

d. There are no interest payments in the schedule

2. The formula (1 + i)n is also called

a. present value factor for lump-sum payment

b. future value factor for lump-sum payment

c. present value factor for ordinary annuity

d. future value factor for ordinary annuity

3. An increase in the present value may be caused by

a. increase in the discount rate

b. decrease in the discount rate

c. discount rate does not affect the present value

d. none of the above

4. Interest payments that are based on the original principal and

previous interest

recognized is based on

a. present value

c. simple interest rate

b. future value

d. compound interest rate

5. The time value of money suggest that a peso received today is

worth

a peso received in the

future.

a. less than

c. the same as

b. more than

d. none of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you