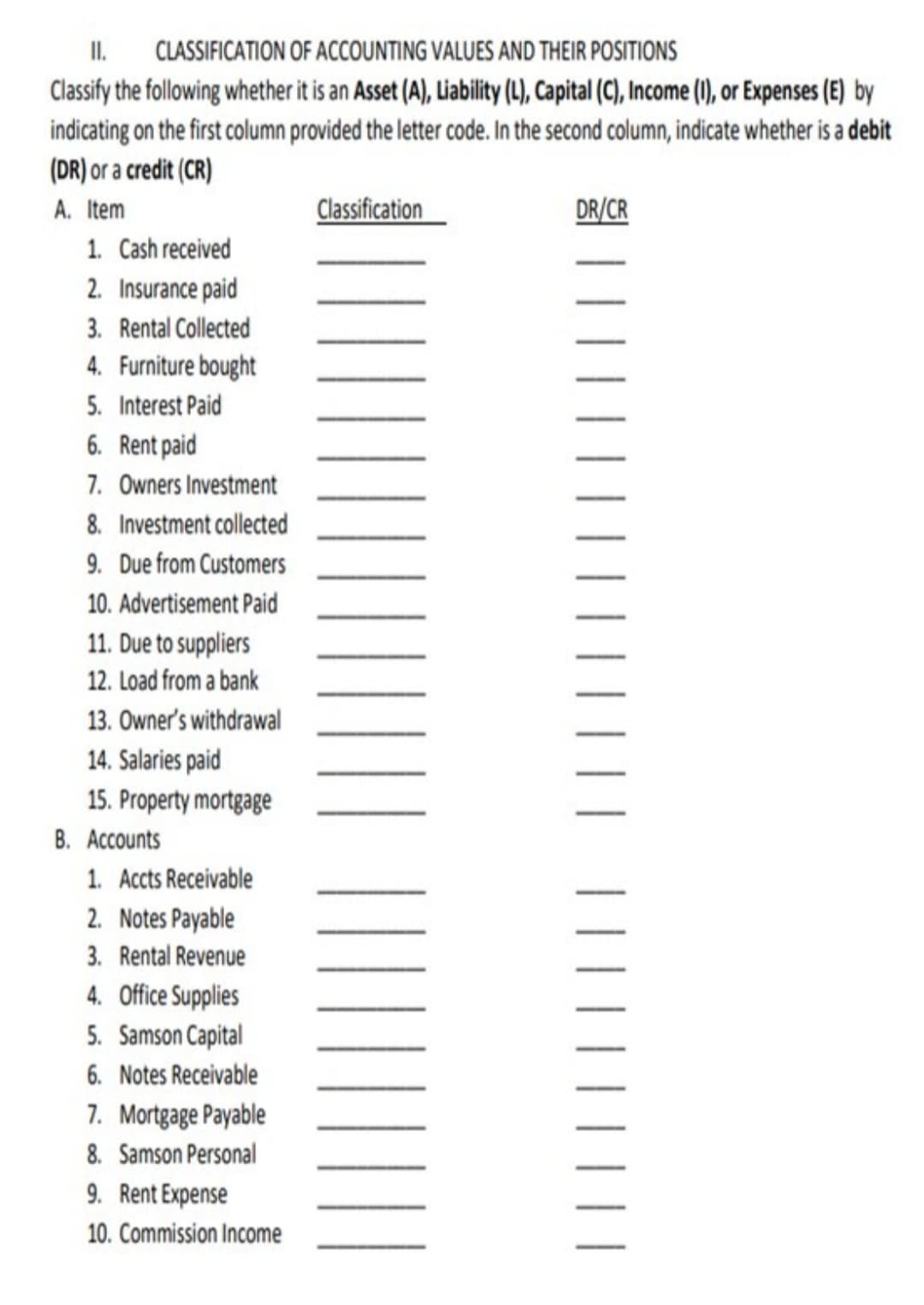

II. Classify the following whether it is an Asset (A), Liability (L), Capital (C), Income (), or Expenses (E) by indicating on the first column provided the letter code. In the second column, indicate whether is a debit (DR) or a credit (CR) CLASSIFICATION OF ACCOUNTING VALUES AND THEIR POSITIONS

II. Classify the following whether it is an Asset (A), Liability (L), Capital (C), Income (), or Expenses (E) by indicating on the first column provided the letter code. In the second column, indicate whether is a debit (DR) or a credit (CR) CLASSIFICATION OF ACCOUNTING VALUES AND THEIR POSITIONS

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter4: Adjusting Entries And The Work Sheet

Section: Chapter Questions

Problem 2E: Classify each of the accounts listed below as assets (A), liabilities (L), owners equity (OE),...

Related questions

Topic Video

Question

Transcribed Image Text:II.

Classify the following whether it is an Asset (A), Liability (4), Capital (C), Income (), or Expenses (E) by

indicating on the first column provided the letter code. In the second column, indicate whether is a debit

(DR) or a credit (CR)

CLASSIFICATION OF ACCOUNTING VALUES AND THEIR POSITIONS

A. Item

Classification

DR/CR

1. Cash received

2. Insurance paid

3. Rental Collected

4. Furniture bought

5. Interest Paid

6. Rent paid

7. Owners Investment

8. Investment collected

9. Due from Customers

10. Advertisement Paid

11. Due to suppliers

12. Load from a bank

13. Owner's withdrawal

14. Salaries paid

15. Property mortgage

B. Accounts

1. Accts Receivable

2. Notes Payable

3. Rental Revenue

4. Office Supplies

5. Samson Capital

6. Notes Receivable

7. Mortgage Payable

8. Samson Personal

9. Rent Expense

10. Commission Income

| |

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning