1. Journalize the selected transactions. Assume 360 days per year. If no entry is required, select "No Entry Required" from the dropdown and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. Jan. 3: Issued a check to establish a petty cash fund of $4,500. Description Debit Credit Feb. 26: Replenished the petty cash fund, based on the following summary of petty cash receipts: office supplies, $1.680; miscellaneous selling expense, $570; miscellaneous administrative expense, $880. Description Debit Credit Apr. 14: Purchased $31.300 of merchandise on account, terms, n/30. The perpetual inventory system is used to account for inventory. Description Debit Credit May 13: Paid the invoice of April 14. Description Debit Credit May 17: Received cash from daily cash sales for $21,200. The amount indicated by the cash register was $21,240. Description Debit Credit

1. Journalize the selected transactions. Assume 360 days per year. If no entry is required, select "No Entry Required" from the dropdown and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. Jan. 3: Issued a check to establish a petty cash fund of $4,500. Description Debit Credit Feb. 26: Replenished the petty cash fund, based on the following summary of petty cash receipts: office supplies, $1.680; miscellaneous selling expense, $570; miscellaneous administrative expense, $880. Description Debit Credit Apr. 14: Purchased $31.300 of merchandise on account, terms, n/30. The perpetual inventory system is used to account for inventory. Description Debit Credit May 13: Paid the invoice of April 14. Description Debit Credit May 17: Received cash from daily cash sales for $21,200. The amount indicated by the cash register was $21,240. Description Debit Credit

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter9: Accounting For Purchases And Cash Payments

Section: Chapter Questions

Problem 4AP

Related questions

Question

100%

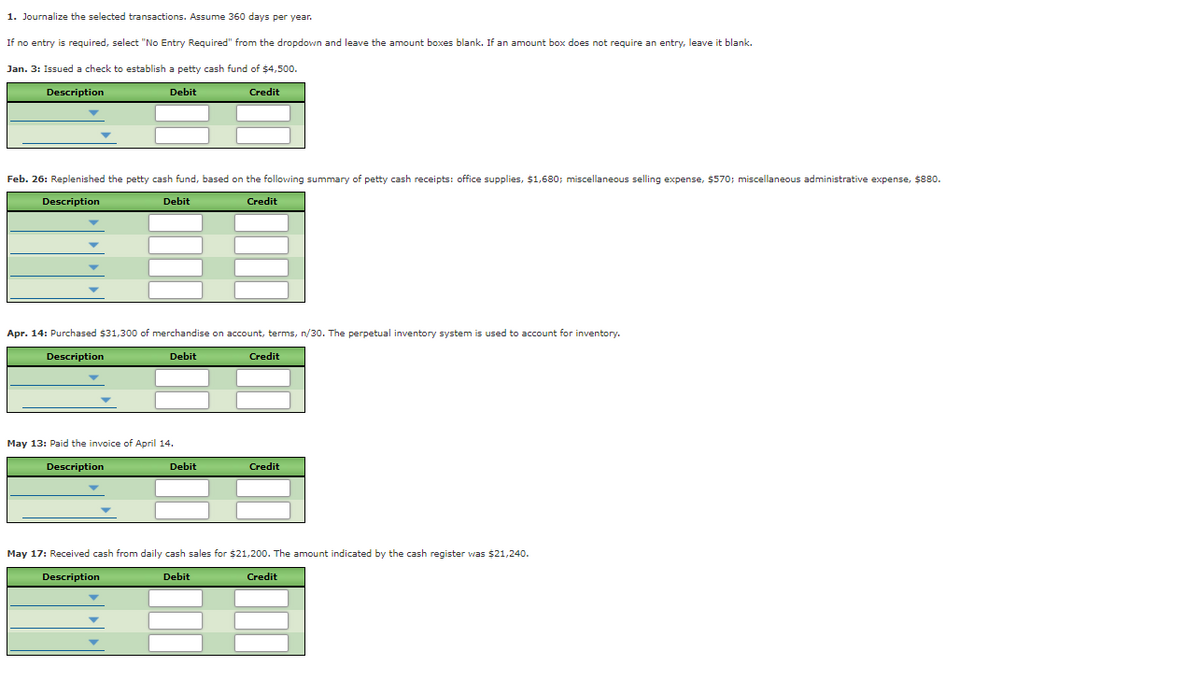

Transcribed Image Text:1. Journalize the selected transactions. Assume 360 days per year.

If no entry is required, select "No Entry Required" from the dropdown and leave the amount boxes blank. If an amount box does not require an entry, leave it blank.

Jan. 3: Issued a check to establish a petty cash fund of $4,500.

Description

Debit

Credit

Feb. 26: Replenished the petty cash fund, based on the following summary of petty cash receipts: office supplies, $1,680; miscellaneous selling expense, $570; miscellaneous administrative expense, $880.

Description

Debit

Credit

Apr. 14: Purchased $31,300 of merchandise on account, terms, n/30. The perpetual inventory system is used to account for inventory.

Description

Debit

Credit

May 13: Paid the invoice of April 14.

Description

Debit

Credit

May 17: Received cash from daily cash sales for $21,200. The amount indicated by the cash register was $21,240.

Description

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning