n Pennsylvania, state sales tax is used to pay for services provided by the state. TI sales tax rates vary by city and county. In Warren County the sales tax rate is 6%; in Allegheny County, the sales tax rate is 7%; and in Philadelphia the sales tax rate is 3%. Using the Philadelphia sales tax rate, choose the table that includes 5 possibl solutions pairs. A. Cost before sales tax Amount of sales tax 10 0.8 20 1.6 30 2.4 40 3.2 50 4.0

n Pennsylvania, state sales tax is used to pay for services provided by the state. TI sales tax rates vary by city and county. In Warren County the sales tax rate is 6%; in Allegheny County, the sales tax rate is 7%; and in Philadelphia the sales tax rate is 3%. Using the Philadelphia sales tax rate, choose the table that includes 5 possibl solutions pairs. A. Cost before sales tax Amount of sales tax 10 0.8 20 1.6 30 2.4 40 3.2 50 4.0

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter1: Introductin To Taxation

Section: Chapter Questions

Problem 15P

Related questions

Question

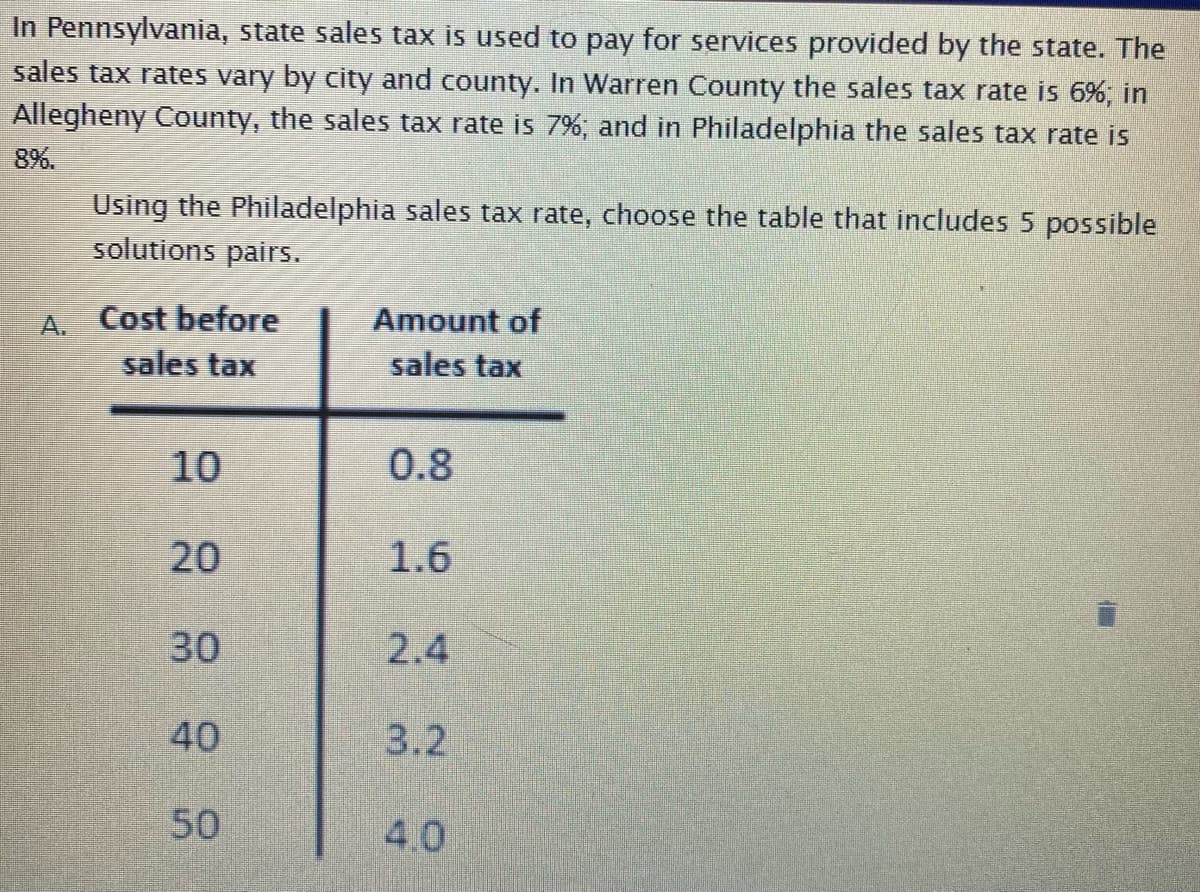

Transcribed Image Text:In Pennsylvania, state sales tax is used to pay for services provided by the state. The

sales tax rates vary by city and county. In Warren County the sales tax rate is 6%; in

Allegheny County, the sales tax rate is 7%, and in Philadelphia the sales tax rate is

8%.

Using the Philadelphia sales tax rate, choose the table that includes 5 possible

solutions pairs.

A. Cost before

sales tax

Amount of

sales tax

10

0.8

20

1.6

30

2.4

40

3.2

50

4.0

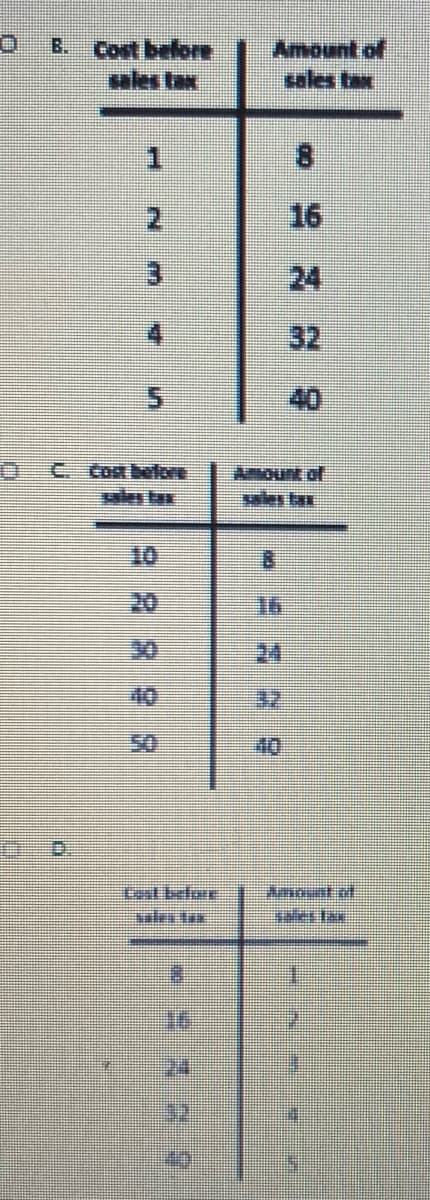

Transcribed Image Text:Cort belore

sales tax

Amount of

sales tax

B.

8.

16

24

32

40

C. Con belore

ales tax

ount of

swles bax

10

20

30

24

40

32

50

40

Amount of

sules tax

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT