1. Match the Vocabulary word with the definition below. a. Payments to governments that are then used for public goods and services. 1. FICA tax 2. Medicare b. A certain percentage is taken out of your income and is used to fund this program. 3. Payroll Taxes o. This is money that is withheld from your paycheck by your employer and given to the government to 4. Taxes use. 5. Property Taxes d. FICA tax, Medicare tax, federal income tax, state income tax, and other local taxes are all part of a specific tax. ... 6. Income Tax e. Government income that they get from taxes. 7. Internal Revenue Service ...... f. You pay these taxes if you own a home, boat, car, ATV, etc. 8. Withholding g. "Federal Insurance Contribution Act" that funds social security and Medicare. 9. Tax Revenue ... h. Taxes that you pay based on your salary, hourly wage, tips, or interest.

1. Match the Vocabulary word with the definition below. a. Payments to governments that are then used for public goods and services. 1. FICA tax 2. Medicare b. A certain percentage is taken out of your income and is used to fund this program. 3. Payroll Taxes o. This is money that is withheld from your paycheck by your employer and given to the government to 4. Taxes use. 5. Property Taxes d. FICA tax, Medicare tax, federal income tax, state income tax, and other local taxes are all part of a specific tax. ... 6. Income Tax e. Government income that they get from taxes. 7. Internal Revenue Service ...... f. You pay these taxes if you own a home, boat, car, ATV, etc. 8. Withholding g. "Federal Insurance Contribution Act" that funds social security and Medicare. 9. Tax Revenue ... h. Taxes that you pay based on your salary, hourly wage, tips, or interest.

Chapter22: S Corporations

Section: Chapter Questions

Problem 9DQ

Related questions

Question

help

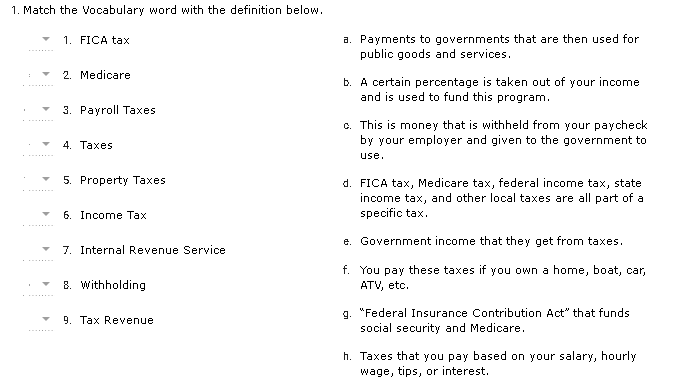

Transcribed Image Text:1. Match the Vocabulary word with the definition below.

a. Payments to governments that are then used for

public goods and services.

1. FICA tax

2. Medicare

b. A certain percentage is taken out of your income

and is used to fund this program.

3. Payroll Taxes

c. This is money that is withheld from your paycheck

by your employer and given to the government to

4. Taxes

use.

5. Property Taxes

d. FICA tax, Medicare tax, federal income tax, state

income tax, and other local taxes are all part of a

specific tax.

6. Income Tах

e. Government income that they get from taxes.

7. Internal Revenue Service

f. You pay these taxes if you own a home, boat, car,

ATV, etc.

8. withholding

g. "Federal Insurance Contribution Act" that funds

social security and Medicare.

9. Таx Revenue

h. Taxes that you pay based on your salary, hourly

wage, tips, or interest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning