1. Stihl Repairs completed the following petty cash transactions during July 2017: Add 13% HST to all transactions. All vouchers are numbered sequentially beginning with #81 y 5: Prepared a $500 cheque, cashed it, and turned the proceeds and the petty cash K over to Bob Stuart, the petty cashier. The fund was started with this $500. y 6: Paid $108.00 COD charges on merchandise purchased for resale. Stihl Repairs es the perpetual inventory method to account for merchandise inventory. y 11: Paid $23.75 delivery charges on merchandise sold to a customer. y 12: Purchased file folders, $8.50. y 14: Reimbursed Collin Dodge, the manager of the business, $8.26 for office oplies purchased. y 18: Purchased paper for printer, $12.15. y 27: Paid $21.60 COD charges on merchandise purchased for resale. y 28: Purchased stamps, $23.00 y 30: Reimbursed Collin Dodge $64.80 for business car expenses. y 31: Bob Stuart sorted the petty cash receipts by accounts affected and exchanged =m for a cheque to reimburse the fund for expenditures. quired: Prepare a general journal entry to record establishing the petty cash fund. 2).Prepare summary of petty cash payments, that has these categories: delivery expense, auto pense, postage expense, merchandise inventory, and office supplies. Calculate the cash on hand Prepare the general journal entry to record the reimbursement of the fund

1. Stihl Repairs completed the following petty cash transactions during July 2017: Add 13% HST to all transactions. All vouchers are numbered sequentially beginning with #81 y 5: Prepared a $500 cheque, cashed it, and turned the proceeds and the petty cash K over to Bob Stuart, the petty cashier. The fund was started with this $500. y 6: Paid $108.00 COD charges on merchandise purchased for resale. Stihl Repairs es the perpetual inventory method to account for merchandise inventory. y 11: Paid $23.75 delivery charges on merchandise sold to a customer. y 12: Purchased file folders, $8.50. y 14: Reimbursed Collin Dodge, the manager of the business, $8.26 for office oplies purchased. y 18: Purchased paper for printer, $12.15. y 27: Paid $21.60 COD charges on merchandise purchased for resale. y 28: Purchased stamps, $23.00 y 30: Reimbursed Collin Dodge $64.80 for business car expenses. y 31: Bob Stuart sorted the petty cash receipts by accounts affected and exchanged =m for a cheque to reimburse the fund for expenditures. quired: Prepare a general journal entry to record establishing the petty cash fund. 2).Prepare summary of petty cash payments, that has these categories: delivery expense, auto pense, postage expense, merchandise inventory, and office supplies. Calculate the cash on hand Prepare the general journal entry to record the reimbursement of the fund

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 2PB

Related questions

Question

100%

Petty cash

Transcribed Image Text:.. . .

2

3 . L

4 . I 5... I .

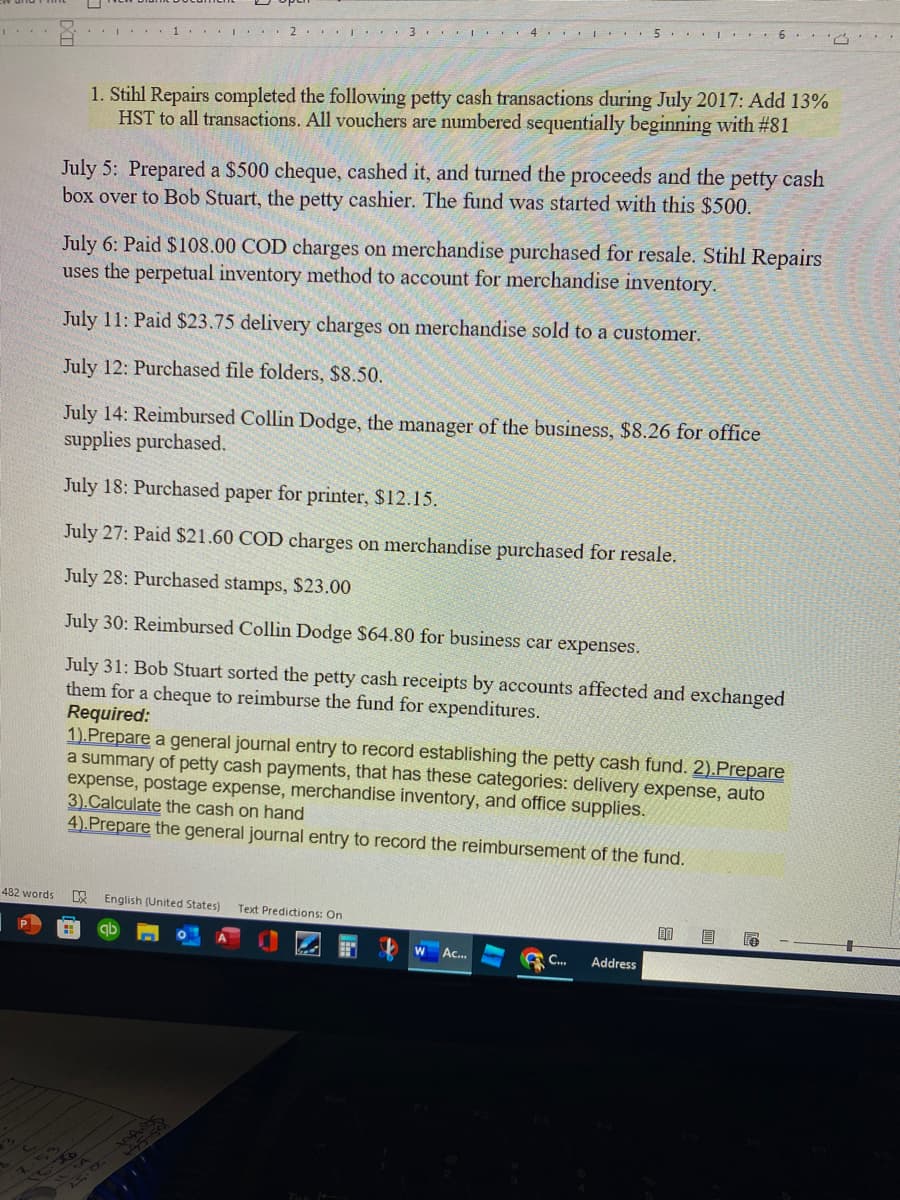

1. Stihl Repairs completed the following petty cash transactions during July 2017: Add 13%

HST to all transactions. All vouchers are numbered sequentially beginning with #81

July 5: Prepared a $500 cheque, cashed it, and turned the proceeds and the petty cash

box over to Bob Stuart, the petty cashier. The fund was started with this $500.

July 6: Paid $108.00 COD charges on merchandise purchased for resale. Stihl Repairs

uses the perpetual inventory method to account for merchandise inventory.

July 11: Paid $23.75 delivery charges on merchandise sold to a customer.

July 12: Purchased file folders, $8.50.

July 14: Reimbursed Collin Dodge, the manager of the business, $8.26 for office

supplies purchased.

July 18: Purchased paper for printer, $12.15.

July 27: Paid $21.60 COD charges on merchandise purchased for resale.

July 28: Purchased stamps, $23.00

July 30: Reimbursed Collin Dodge $64.80 for business car expenses.

July 31: Bob Stuart sorted the petty cash receipts by accounts affected and exchanged

them for a cheque to reimburse the fund for expenditures.

Required:

1).Prepare a general journal entry to record establishing the petty cash fund. 2).Prepare

a summary of petty cash payments, that has these categories: delivery expense, auto

expense, postage expense, merchandise inventory, and office supplies.

3).Calculate the cash on hand

4).Prepare the general journal entry to record the reimbursement of the fund.

482 words

W English (United States)

Text Predictions: On

qb

即

Ac...

C...

Address

554

350

1-4

25-04

21

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning