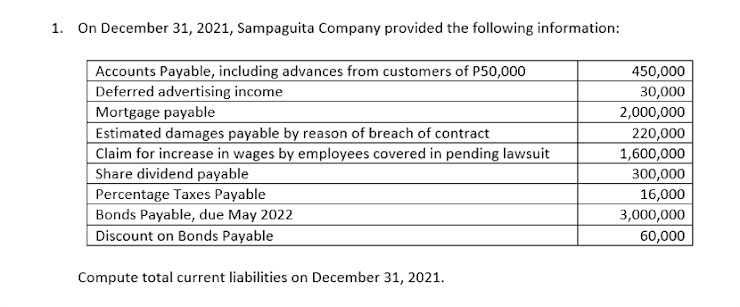

1. On December 31, 2021, Sampaguita Company provided the following information: Accounts Payable, including advances from customers of P50,000 Deferred advertising income Mortgage payable Estimated damages payable by reason of breach of contract Claim for increase in wages by emplloyees covered in pending lawsuit Share dividend payable Percentage Taxes Payable Bonds Payable, due May 2022 Discount on Bonds Payable 450,000 30,000 2,000,000 220,000 1,600,000 300,000 16,000 3,000,000 60,000 Compute total current liabilities on December 31, 2021.

1. On December 31, 2021, Sampaguita Company provided the following information: Accounts Payable, including advances from customers of P50,000 Deferred advertising income Mortgage payable Estimated damages payable by reason of breach of contract Claim for increase in wages by emplloyees covered in pending lawsuit Share dividend payable Percentage Taxes Payable Bonds Payable, due May 2022 Discount on Bonds Payable 450,000 30,000 2,000,000 220,000 1,600,000 300,000 16,000 3,000,000 60,000 Compute total current liabilities on December 31, 2021.

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 56P

Related questions

Question

100%

Transcribed Image Text:1. On December 31, 2021, Sampaguita Company provided the following information:

Accounts Payable, including advances from customers of P50,000

Deferred advertising income

Mortgage payable

Estimated damages payable by reason of breach of contract

Claim for increase in wages by employees covered in pending lawsuit

Share dividend payable

Percentage Taxes Payable

450,000

30,000

2,000,000

220,000

1,600,000

300,000

16,000

Bonds Payable, due May 2022

3,000,000

Discount on Bonds Payable

60,000

Compute total current liabilities on December 31, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT