1. Prepare a perpetual inventory record for All Things Auto, using the first in, first out (FIFO) method to determine the value of ending inventory at December 31, 2020, and the total amount to be assigned to cost of goods sold for the period. 2. Given that selling, distribution and administrative costs for the quarter were $23,445, $10,250 and$75,435 respectively, prepare an income statement for All Things Auto (DieHard) for the quarter ended December 31, 2020, to determine the net profit for the quarter. 3. Journalize the transactions on November 12 and November 27, assuming the business uses a: - Perpetual inventory system - Periodic inventory system 4. Vallie Enterprise sells a product that cost $200 per unit and has a monthly demand of 500 units. The annual holding cost per unit is calculated as 2% of the unit purchase price. It costs the business $30 to place a single order. The maximum number of units sold for any one week is 150 and minimum sales 80 units. The vendor takes anywhere from 2 to 4 weeks to deliver the merchandise after the order is placed. The EOQ model is appropriate. i) What is the cost minimizing solution for this product each year? ii)Determine the re-order level, minimum inventory level and maximum inventory level for the product.

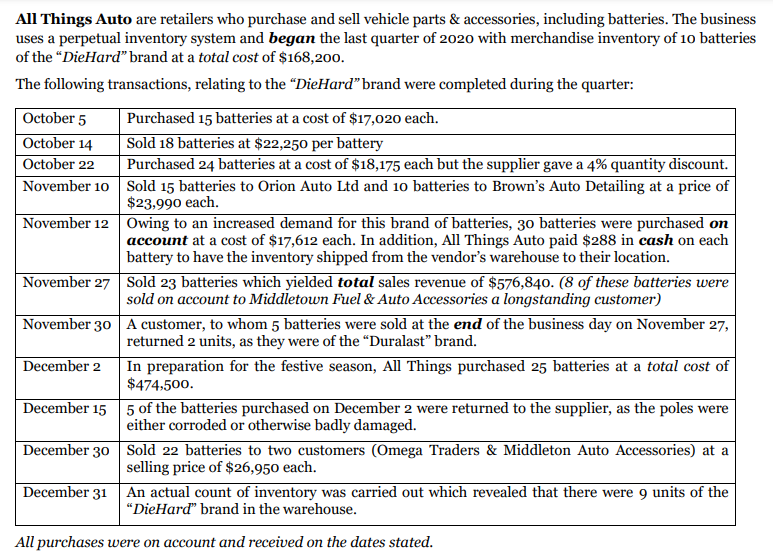

1. Prepare a perpetual inventory record for All Things Auto, using the first in, first out (FIFO) method to determine the value of ending inventory at December 31, 2020, and the total amount to be assigned to cost of goods sold for the period.

2. Given that selling, distribution and administrative costs for the quarter were $23,445, $10,250 and$75,435 respectively, prepare an income statement for All Things Auto (DieHard) for the quarter ended December 31, 2020, to determine the net profit for the quarter.

3. Journalize the transactions on November 12 and November 27, assuming the business uses a:

- Perpetual inventory system

- Periodic inventory system

4. Vallie Enterprise sells a product that cost $200 per unit and has a monthly demand of 500 units. The annual holding cost per unit is calculated as 2% of the unit purchase price. It costs the

business $30 to place a single order.

The maximum number of units sold for any one week is 150 and minimum sales 80 units. The vendor takes anywhere from 2 to 4 weeks to deliver the merchandise after the order is placed. The

EOQ model is appropriate.

i) What is the cost minimizing solution for this product each year?

ii)Determine the re-order level, minimum inventory level and maximum inventory level for the product.

Step by step

Solved in 2 steps