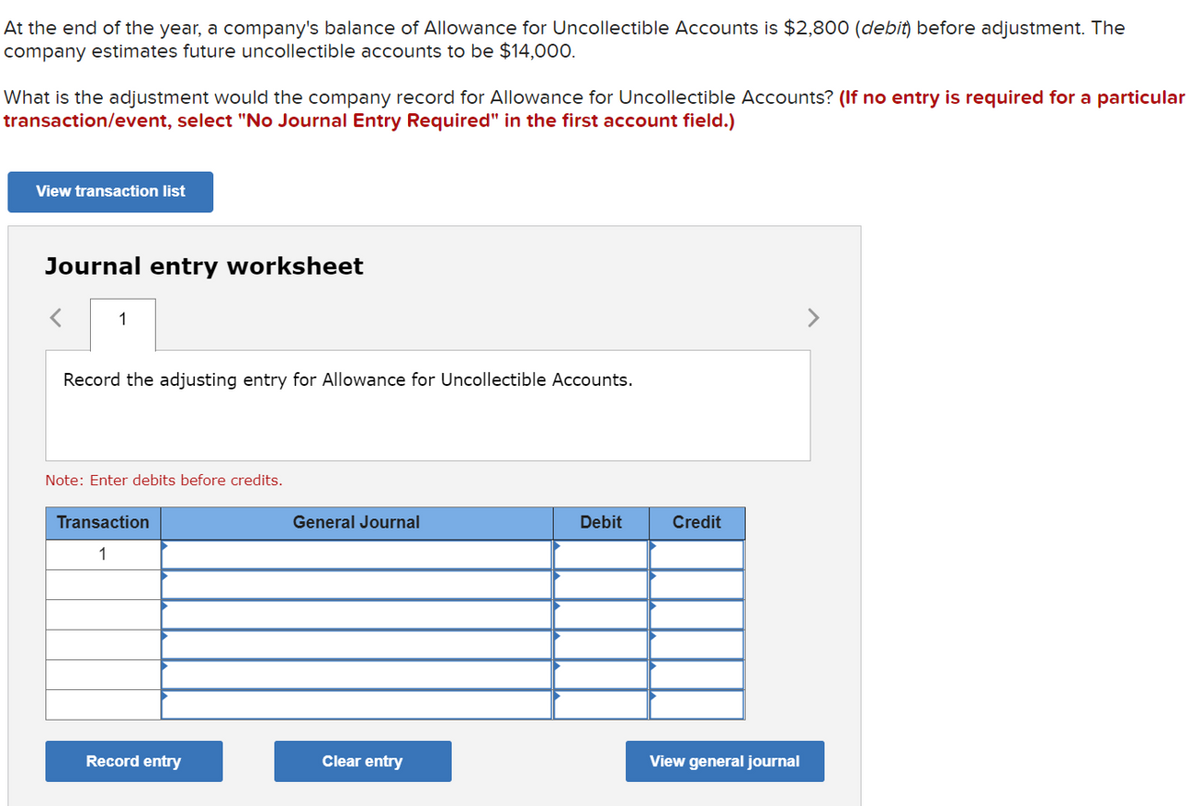

At the end of the year, a company's balance of Allowance for Uncollectible Accounts is $2,800 (debit) before adjustment. The company estimates future uncollectible accounts to be $14,000. What is the adjustment would the company record for Allowance for Uncollectible Accounts? (If no entry is required for a particular ransaction/event, select "No Journal Entry Required" in the first account field.)

At the end of the year, a company's balance of Allowance for Uncollectible Accounts is $2,800 (debit) before adjustment. The company estimates future uncollectible accounts to be $14,000. What is the adjustment would the company record for Allowance for Uncollectible Accounts? (If no entry is required for a particular ransaction/event, select "No Journal Entry Required" in the first account field.)

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter14: Accounting For Uncollectible Accounts Receivable

Section14.1: Uncollectible Accounts Receivable

Problem 1OYO

Related questions

Question

Transcribed Image Text:At the end of the year, a company's balance of Allowance for Uncollectible Accounts is $2,800 (debit) before adjustment. The

company estimates future uncollectible accounts to be $14,000.

What is the adjustment would the company record for Allowance for Uncollectible Accounts? (If no entry is required for a particular

transaction/event, select "No Journal Entry Required" in the first account field.)

View transaction list

Journal entry worksheet

1

<>

Record the adjusting entry for Allowance for Uncollectible Accounts.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

1

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,