1. Inventory should be stated at (a) Lower of cost and fair value. (b) Lower of cost and net realizable value. (c) Lower of cost and nominal value. (d) Lower of cost and net selling price.

1. Inventory should be stated at (a) Lower of cost and fair value. (b) Lower of cost and net realizable value. (c) Lower of cost and nominal value. (d) Lower of cost and net selling price.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 75.1C

Related questions

Topic Video

Question

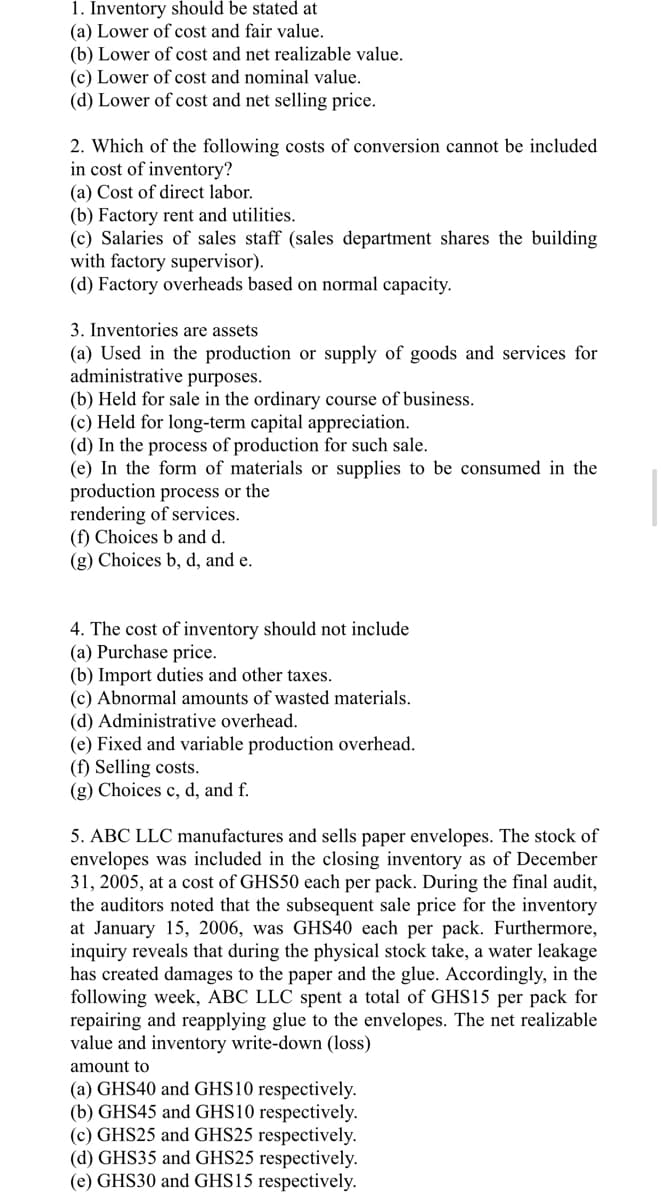

Transcribed Image Text:1. Inventory should be stated at

(a) Lower of cost and fair value.

(b) Lower of cost and net realizable value.

(c) Lower of cost and nominal value.

(d) Lower of cost and net selling price.

2. Which of the following costs of conversion cannot be included

in cost of inventory?

(a) Cost of direct labor.

(b) Factory rent and utilities.

(c) Salaries of sales staff (sales department shares the building

with factory supervisor).

(d) Factory overheads based on normal capacity.

3. Inventories are assets

(a) Used in the production or supply of goods and services for

administrative purposes.

(b) Held for sale in the ordinary course of business.

(c) Held for long-term capital appreciation.

(d) In the process of production for such sale.

(e) In the form of materials or supplies to be consumed in the

production process or the

rendering of services.

(f) Choices b and d.

(g) Choices b, d, and e.

4. The cost of inventory should not include

(a) Purchase price.

(b) Import duties and other taxes.

(c) Abnormal amounts of wasted materials.

(d) Administrative overhead.

(e) Fixed and variable production overhead.

(f) Selling costs.

(g) Choices c, d, and f.

5. ABC LLC manufactures and sells paper envelopes. The stock of

envelopes was included in the closing inventory as of December

31, 2005, at a cost of GHS50 each per pack. During the final audit,

the auditors noted that the subsequent sale price for the inventory

at January 15, 2006, was GHS40 each per pack. Furthermore,

inquiry reveals that during the physical stock take, a water leakage

has created damages to the paper and the glue. Accordingly, in the

following week, ABC LLC spent a total of GHS15 per pack for

repairing and reapplying glue to the envelopes. The net realizable

value and inventory write-down (loss)

amount to

(a) GHS40 and GHS10 respectively.

(b) GHS45 and GHS10 respectively.

(c) GHS25 and GHS25 respectively.

(d) GHS35 and GHS25 respectively.

(e) GHS30 and GHS15 respectively.

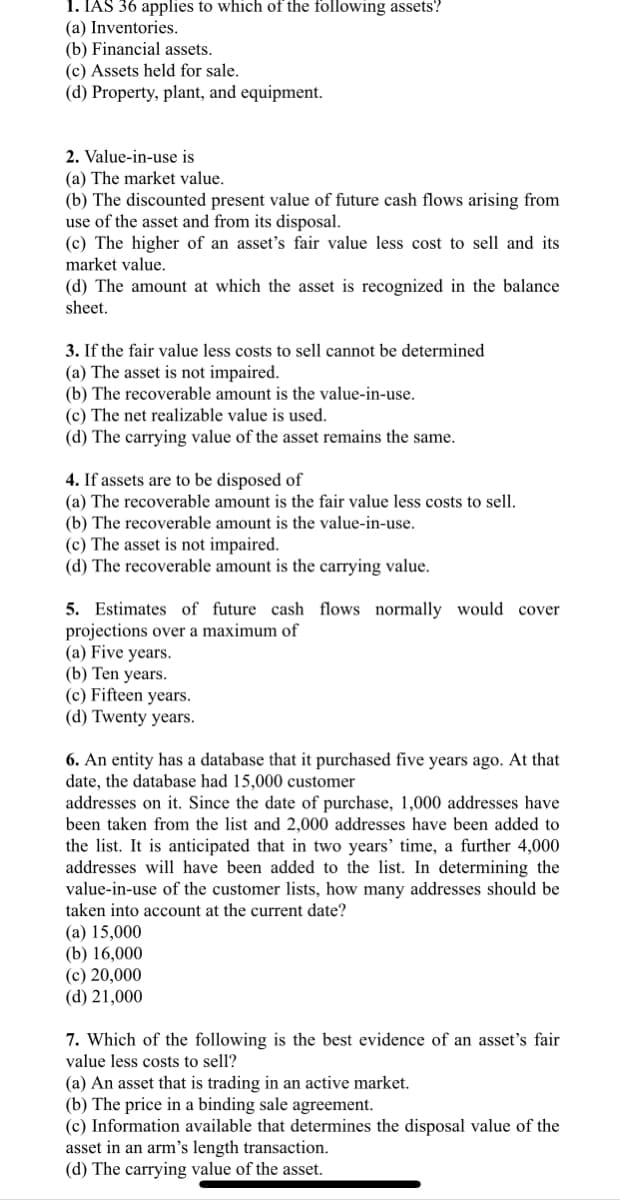

Transcribed Image Text:1. IAS 36 applies to which of the following assets?

(a) Inventories.

(b) Financial assets.

(c) Assets held for sale.

(d) Property, plant, and equipment.

2. Value-in-use is

(a) The market value.

(b) The discounted present value of future cash flows arising from

use of the asset and from its disposal.

(c) The higher of an asset's fair value less cost to sell and its

market value.

(d) The amount at which the asset is recognized in the balance

sheet.

3. If the fair value less costs to sell cannot be determined

(a) The asset is not impaired.

(b) The recoverable amount is the value-in-use.

(c) The net realizable value is used.

(d) The carrying value of the asset remains the same.

4. If assets are to be disposed of

(a) The recoverable amount is the fair value less costs to sell.

(b) The recoverable amount is the value-in-use.

(c) The asset is not impaired.

(d) The recoverable amount is the carrying value.

5. Estimates of future cash flows normally would cover

projections over a maximum of

(a) Five years.

(b) Ten years.

(c) Fifteen years.

(d) Twenty years.

6. An entity has a database that it purchased five years ago. At that

date, the database had 15,000 customer

addresses on it. Since the date of purchase, 1,000 addresses have

been taken from the list and 2,000 addresses have been added to

the list. It is anticipated that in two years' time, a further 4,000

addresses will have been added to the list. In determining the

value-in-use of the customer lists, how many addresses should be

taken into account at the current date?

(a) 15,000

(b) 16,000

(c) 20,000

(d) 21,000

7. Which of the following is the best evidence of an asset's fair

value less costs to sell?

(a) An asset that is trading in an active market.

(b) The price in a binding sale agreement.

(c) Information available that determines the disposal value of the

asset in an arm's length transaction.

(d) The carrying value of the asset.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning