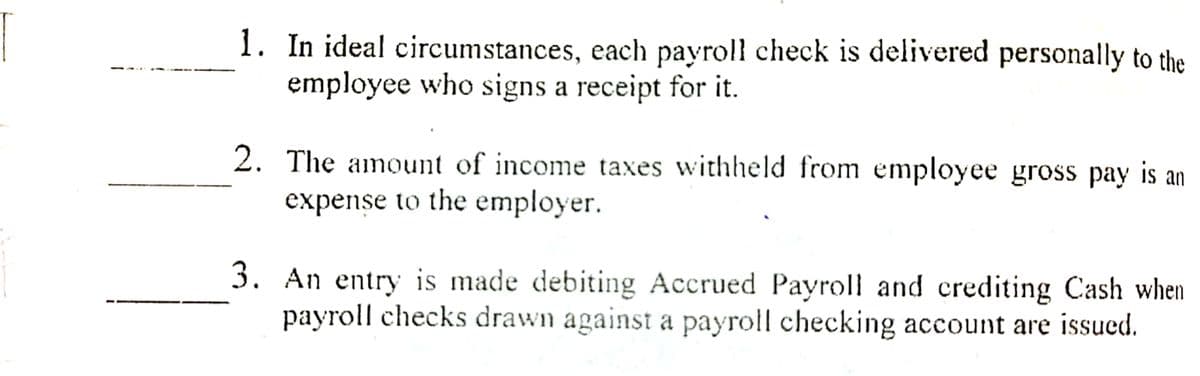

1. In ideal circumstances, each payroll check is delivered personally to the employee who signs a receipt for it. 2. The amount of income taxes withheld from employee gross pay is an expense to the employer. 3. An entry is made debiting Accrued Payroll and crediting Cash when payroll checks drawn against a payroll checking account are issued.

1. In ideal circumstances, each payroll check is delivered personally to the employee who signs a receipt for it. 2. The amount of income taxes withheld from employee gross pay is an expense to the employer. 3. An entry is made debiting Accrued Payroll and crediting Cash when payroll checks drawn against a payroll checking account are issued.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 10MCQ: When a credit is made to federal income taxes withholding payable account related to taxes withheld...

Related questions

Question

Please write TRUE if the statement is True. And if FALSE, WRITE THE CORRECT STATEMENT.

Transcribed Image Text:1. In ideal circumstances, each payroll check is delivered personally to the

employee who signs a receipt for it.

2. The amount of income taxes withheld from employee gross pay is an

expense to the employer.

3. An entry is made debiting Accrued Payroll and crediting Cash when

payroll checks drawn against a payroll checking account are issued.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning