how is "gross earnings" of $1021.01 derived?

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.9EX

Related questions

Question

Payroll accounting, has to do with "piece-rate employee overtime":

The problem is attached. My question is how is "gross earnings" of $1021.01 derived?

Transcribed Image Text:Chapter 3

Gross Pay Computation

127

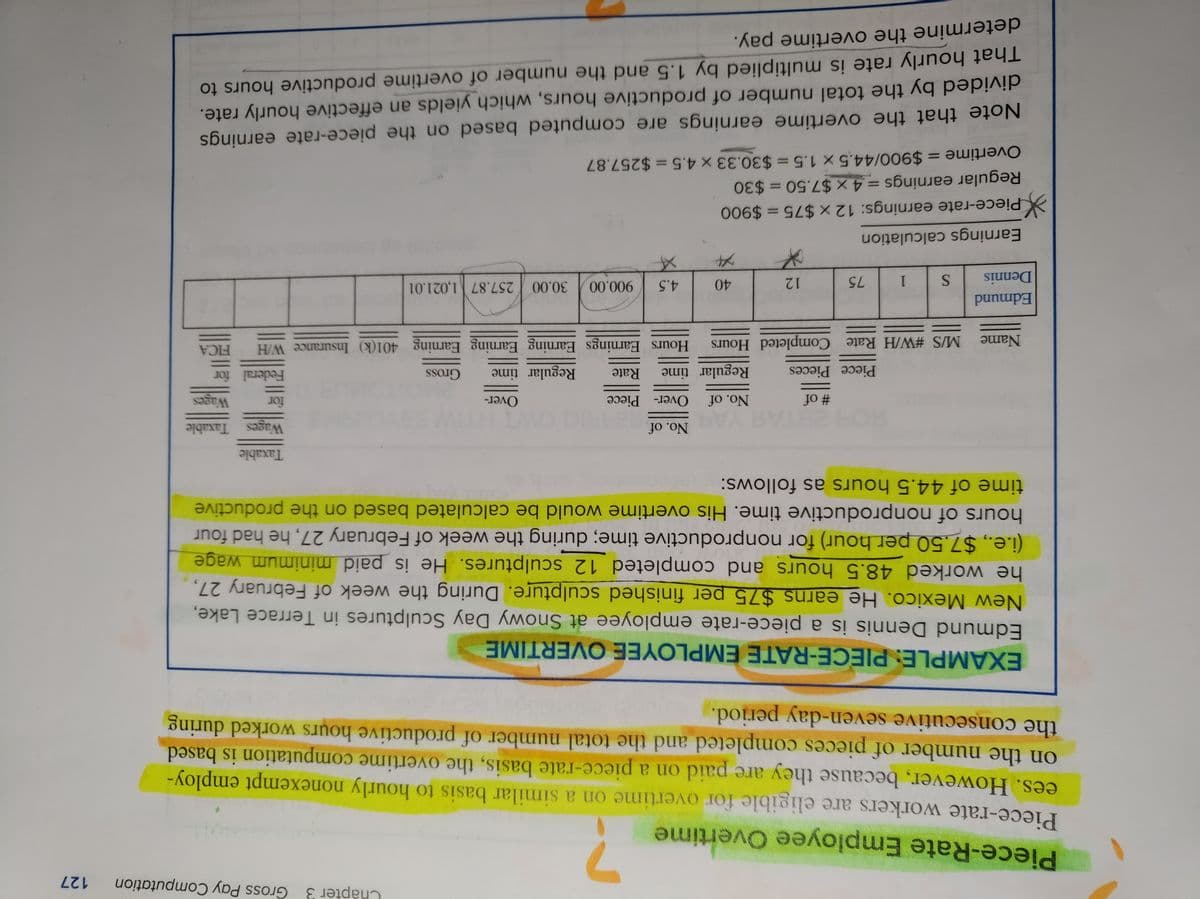

Piece-Rate Employee Overtime

Piece-rate workers are eligible for overtime on a similar basis to hourly nonexempt employ-

ees. However, because they are paid on a piece-rate basis, the overtime computation is based

on the number of pieces completed and the total number of productive hours worked during

the consecutive seven-day period.

EXAMPLE: PIECE-RATE EMPLOYEE OVERTIME

Edmund Dennis is a piece-rate employee at Snowy Day Sculptures in Terrace Lake,

New Mexico. He earns $75 per finished sculpture. During the week of February 27,

he worked 48.5 hours and completed 12 sculptures. He is paid minimum wage

(i.e., $7.50 per hour) for nonproductive time; during the week of February 27, he had four

hours of nonproductive time. His overtime would be calculated based on the productive

time of 44.5 hours as follows:

Taxable

No. of

Wages Taxable

MILLH

Wages

for

Federal for

# of

No. of

Over- Piece

Over-

Piece Pieces

Regular time

Rate

Regular time

Hours Earnings Earning Earning Earning 401(k) Insurance W/H

FICA

Name

M/S #W/H Rate Completed Hours

Edmund

4.5

900.00

30.00

257.87 1,021.01

Dennis

1.

75

12

40

Earnings calculation

Piece-rate earnings: 12 x $75 = $900

Regular earnings = 4 x $7.50 = $30

Overtime = $900/44.5 × 1.5 = $30.33 x 4.5 = $257.87

%3D

%3D

%3D

%3D

Note that the overtime earnings are computed based on the piece-rate earnings

divided by the total number of productive hours, which yields an effective hourly rate.

That hourly rate is multiplied by 1.5 and the number of overtime productive hours to

%3D

determine the overtime pay.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning