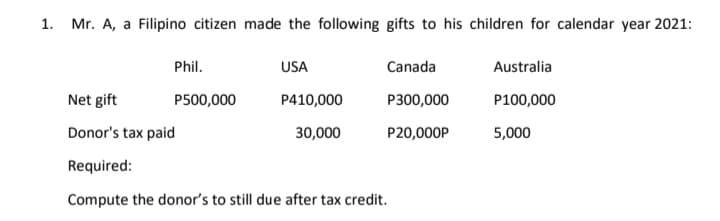

1. Mr. A, a Filipino citizen made the following gifts to his children for calendar year 2021: Phil. USA Canada Australia Net gift P500,000 P410,000 P300,000 P100,000 Donor's tax paid 30,000 P20,000P 5,000 Required: Compute the donor's to still due after tax credit.

1. Mr. A, a Filipino citizen made the following gifts to his children for calendar year 2021: Phil. USA Canada Australia Net gift P500,000 P410,000 P300,000 P100,000 Donor's tax paid 30,000 P20,000P 5,000 Required: Compute the donor's to still due after tax credit.

Chapter13: Property Transact Ions: Determination Of Gain Or Loss, Basis Considerations, And Nontaxable Exchanges

Section: Chapter Questions

Problem 57P

Related questions

Question

Transcribed Image Text:1. Mr. A, a Filipino citizen made the following gifts to his children for calendar year 2021:

Phil.

USA

Canada

Australia

Net gift

P500,000

P410,000

P300,000

P100,000

Donor's tax paid

30,000

P20,000P

5,000

Required:

Compute the donor's to still due after tax credit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you