1. Prepare corrected income statements for the three years. 2. State, whether each year’s net income before your corrections is understated or overstated, and indicate the amount of the understatement or overstatement. 3. Compute the inventory, turnover and days sales in inventory using the correct income statement for the three years. round to two decimals.

1. Prepare corrected income statements for the three years. 2. State, whether each year’s net income before your corrections is understated or overstated, and indicate the amount of the understatement or overstatement. 3. Compute the inventory, turnover and days sales in inventory using the correct income statement for the three years. round to two decimals.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter14: Adjustments For A Merchandising Business

Section: Chapter Questions

Problem 3MC: Under the periodic inventory system, what account is debited when an estimate is made for the cost...

Related questions

Question

1. Prepare corrected income statements for the three years.

2. State, whether each year’s net income before your corrections is understated or overstated, and indicate the amount of the understatement or overstatement.

3. Compute the inventory, turnover and days sales in inventory using the correct income statement for the three years. round to two decimals.

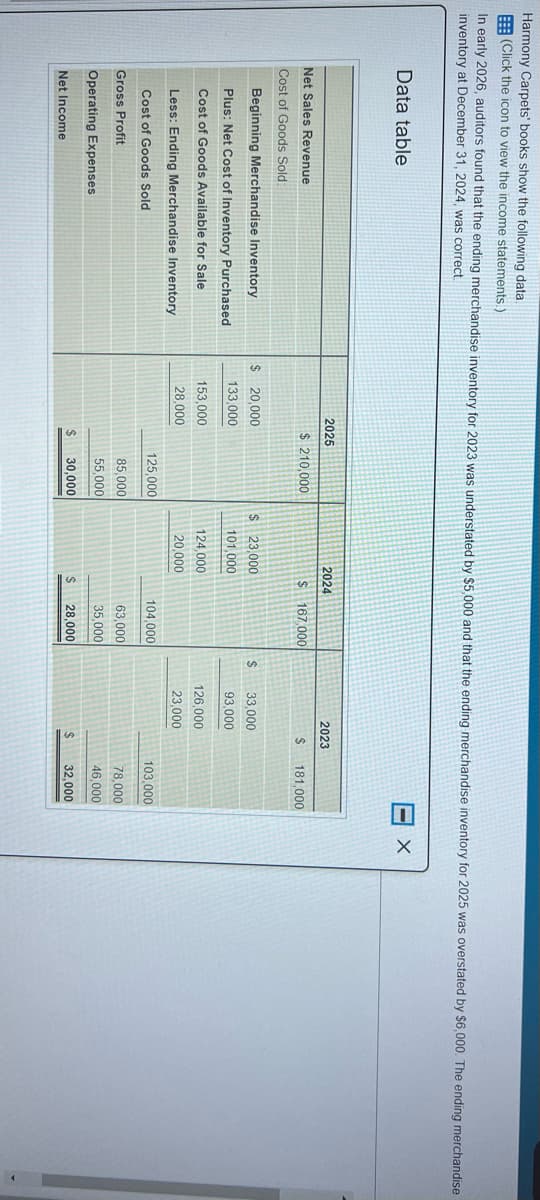

Transcribed Image Text:Harmony Carpets' books show the following data.

(Click the icon to view the income statements.)

In early 2026, auditors found that the ending merchandise inventory for 2023 was understated by $5,000 and that the ending merchandise inventory for 2025 was overstated by $6,000. The ending merchandise

inventory at December 31, 2024, was correct.

Data table

Net Sales Revenue

Cost of Goods Sold:

Beginning Merchandise Inventory

Plus: Net Cost of Inventory Purchased

Cost of Goods Available for Sale

Less: Ending Merchandise Inventory

Cost of Goods Sold

Gross Profit

Operating Expenses

Net Income

2025

$ 20,000

133.000

153,000

28,000

$ 210,000

125,000

85,000

55,000

30,000

2024

$ 23,000

101,000

124,000

20,000

$ 167,000

104,000

63,000

35,000

28,000

S

2023

33,000

93,000

126,000

23,000

$ 181,000

$

103,000

78,000

46,000

32,000

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College