1. Internal control a. Two or more people working together to overcome internal controls. 2. Control procedures 3. Firewalls b. Part of internal control that ensures resources are not wasted. 4. Encryption c. Requires companies to review internal control and take responsibility for the accuracy and completeness of their financial reports. 5. Environment 6. Information system 7. Separation of duties d. Should be prenumbered to prevent theft and inefficiency. 8. Collusion e. Limits access to a local network. 9. Documents f. Example: The person who opens the bank statement should not also be the person who is reconciling cash. 10. Audits g. Identification of uncertainties that may arise due to a company's products, services, or operations. 11. Operational efficiency 12. Risk assessment h. Examination of a company's financial statements and accounting system by a trained accounting professional. 13. Sarbanes-Oxley Act i. Without a sufficient one of these, information cannot properly be gathered and summarized. j. The organizational plan and all the related measures that safeguard assets, encourage employees to follow company policies, promote operational efficiency, and ensure accurate and reliable accounting data. k. Component of internal control that helps ensure business goals are achieved. I. Rearranges data by a mathematical process. m. To establish an effective one, a company's CEO and top managers must behave honorably to set a good example for employees.

1. Internal control a. Two or more people working together to overcome internal controls. 2. Control procedures 3. Firewalls b. Part of internal control that ensures resources are not wasted. 4. Encryption c. Requires companies to review internal control and take responsibility for the accuracy and completeness of their financial reports. 5. Environment 6. Information system 7. Separation of duties d. Should be prenumbered to prevent theft and inefficiency. 8. Collusion e. Limits access to a local network. 9. Documents f. Example: The person who opens the bank statement should not also be the person who is reconciling cash. 10. Audits g. Identification of uncertainties that may arise due to a company's products, services, or operations. 11. Operational efficiency 12. Risk assessment h. Examination of a company's financial statements and accounting system by a trained accounting professional. 13. Sarbanes-Oxley Act i. Without a sufficient one of these, information cannot properly be gathered and summarized. j. The organizational plan and all the related measures that safeguard assets, encourage employees to follow company policies, promote operational efficiency, and ensure accurate and reliable accounting data. k. Component of internal control that helps ensure business goals are achieved. I. Rearranges data by a mathematical process. m. To establish an effective one, a company's CEO and top managers must behave honorably to set a good example for employees.

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 2MC: Internal control is said to be the backbone of all businesses. Which of the following is the best...

Related questions

Question

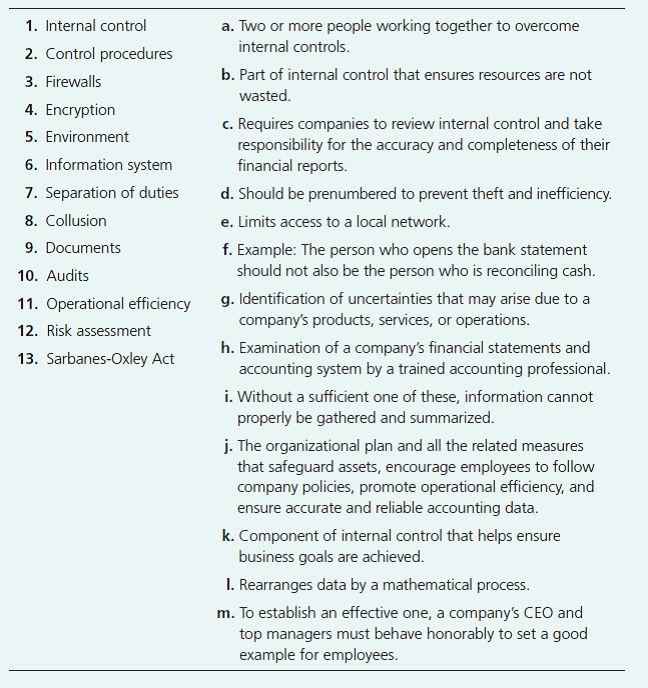

Understanding internal control, components, procedures, and laws

Match the following terms with their definitions.

Transcribed Image Text:1. Internal control

a. Two or more people working together to overcome

internal controls.

2. Control procedures

3. Firewalls

b. Part of internal control that ensures resources are not

wasted.

4. Encryption

c. Requires companies to review internal control and take

responsibility for the accuracy and completeness of their

financial reports.

5. Environment

6. Information system

7. Separation of duties

d. Should be prenumbered to prevent theft and inefficiency.

8. Collusion

e. Limits access to a local network.

9. Documents

f. Example: The person who opens the bank statement

should not also be the person who is reconciling cash.

10. Audits

g. Identification of uncertainties that may arise due to a

company's products, services, or operations.

11. Operational efficiency

12. Risk assessment

h. Examination of a company's financial statements and

accounting system by a trained accounting professional.

13. Sarbanes-Oxley Act

i. Without a sufficient one of these, information cannot

properly be gathered and summarized.

j. The organizational plan and all the related measures

that safeguard assets, encourage employees to follow

company policies, promote operational efficiency, and

ensure accurate and reliable accounting data.

k. Component of internal control that helps ensure

business goals are achieved.

I. Rearranges data by a mathematical process.

m. To establish an effective one, a company's CEO and

top managers must behave honorably to set a good

example for employees.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning