1. Owner Pedro invested an initial capital of amounting P50,000 in order to put up his janitorial services company. During the first year of operations (2018), the company had a loss of P25,000. Because of this, Pedro invested additional capital amounting to P50,000 in 2019. In the second year (2019), the company had a net income of P100,000 and Pedro withdrew P10,000 for personal use. > Compute for the ending capital balance of Pedro for the year 2019.

1. Owner Pedro invested an initial capital of amounting P50,000 in order to put up his janitorial services company. During the first year of operations (2018), the company had a loss of P25,000. Because of this, Pedro invested additional capital amounting to P50,000 in 2019. In the second year (2019), the company had a net income of P100,000 and Pedro withdrew P10,000 for personal use. > Compute for the ending capital balance of Pedro for the year 2019.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter18: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 1BD

Related questions

Question

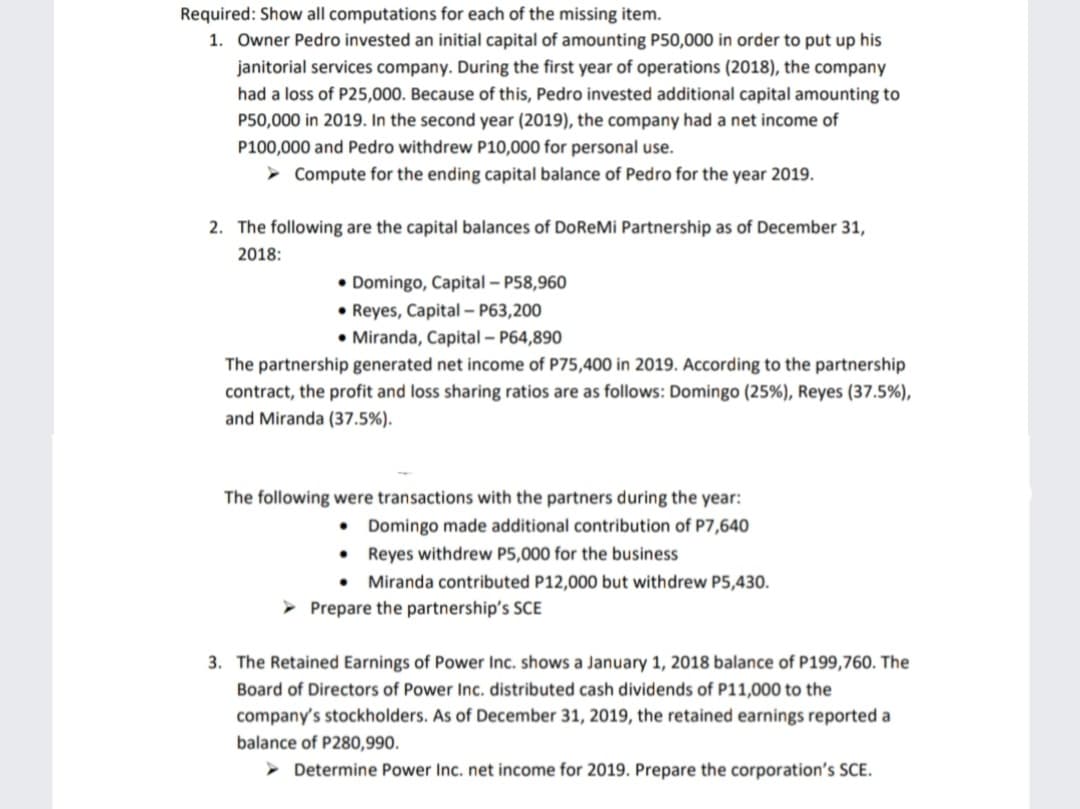

Transcribed Image Text:Required: Show all computations for each of the missing item.

1. Owner Pedro invested an initial capital of amounting P50,000 in order to put up his

janitorial services company. During the first year of operations (2018), the company

had a loss of P25,000. Because of this, Pedro invested additional capital amounting to

P50,000 in 2019. In the second year (2019), the company had a net income of

P100,000 and Pedro withdrew P10,000 for personal use.

> Compute for the ending capital balance of Pedro for the year 2019.

2. The following are the capital balances of DoReMi Partnership as of December 31,

2018:

• Domingo, Capital – P58,960

• Reyes, Capital - P63,200

• Miranda, Capital – P64,890

The partnership generated net income of P75,400 in 2019. According to the partnership

contract, the profit and loss sharing ratios are as follows: Domingo (25%), Reyes (37.5%),

and Miranda (37.5%).

The following were transactions with the partners during the year:

• Domingo made additional contribution of P7,640

• Reyes withdrew P5,000 for the business

• Miranda contributed P12,000 but withdrew P5,430.

Prepare the partnership's SCE

3. The Retained Earnings of Power Inc. shows a January 1, 2018 balance of P199,760. The

Board of Directors of Power Inc. distributed cash dividends of P11,000 to the

company's stockholders. As of December 31, 2019, the retained earnings reported a

balance of P280,990.

Determine Power Inc. net income for 2019. Prepare the corporation's SCE.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College