From pages 4-1 and 4-2 of the VLN, the COSO Framework describes 5 components of internal control. What is the purpose of internal controls from a financial accounting perspective? 1. To guarantee no fraud will occur in the organization. 2. To help safeguard the company's assets. 3. To help improve the accuracy and reliability of the accounting information. 4.To prevent collusion. Group of answer choices A. 1,2, and 3 B. 2 and 3 C. 2, 3, and 4 D.1, 2, 3, and 4

From pages 4-1 and 4-2 of the VLN, the COSO Framework describes 5 components of internal control. What is the purpose of internal controls from a financial accounting perspective? 1. To guarantee no fraud will occur in the organization. 2. To help safeguard the company's assets. 3. To help improve the accuracy and reliability of the accounting information. 4.To prevent collusion. Group of answer choices A. 1,2, and 3 B. 2 and 3 C. 2, 3, and 4 D.1, 2, 3, and 4

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter1: Accounting As A Form Of Communication

Section: Chapter Questions

Problem 1.7DC

Related questions

Question

From pages 4-1 and 4-2 of the VLN, the COSO Framework describes 5 components of internal control. What is the purpose of internal controls from a financial accounting perspective?

1. To guarantee no fraud will occur in the organization.

2. To help safeguard the company's assets.

3. To help improve the accuracy and reliability of the accounting information.

4.To prevent collusion.

Group of answer choices

A. 1,2, and 3

B. 2 and 3

C. 2, 3, and 4

D.1, 2, 3, and 4

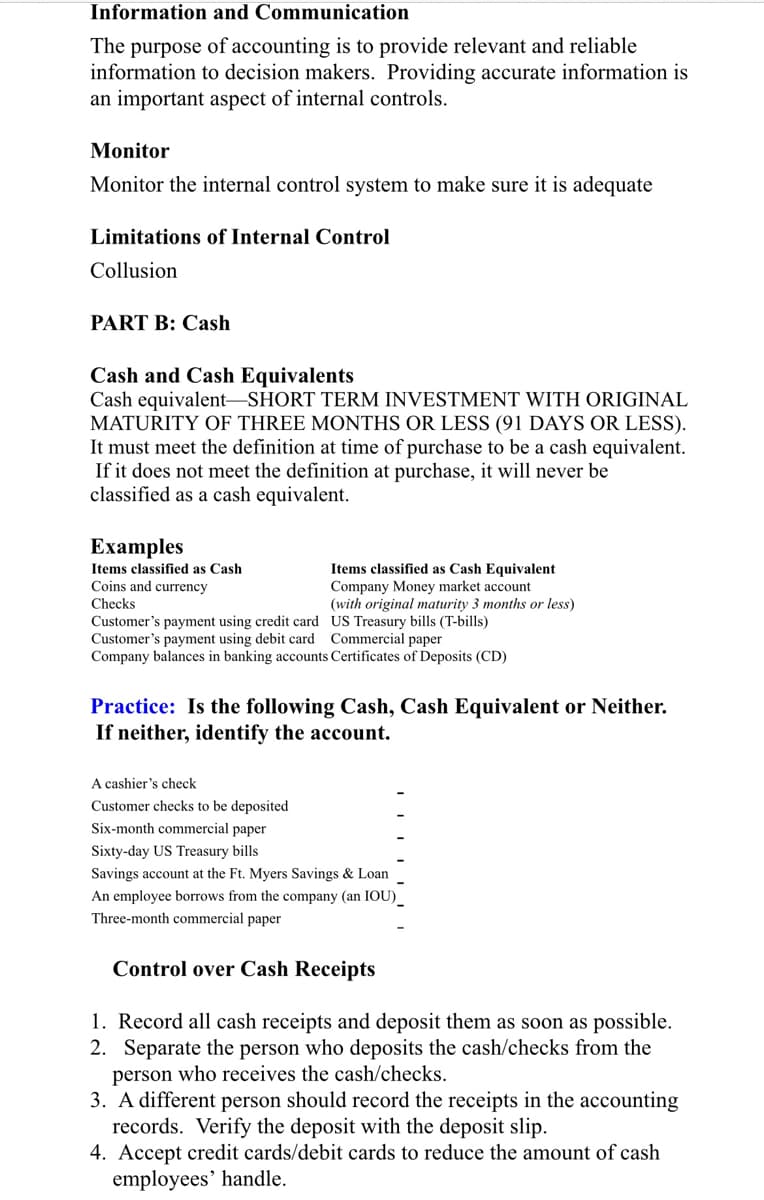

Transcribed Image Text:Information and Communication

The purpose of accounting is to provide relevant and reliable

information to decision makers. Providing accurate information is

an important aspect of internal controls.

Monitor

Monitor the internal control system to make sure it is adequate

Limitations of Internal Control

Collusion

PART B: Cash

Cash and Cash Equivalents

Cash equivalent-SHORT TERM INVESTMENT WITH ORIGINAL

MATURITY OF THREE MONTHS OR LESS (91 DAYS OR LESS).

It must meet the definition at time of purchase to be a cash equivalent.

If it does not meet the definition at purchase, it will never be

classified as a cash equivalent.

Examples

Items classified as Cash

Coins and currency

Items classified as Cash Equivalent

Company Money market account

(with original maturity 3 months or less)

Checks

Customer's payment using credit card US Treasury bills (T-bills)

Customer's payment using debit card Commercial paper

Company balances in banking accounts Certificates of Deposits (CD)

Practice: Is the following Cash, Cash Equivalent or Neither.

If neither, identify the account.

A cashier's check

Customer checks to be deposited

Six-month commercial paper

Sixty-day US Treasury bills

ngs

at the Ft. Myers Savings & Loan

An employee borrows from the company (an IOU)

Three-month commercial paper

Control over Cash Receipts

1. Record all cash receipts and deposit them as soon as possible.

2. Separate the person who deposits the cash/checks from the

person who receives the cash/checks.

3. A different person should record the receipts in the accounting

records. Verify the deposit with the deposit slip.

4. Accept credit cards/debit cards to reduce the amount of cash

employees' handle.

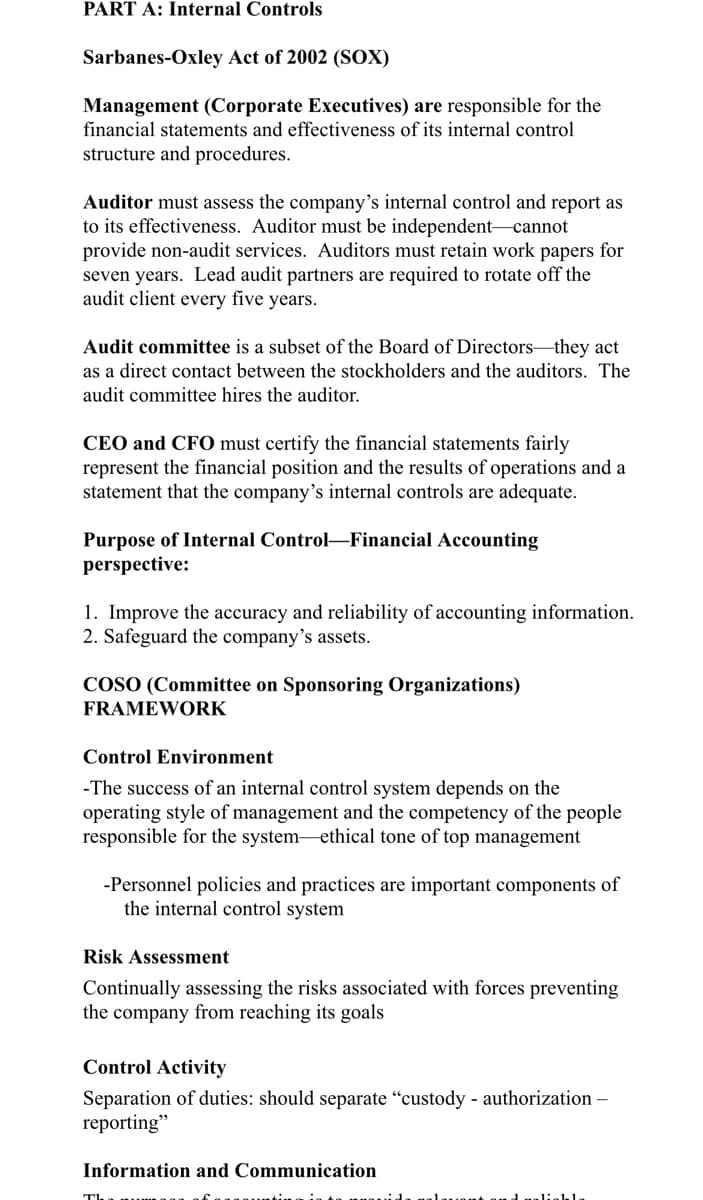

Transcribed Image Text:PART A: Internal Controls

Sarbanes-Oxley Act of 2002 (SOX)

Management (Corporate Executives) are responsible for the

financial statements and effectiveness of its internal control

structure and procedures.

Auditor must assess the company's internal control and report as

to its effectiveness. Auditor must be independent-cannot

provide non-audit services. Auditors must retain work papers for

seven years. Lead audit partners are required to rotate off the

audit client every five years.

Audit committee is a subset of the Board of Directors-they act

as a direct contact between the stockholders and the auditors. The

audit committee hires the auditor.

CEO and CF0 must certify the financial statements fairly

represent the financial position and the results of operations and a

statement that the company's internal controls are adequate.

Purpose of Internal Control-Financial Accounting

perspective:

1. Improve the accuracy and reliability of accounting information.

2. Safeguard the company's assets.

COSO (Committee on Sponsoring Organizations)

FRAMEWORK

Control Environment

-The success of an internal control system depends on the

operating style of management and the competency of the people

responsible for the system-ethical tone of top management

-Personnel policies and practices are important components of

the internal control system

Risk Assessment

Continually assessing the risks associated with forces preventing

the company from reaching its goals

Control Activity

Separation of duties: should separate “custody - authorization –

reporting"

Information and Communication

Tha

uont and ualiekle

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,