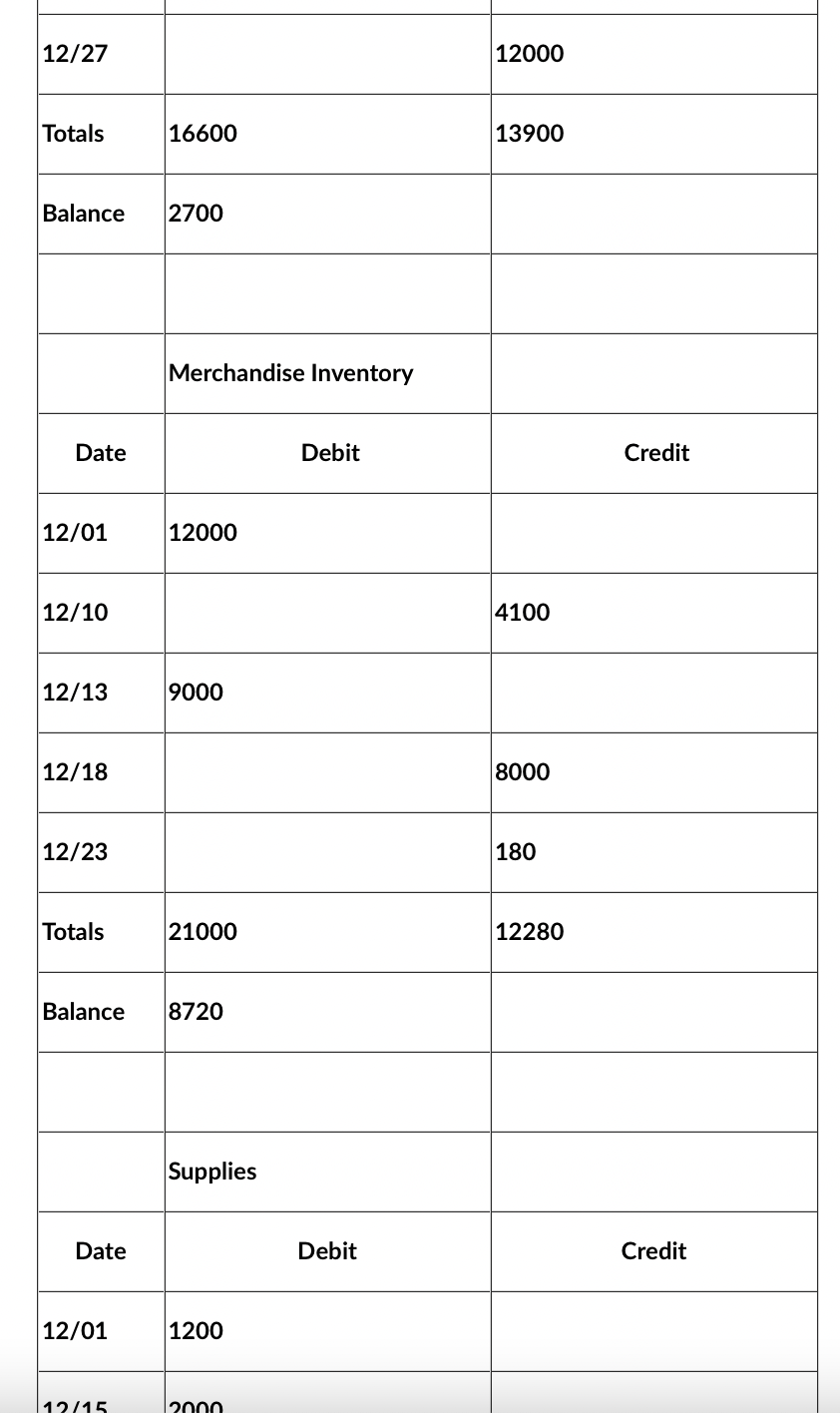

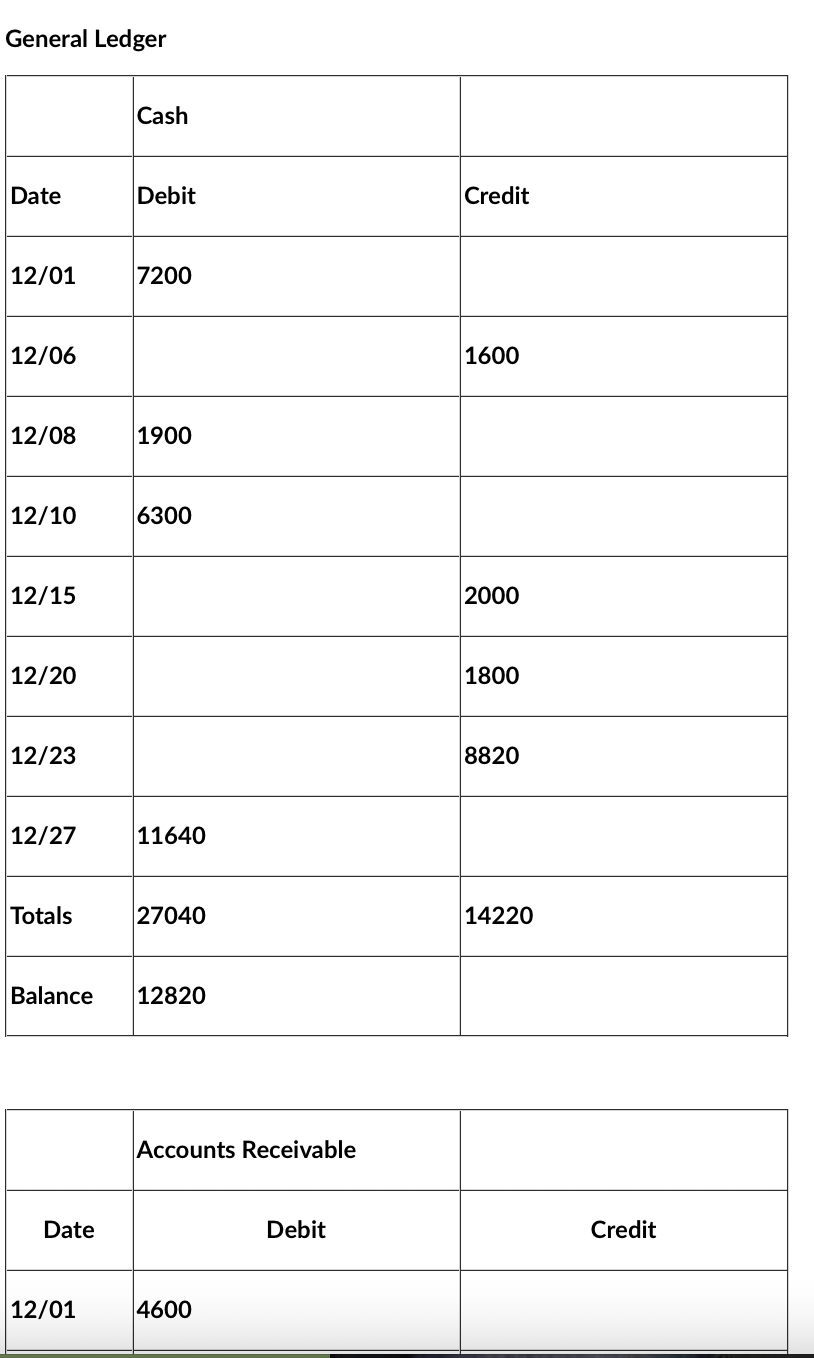

1. Prepare a General ledger for thr following information below: Use the pictures as reference J & M Accounting Services and Office Supplies, LLC Trial Balance January 1, 2022 Title Debit Credit Cash 9,200 Accounts Receivable 2,400 Merchandise Inventory 2,100* Supplies 860 Equipment 23,000 Accumulated Depreciation 1,500 Accounts Payable 3,300 Unearned Service Revenue 3,600 Salaries and Wages Payable 2,485 Common Stock 20,000 Retained Earnings 6,675 Totals $37,560 $37,560 *(3,000 units at $0.70) During the month of January, the following summary transactions were completed. 3 Paid January’s rent $350. 3 Purchased merchandise on account from dd’s Discount Supply terms 2/10, n/30. (4,000 units @ $0.75) 4 Sold 4,400 units of inventory for Cash at $0.96 each. (3,000 @ $0.70 and 1,400 @ $0.75) 7 Gave a January 4th customer $192 for 200 units returned costing $150. (Units were returned to inventory.) 7 Received $2,000 cash from customers in payment of account. (No Discounts) 10 Paid $3,550 for salaries due employees, of which $2,485 is for December and $1,065 is for January. 11 Paid $2,800 on account. (No Discounts) 12 Paid dd’s Discount Supply in full, less discount. 13 Purchased 5,000 units for inventory on account from Office Headquarters at $0.80 each. Terms 2/10, n30. 14 Sold 4,000 units of inventory to customers on account at $0.99 per unit. Terms 2/10, n30. (Sold 2,800 units @ $0.75 and 1,200 units @ $0.80) 17 Received $5,450 Cash for services performed in January. 19 Purchased supplies on account $1,500. 24 Paid Salaries $3,550. 24 Received collections in full, less discount, from customers billed for sales on January 14th. Round to Whole Dollars. 28 Performed services on account and billed customers $2,180. 28 Paid Office Headquarters in full. (No discount). 31 Received $1,500 from customers for services to be performed in the future.

1. Prepare a General ledger for thr following information below:

Use the pictures as reference

J & M Accounting Services and Office Supplies, LLC

January 1, 2022

|

Title |

Debit |

Credit |

|

Cash |

9,200 |

|

|

|

2,400 |

|

|

Merchandise Inventory |

2,100* |

|

|

Supplies |

860 |

|

|

Equipment |

23,000 |

|

|

|

|

1,500 |

|

Accounts Payable |

|

3,300 |

|

Unearned Service Revenue |

|

3,600 |

|

Salaries and Wages Payable |

|

2,485 |

|

Common Stock |

|

20,000 |

|

|

|

6,675 |

|

Totals |

$37,560 |

$37,560 |

*(3,000 units at $0.70)

During the month of January, the following summary transactions were completed.

3 Paid January’s rent $350.

3 Purchased merchandise on account from dd’s Discount Supply terms 2/10, n/30. (4,000 units @ $0.75)

4 Sold 4,400 units of inventory for Cash at $0.96 each. (3,000 @ $0.70 and 1,400 @ $0.75)

7 Gave a January 4th customer $192 for 200 units returned costing $150. (Units were returned to inventory.)

7 Received $2,000 cash from customers in payment of account. (No Discounts)

10 Paid $3,550 for salaries due employees, of which $2,485 is for December and $1,065 is for January.

11 Paid $2,800 on account. (No Discounts)

12 Paid dd’s Discount Supply in full, less discount.

13 Purchased 5,000 units for inventory on account from Office Headquarters at $0.80 each. Terms 2/10, n30.

14 Sold 4,000 units of inventory to customers on account at $0.99 per unit. Terms 2/10, n30.

(Sold 2,800 units @ $0.75 and 1,200 units @ $0.80)

17 Received $5,450 Cash for services performed in January.

19 Purchased supplies on account $1,500.

24 Paid Salaries $3,550.

24 Received collections in full, less discount, from customers billed for sales on January 14th. Round to Whole Dollars.

28 Performed services on account and billed customers $2,180.

28 Paid Office Headquarters in full. (No discount).

31 Received $1,500 from customers for services to be performed in the future.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps