Q: The estimated monthly sales of Mona Lisa paint-by-number sets is given by the formula q = 95e−3p2 +…

A: The estimated monthly sales of Mona Lisa paint-by-number sets is given by the formula q = 95e−3p2 +…

Q: Refer to the figure. Suppose that the economy is currently at point A, and the unemployment rate at…

A: Short-run Phillips curve The Short-run Phillips curve is downward sloping from left to right. The…

Q: You are the manager of Taurus Technologies (Firm 1), and your sole competitor is Spyder Technologies…

A: Given cost functions are, C(Q1) = 120 + 8Q1 C(Q2) = 120 + 12Q2 Market demand function is, P = 160…

Q: Assume that a consumer has a given budget or income of $12 and that she can buy only two goods,…

A: The study of how individuals distribute their money and available monetary income based on their own…

Q: coordinates of points

A: The given diagram illustates the short run and the long run cost curves with Quantity on the X axis…

Q: a) Discuss why anti-trust laws or competition laws are necessary in market environments? b) : Each…

A: A) To safeguard consumers from anti-competitive practises in market environments, antitrust laws or…

Q: b) William consumes hamburgers (H) and Chips (C) and has a utility function U(H,T)=H&C. If the price…

A: “Since you have posted multiple questions with multiple sub-parts, we will provide the solution only…

Q: 2. Consider Q(L,K)= KL. Suppose that the unit output price is $12, and the unit labor cost and the…

A: Production function QL,K=K1/2L1/4 .... (1) Output price P=12 per unit Labor cost per unit w…

Q: Consider a world composed of two countries, Home (H) and Foreign (F). Individuals living in each…

A: Autarky refers to a situation where a country or economy is self-sufficient and does not engage in…

Q: Quantity 0 4 8 00 12 16 20 24 ED. Industry currently has 500 firms, all of which have fixed costs of…

A: A cost schedule refers to a tabular representation of the total costs incurred by a firm in…

Q: O Macmillan Learning The accompanying graph depicts the marginal cost (MC), average total cost…

A: In monopolistically competitive market, there are many firms producing differentiated goods.

Q: There are many differences between a market served by a monopoly and a market that is perfectly…

A: In an economy, there are different types of market based on characteristics of a product whether it…

Q: $800 AGGREGATE EXPENDITURE (in billions) 600. 400 200 150 125 75 $200 $300 $400 $500 $600 O II and…

A: Aggregate Demand: Aggregate demand in an economy is the sum of private consumption expenditure (C),…

Q: The Medicaid program provides health insurance for the O disabled. poor. veterans of wars.

A: The costs of an insured person's medical care and surgical procedures are covered by health…

Q: Discuss issues involved in measuring economic impact studies of the NFL.

A: Economic impact refers to the net effect of an event or project on the economy, typically measured…

Q: Equilibrium in the goods market requires that Aggregate Output equals Aggregate Expenditures. Given…

A: The investment saving curve or IS curve represents various combinations of income and interest rates…

Q: Suppose that two European electronics companies, Siemens (Firm S) and Alcatel-Lucent (Firm T),…

A: The total cost function is a mathematical equation that represents the total cost of producing a…

Q: 3. Rule versus discretion This question below addresses whether monetary policy should be…

A: Monetary policy refers to the actions taken by a central bank, such as the Federal Reserve in the…

Q: The province wishes to improve our environment and accordingly will subsidise your municipality $ 2…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Suppose we wanted to use fiscal policy (a change in taxes OR a change in government spending) in…

A: Fiscal policy refers to the use of government spending and taxation to influence the economy. It is…

Q: My question is (c). Basically, AS curve becoming steeper can be reflected by the value of v bar…

A: Aggregate demand refers to the total demand for commodities and services made by all the economic…

Q: a) What is the market demand for the monopoly? (Hint: Compute the marginal consumer who is…

A: a) To find the market demand, we need to find the quantity of units that consumers are willing to…

Q: Suppose the government regulates the price of a good to be no lower than some minimum level.…

A: Price control is the practice of fixing prices by a legislative body, regulatory body, or by…

Q: Suppose that the monopolist from Question 4 is now forced to charge the same price in both markets.…

A: Under a monopoly, a single seller faces the entire market demand on his own. Here, the seller…

Q: Assets Reserves Loans Bank's Balance Sheet $150 $600 Liabilities and Owners' Equity Deposits Debt…

A: The term "assets" in economics refers to something that may be valuable economically or in the…

Q: The author of your textbook defines a bank’s leverage ratio as the value of its assets divided by…

A: A bank's leverage ratio measures the amount of debt it has concerning its equity. It is calculated…

Q: Principles of Macroeconomics: ECO252 Recalling Classical, Keynesian, and now Supply-side economics.…

A: Considering each school's belief in the role of government in the economy and how economies adjust…

Q: Choose the statement that about deflation that is incorrect. O A. The price level falls if aggregate…

A: Inflation happens with an increment in the prices of products and services, generally because of an…

Q: Some resource-rich countries have succeeded in converting resource wealth into longterm and…

A: Equitable economic growth refers to an economic development that is inclusive and benefits all…

Q: need d. aswell

A: Labour productivity is calculated as production per labour hour. Labour productivity is mostly…

Q: QUESTION - 2- The slope of the AS curve: (a) Why does the AS curve slope upward? (b) If the AS curve…

A: When the price level for goods and the money market are both at equilibrium, the aggregate demand…

Q: Trade Elasticity is of great importance to economics of shipping because it is an indicator of:…

A: Trade elasticity is defined as the percentage change in shipping demand caused by a one percent…

Q: What are the functions of Land Bank of the Philippines and what do they do/mandate?

A: On August 8, 1963, LandBank became operational under the provisions of the Agricultural Land Reform…

Q: 2. Recoverable vs. NonRecoverable Cost: Radio broadcaster CoolPlay Inc., paid $50,000 for an…

A: Cost of license = 50,000 Monthly revenue = 6000 Monthly expenditure = 5000

Q: Parkway Travel Tours is organizing a five-day trip from Toronto to Branson, Missouri, a family town…

A: A break-even chart is a graphical representation of the relationship between revenue, costs, and…

Q: Current Account equilibrium is defined as NX = x₁YW + x2R=m₁Y + m₂R and Capital Account equilibrium…

A: The current and capital accounts records the transactions for nation's balance of payment. The…

Q: a. If segmenting is feasible, what are the profit-maximizing prices, quantities, and maximized…

A: A monopoly refers to a market structure in which a single firm dominates the entire market, allowing…

Q: Suppose individual K consumes two goods and two goods only, good X and good Y. Using a graph with…

A: Substitution effect and income effect are two concepts used in economics to describe the change in…

Q: Consider a prosperous open economy such as Singapore. If Singapore’s saving rate (gross domestic…

A: In an open economy, aggregate expenditure is a sum of consumption (C), investment (I), government…

Q: Question 2 a) Write an equation that expresses the Keynesian production function as depicted by the…

A: A Production function is a mathematical equation that shows the relationship between inputs used in…

Q: V (5) suppose that you decide that it would not be a bad idea to get an internship over the summer…

A: Profit maximizing output choice for a firm is the level of output that generates the highest…

Q: Indy runs a small pet shop. He pays one employee $42,000 per year and spends $60,000 on pets and…

A: Forgone income, also known as opportunity cost, refers to the income or financial benefits that are…

Q: Which of the following statements regarding financing of government expenditure are correct? i. The…

A: Government expenditure refers to the sum of money went through by the government on different…

Q: On the following graph, the black line shows potential real GDP and the blue line shows actual real…

A: GDP or gross domestic product is the sum of the value of all end commodities produced within the…

Q: Derive the production possibilities frontier (PPF) for Home and Foreign and plot it in a graph with…

A: A production possibility frontier (PPF) shows the maximum possible output combinations of two goods…

Q: to the diagram. An indus only if it accepted a wag only if it could shift the by negotiating any…

A: In a monopolistic labor market, employers hire labor at the intersection point of the demand curve…

Q: Explain what is the benefit of a free government.

A: Government refers to the framework or body of individuals, educate, and forms that are capable for…

Q: Pipes R Us has designed a pipeline that provides a throughput of 70,000 gallons of water per 24-hour…

A: The general definition of this term in economics is an economic theory that specifies the rate at…

Q: How much interest (to the nearest dollar) would be saved on the following loan if the condominium…

A: Present value is the value of investment in today's dollar. Future value is the value of investment…

Q: The price of a bond O increases as interest rates in the financial sector increase O decreases as…

A: Bond is a kind of loan. The borrower issues bonds to raise an amount from the investor. Because of…

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

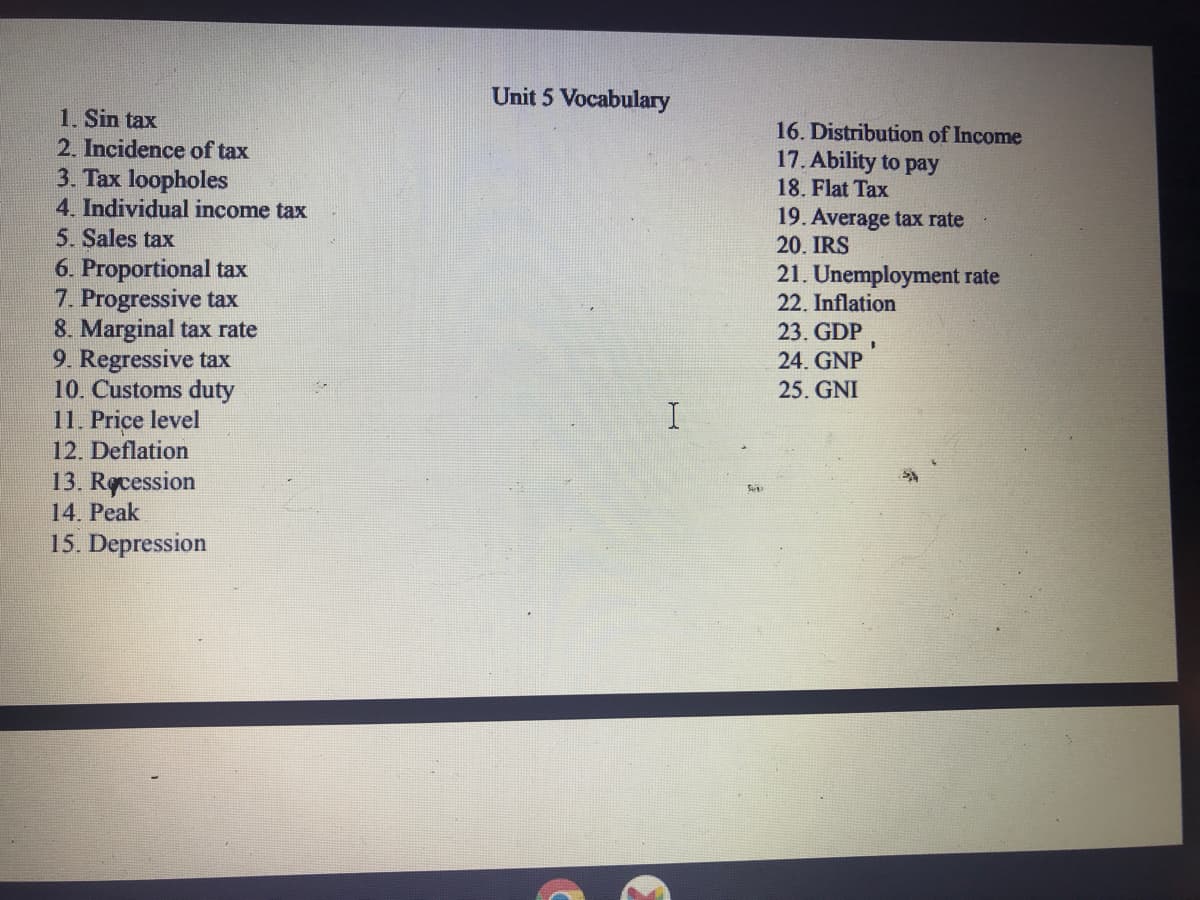

- Define individual income tax. A. Individual income tax is the tax an individual pays to the government based on their income from wages.B. Individual income tax is a tax levied on corporations.C. Individual income tax is a tax levied on the value of property or land.D. Individual income tax is a tax paid on a specific product. The producer often passes the cost of the tax to the consumer.Match the term and the definition: flat tax Places heavier burden on poor than on rich as your income increases, the percentage that you pay increases A. Progressive taxes B. Proportional taxes C. Regressive taxesReduction and elimination of corporate income taxes (CIT) and the economic result: Examples from North Carolina and Ohio The corporate income tax (CIT) is levied by federal and state governments on business profits, which are revenues (what a business makes in sales) minus costs (the cost of doing business). State-level corporate income tax rates vary across the country. Six states (Nevada, Ohio, South Dakota, Texas, Washington, and Wyoming) levy no corporate income tax, while the remaining states and the District of Columbia do tax corporate profits. Note: Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. Lowering the CIT: North Carolina North Carolina’s tax environment is one of the nation’s most competitive. As of 2021, the state boasted the nation’s third-lowest effective tax rates for newly established firms and fifth-lowest rates for mature firms. Just eight years ago, North…

- The government must increase its tax revenues to cover the higher federal deficit. It imposesa sales tax of $5 on salad.1st statement – The Legislative Department levies the taxes.2nd statement – The Executive Department, through the Department of Finance’s line agency, the Bureau of Internal Revenue makes the assessment and collection of internal revenue taxes. a. Only the 1st statement is trueb. Only the 2nd statement is truec. Both statements are trued. Both statements are false1. Statement 1: Police power can be used to raise revenue for the government. Statement 2: The primary purpose of taxation is to implement police power. Statement 3: One example of the principle fiscal adequacy is the Introduction of electronic Filing (Electronic Filing and Payment System (EFPS) or e-BIR Forms Package A. Only statement 2 is false. B. Only statement 1 is true. C. Only statement 2 is true. D. Only statement 3 is false. 2. Statement 1: If Nicanor are both engaged in trade or business, both must be taxed alike. Statement 2: Nicanor reported to the BIR that Inday is a tax evader. The BIR cannot forthwith collect the tax because it has to go through a process. A. Inherent limitation, Inherent limitation B. Inherent limitation, Constitutional limitation C. Constitutional limitation, Inherent limitation D. Constitutional limitation, Constitutional limitation 3. Statement 1: The Commissioner can estimate the income and expense of a taxpayer. Statement 2: Regressive…

- Please no written by hand and no image in 2017 the mortgage interest deduction became even more regressive than in thepast. Regressive, in this context, means that it benefits the wealthy significantlymore than those lower on the income scale. The reason is simple: Mortgage interestis a function of the size of the mortgage. Since the wealthy tend to buy moreexpensive homes, their mortgages are larger and their tax benefits larger. Does thatmatter to your opinion of the subsidy?There are two individuals in a society. The federal income tax in this society is such that that the first $20,000 of income is taxed at 10% and income above that is taxed at 30%. The federal government allows taxes paid to local governments to be deducted. Peter earns a gross income of $53,000, and Sandy earns a gross income of $65,000. Out of his income, Peter pays $3,000 in local taxes; out of her income, Sandy pays $5,000 in local taxes. Which of the following statements is true? a. Peter’s total (local + federal) tax bill is greater than Sandy’s total tax bill. b. The federal tax system is progressive. c. The federal tax system is proportional. d. The federal tax system is regressiveIn 1998, the government reduced its debt by $40 billion and it spent $420 billion. How much tax revenue did the government receive in 1998? Select one: a. $340 billion b. $380 billion c. $420 billion d. $460 billion e. $500 billion

- Income: 115,000 State Tax Rate: 7 % Federal Income Tax: $0 to $29,000 10% Federal Payroll Tax Rate: 12% $29,001 to $58,300 15% $58,301 to $163,000 29% * Round all answers to 2 decimal places. Do not include any commas or percentage signs.* a) Compute the total tax paid b) What is the marginal tax rate? c) What is the average tax rate?22. The Taxes on corporate income (included in current tax receipts) for the 4th quarter of 2019 is: $______ billions. 23.The Taxes on corporate income (included in current tax receipts) for the 4th quarter of 2017 is: $______ billions. 24.The change in the Taxes on corporate income, from 4th quarter of 2017 to the 4th quarter of 2019 is: ______ billions. 25. The Contributions for government social insurance FROM PERSONS for the 4th quarter of 2019 is: $______ billions. 26. The Contributions for government social insurance FROM PERSONS for the 4th quarter of 2017 is: $______ billions. 27. The change in the Contributions for government social insurance FROM PERSONS, from 4th quarter of 2017 to the 4th quarter of 2019 is: ______ billions.3-The public welfare spending category for state and local governments includes Group of answer choices many programs that are initiated by private foundations. contributions in support of public universities. some federal programs that are administered by state and local governments. All of the above are correct. 3.1-The amount of income tax owed by a family is Group of answer choices not simply proportional to its total income. unaffected by deductions. total income minus tax credits. a constant fraction of income.