1. On December 1, 20x5, EE and FF formeda partnership, agreeing to share for profits and losses in the ratio of 2:3, respectively. EE invested a parcel of land that cost him P25,000. FF invested P30,000 cash. The land was sold for P50,000 on the same date, three hours after formation of the partnership. How much should be the capital balance of EE right after formation? C. d. a. b. P25,000 30,000 P60,000 50,000 (AICPA)

1. On December 1, 20x5, EE and FF formeda partnership, agreeing to share for profits and losses in the ratio of 2:3, respectively. EE invested a parcel of land that cost him P25,000. FF invested P30,000 cash. The land was sold for P50,000 on the same date, three hours after formation of the partnership. How much should be the capital balance of EE right after formation? C. d. a. b. P25,000 30,000 P60,000 50,000 (AICPA)

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 1PA: The partnership of Tatum and Brook shares profits and losses in a 60:40 ratio respectively after...

Related questions

Question

How to compute partnership capital balance

Transcribed Image Text:9.

Partnership

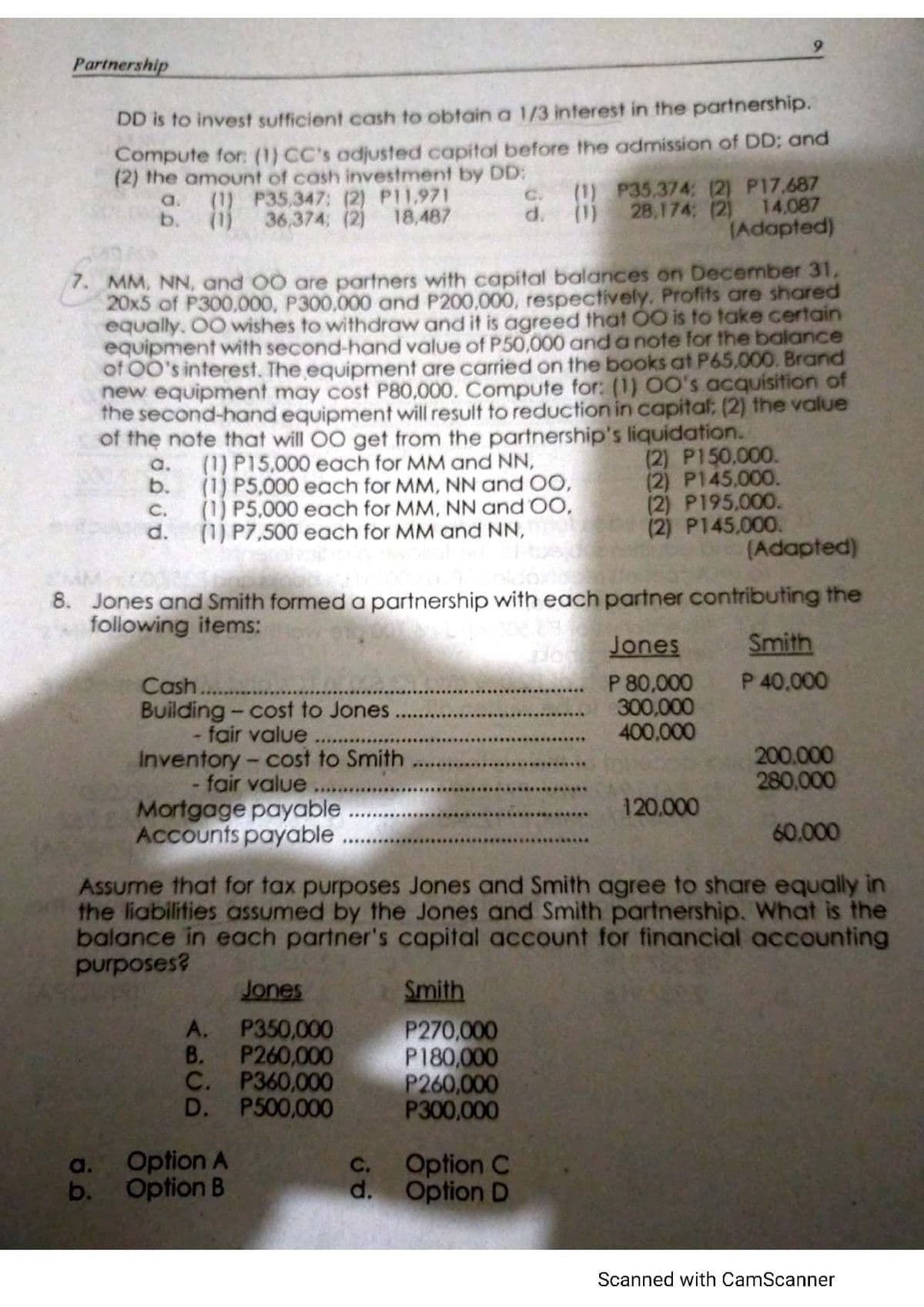

DD is to invest sufficient cash to obtain a 1/3 interest in the partnership.

Compute for: (1) CC's adjusted capital before the admission of DD; and

(2) the amount of cash investment by DD:

a.

b.

(1) P35,374; (2) P17,687

(1) P35,347: (2) P11,971

36,374: (2) 18,487

(1)

C.

28,174; (2) 14,087

(Adapted)

d.

7. MM, NN, and O0 are partners with capital balances on December 31,

20x5 of P300,000, P300,000 and P200,000, respectively. Profits are shared

equally. OO wishes to withdraw and it is agreed that O0 is to take certain

equipment with second-hand value of P50,000 and a note for the balance

of OO's interest. The equipment are carried on the books at P65,000. Brand

new equipment may cost P80,000. Compute for: (1) O0's acquisition of

the second-hand equipment will result to reduction in capitat; (2) the value

of the note that will O0 get from the partnership's liquidation.

(1) P15,000 each for MM and NN,

(1) P5,000 each for MM, NN and O0,

(1) P5,000 each for MM, NN and 00,

(2) P150.000.

(2) P145,000.

(2) P195,000.

(2) P145,000.

a.

b.

C.

d.

) P7,500 each for MM and NN,

(Adapted)

8. Jones and Smith formed a partnership with each partner contributing the

folowing items:

Smith

Jones

P 80,000

300,000

400.000

P 40,000

Cash...

Building - cost to Jones

fair value

Inventory- cost to Smith

fair value

Mortgage payable

Accounts payable.

200.000

280,000

120,000

60.000

Assume that for tax purposes Jones and Smith agree to share equally in

the liabilities assumed by the Jones and Smith partnership. What is the

balance in each partner's capital account for financial accounting

purposes?

Jones

Smith

P270,000

P180,000

P260,000

P300,000

P350,000

В.

A.

P260,000

C. P360,000

D. P500,000

C. Option C

d. Option D

a. Option A

b.

Option B

Scanned with CamScanner

Transcribed Image Text:Partnership

Partnership Formation:

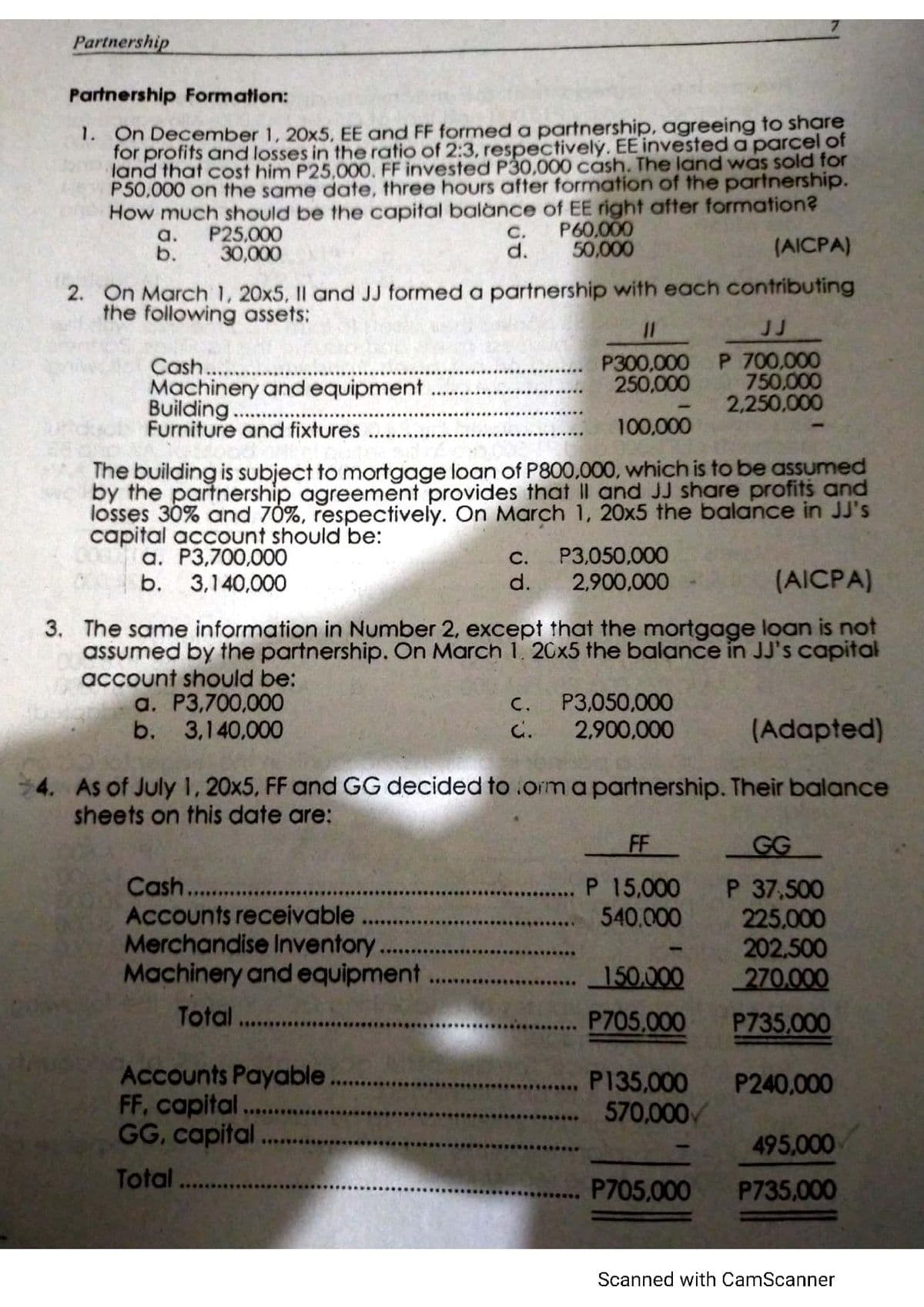

1. On December 1, 20x5, EE and FF formed a partnership, agreeing to share

for profits and losses in the ratio of 2:3, respectivelý. EE invested a parcel of

land that cost him P25,00O. FF invested P30,000 cash. The land was sold for

P50,000 on the same date, three hours after formation of the partnership.

How much should be the capital balànce of EE right after formation?

a.

b.

P25,000

P60,000

50,000

C.

30,000

(AICPA)

2. On March 1, 20x5, Il and JJ formed a partnership with each contributing

the following assets:

JJ

Cash..

Machinery and equipment

Building..

Furniture and fixtures

P300,000 P 700,000

750,000

2,250.000

250,000

100,000

The building is subject to mortgage loan of P800,000, which is to be assumed

by the partnership agreement provides that II and JJ share profits and

losses 30% and 70%, respectively. On March 1, 20x5 the balance in JJ's

capital account should be:

0000a. P3,700,000

b. 3,140,000

P3.050.000

2,900,000

C.

d.

(AICPA)

3. The same information in Number 2, except that the mortgage loan is not

assumed by the partnership. On March 1. 20x5 the balance in JJ's capital

account should be:

a. P3,700,000

b. 3,140,000

C.

P3,050,000

C.

2,900,000

(Adapted)

4. As of July 1, 20x5, FF and GG decided to .orm a partnership. Their balance

sheets on this date are:

FF

GG

Cash. .

Accounts receivable

Merchandise Inventory...

Machinery and equipment

P 15,000

540.000

P 37,500

225,000

202,500

270,000

150,000

Total...

P705,000

P735,000

Accounts Payable.

FF, capital...

GG, capital

P135,000

570,000

P240,000

495,000

Total

P705.000

P735,000

Scanned with CamScanner

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,