1. Present entries to record the following for a business that uses the Allowance Method: a) Record the adjusting entry at 12/31/19, the end of the fiscal year to provide for doubtful accounts. The accounts receivable account has a balance of $100,000 and the contra asse account, before adjustment has a debit balance of $700. Analysis of receivables indicates doubtful accounts of $4,500 b) In March of the following fiscal year $610 owed by the Filthy Disgusting Yankees Inc was written off. Six months later the $610 is reinstated and payment of that amount received

1. Present entries to record the following for a business that uses the Allowance Method: a) Record the adjusting entry at 12/31/19, the end of the fiscal year to provide for doubtful accounts. The accounts receivable account has a balance of $100,000 and the contra asse account, before adjustment has a debit balance of $700. Analysis of receivables indicates doubtful accounts of $4,500 b) In March of the following fiscal year $610 owed by the Filthy Disgusting Yankees Inc was written off. Six months later the $610 is reinstated and payment of that amount received

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter14: Accounting For Uncollectible Accounts Receivable

Section14.1: Uncollectible Accounts Receivable

Problem 1OYO

Related questions

Question

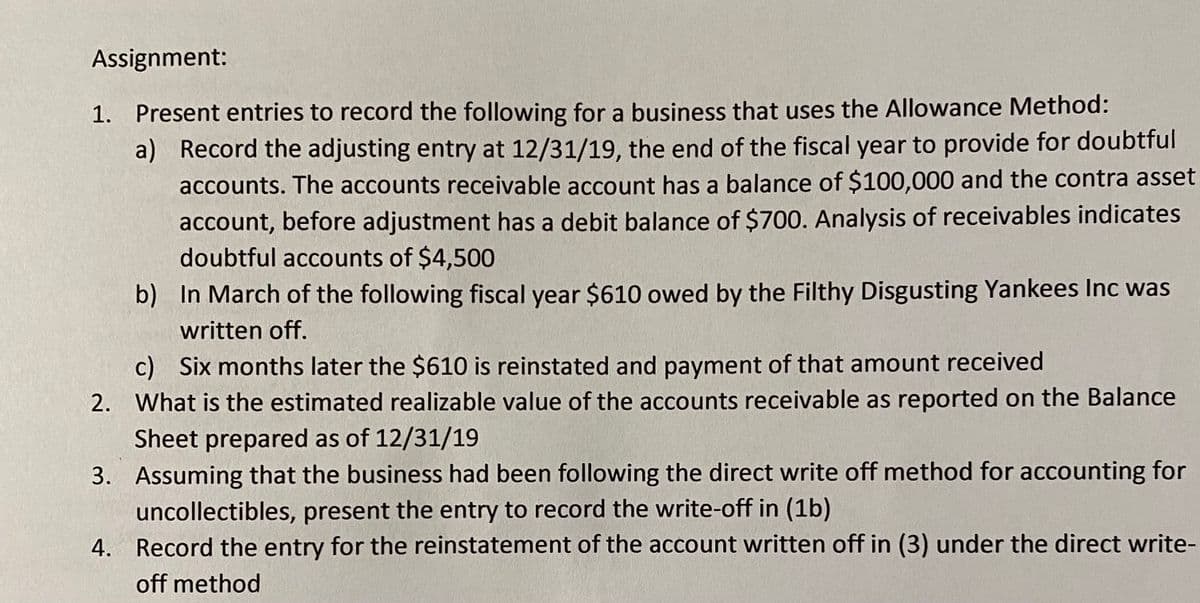

Transcribed Image Text:Assignment:

1. Present entries to record the following for a business that uses the Allowance Method:

a) Record the adjusting entry at 12/31/19, the end of the fiscal year to provide for doubtful

accounts. The accounts receivable account has a balance of $100,000 and the contra asset

account, before adjustment has a debit balance of $700. Analysis of receivables indicates

doubtful accounts of $4,500

b) In March of the following fiscal year $610 owed by the Filthy Disgusting Yankees Inc was

written off.

c) Six months later the $610 is reinstated and payment of that amount received

2. What is the estimated realizable value of the accounts receivable as reported on the Balance

Sheet prepared as of 12/31/19

3. Assuming that the business had been following the direct write off method for accounting for

uncollectibles, present the entry to record the write-off in (1b)

4. Record the entry for the reinstatement of the account written off in (3) under the direct write-

off method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College