Blessing and Linda formed a partnership by investing P220,000 and P380,000, respectively. At he end of its first year of operations, the partnership has realized a profit of P400,000. nstructions: determine the distribution of profit under each of the following independent assumptions: 1. The partnership agreement does not mention profit sharing 2. Profit is divided in the ratio of the original investments. 3. Interest at 10% is to be allowed on the original capital investments and the balance to be divided equally. 4. Salaries of P75,000 and P55,000 respectively and the balance to be divided equally. 5. Interest at 12% is to be allowed on the original capital investments, salaries of P225,000 and P275,000 to partners, respectively and the balance to be divided in the ratio 2:3. In case of insufficient net income, however, this has to be distributed in the salary ratio. While if there is a net loss, then it has to be distributed equally. You may modify your answer sheet to fit your solution. Follow the Instructions strictly. Answer what Is asked only. Note:

Blessing and Linda formed a partnership by investing P220,000 and P380,000, respectively. At he end of its first year of operations, the partnership has realized a profit of P400,000. nstructions: determine the distribution of profit under each of the following independent assumptions: 1. The partnership agreement does not mention profit sharing 2. Profit is divided in the ratio of the original investments. 3. Interest at 10% is to be allowed on the original capital investments and the balance to be divided equally. 4. Salaries of P75,000 and P55,000 respectively and the balance to be divided equally. 5. Interest at 12% is to be allowed on the original capital investments, salaries of P225,000 and P275,000 to partners, respectively and the balance to be divided in the ratio 2:3. In case of insufficient net income, however, this has to be distributed in the salary ratio. While if there is a net loss, then it has to be distributed equally. You may modify your answer sheet to fit your solution. Follow the Instructions strictly. Answer what Is asked only. Note:

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.9AP

Related questions

Question

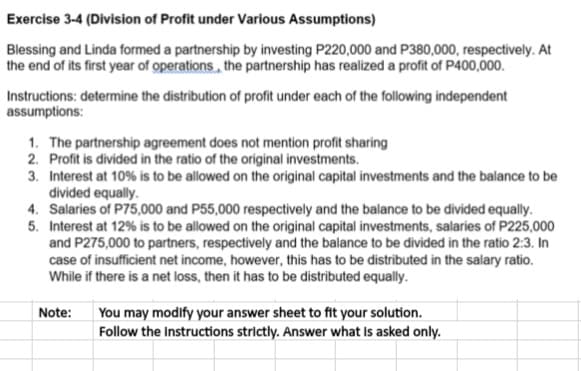

Transcribed Image Text:Exercise 3-4 (Division of Profit under Various Assumptions)

Blessing and Linda formed a partnership by investing P220,000 and P380,000, respectively. At

the end of its first year of operations, the partnership has realized a profit of P400,000.

Instructions: determine the distribution of profit under each of the following independent

assumptions:

1. The partnership agreement does not mention profit sharing

2. Profit is divided in the ratio of the original investments.

3. Interest at 10% is to be allowed on the original capital investments and the balance to be

divided equally.

4. Salaries of P75,000 and P55,000 respectively and the balance to be divided equally.

5. Interest at 12% is to be allowed on the original capital investments, salaries of P225,000

and P275,000 to partners, respectively and the balance to be divided in the ratio 2:3. In

case of insufficient net income, however, this has to be distributed in the salary ratio.

While if there is a net loss, then it has to be distributed equally.

Note:

You may modify your answer sheet to fit your solution.

Follow the Instructions strictly. Answer what Is asked only.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College