1. Prepare a statement of liquidation with supporting schedules.

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 3EA: The partnership of Tasha and Bill shares profits and losses in a 50:50 ratio, and the partners have...

Related questions

Question

1. Prepare a statement of liquidation with supporting schedules.

2.

3. Prepare a cash priority program.

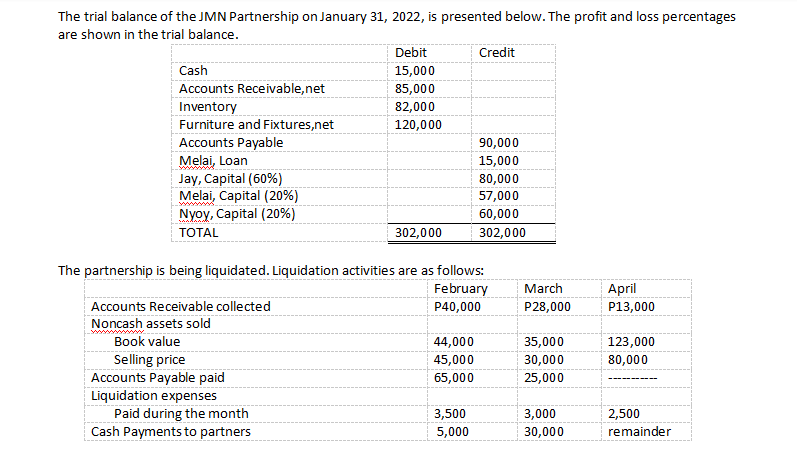

Transcribed Image Text:The trial balance of the JMN Partnership on January 31, 2022, is presented below. The profit and loss percentages

are shown in the trial balance.

Debit

Credit

Cash

15,000

Accounts Receivable,net

85,000

Inventory

Furniture and Fixtures,net

Accounts Payable

Melai, Loan

Jay, Capital (60%)

Melai, Capital (20%)

Nyoy, Capital (20%)

82,000

120,000

90,000

15,000

80,000

57,000

60,000

TOTAL

302,000

302,000

The partnership is being liquidated. Liquidation activities are as follows:

February

P40,000

March

April

Accounts Receivable collected

P28,000

P13,000

Noncash assets sold

Book value

44,000

35,000

123,000

Selling price

Accounts Payable paid

Liquidation expenses

Paid during the month

Cash Payments to partners

45,000

30,000

80,000

65,000

25,000

3,500

3,000

2,500

5,000

30,000

remainder

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,