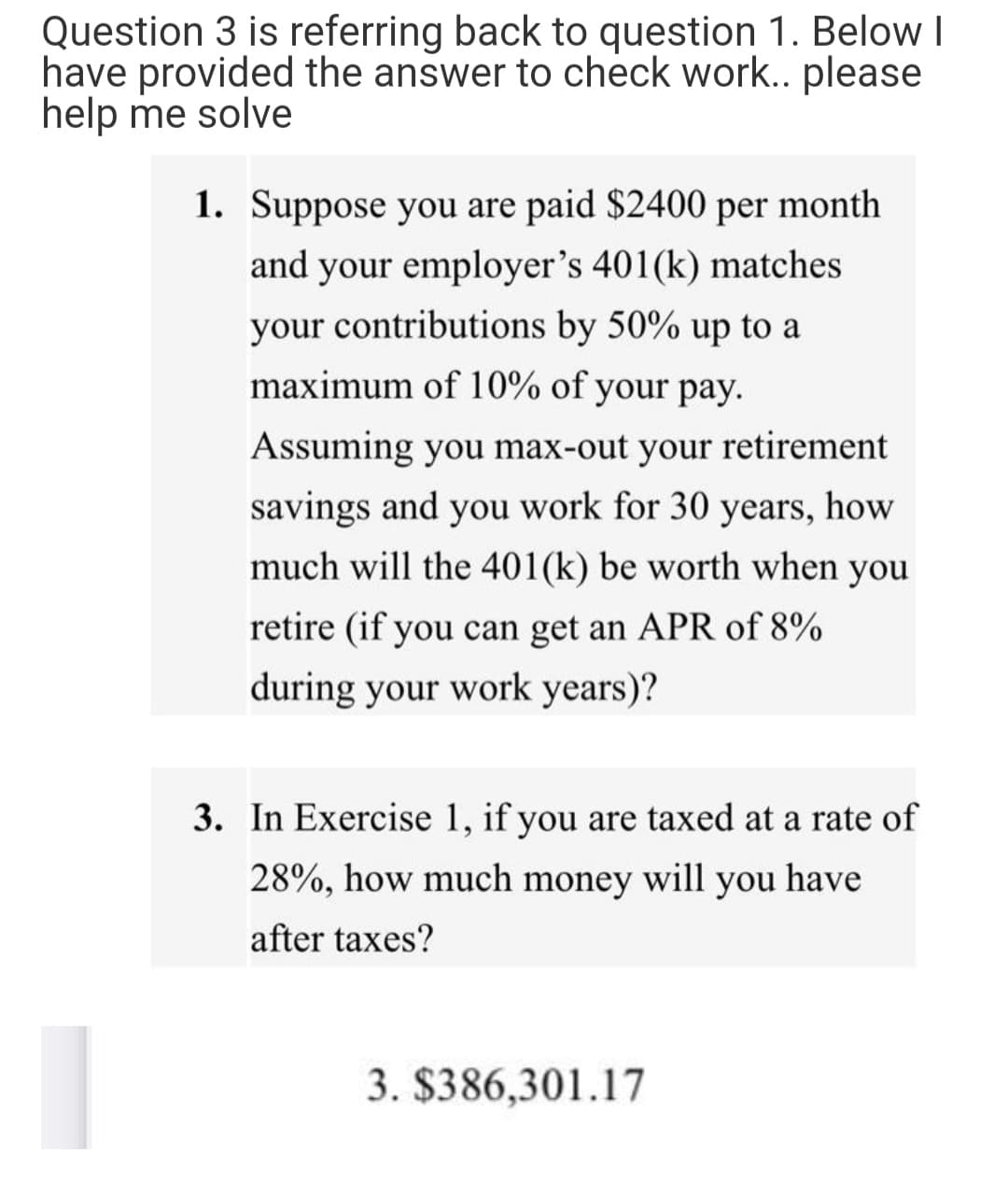

1. Suppose you are paid $2400 per month and your employer's 401(k) matches your contributions by 50% up to a maximum of 10% of your pay. Assuming you max-out your retirement savings and you work for 30 years, how much will the 401(k) be worth when you retire (if you can get an APR of 8% during your work years)? 3. In Exercise 1, if you are taxed at a rate of 28%, how much money will you have after taxes?

1. Suppose you are paid $2400 per month and your employer's 401(k) matches your contributions by 50% up to a maximum of 10% of your pay. Assuming you max-out your retirement savings and you work for 30 years, how much will the 401(k) be worth when you retire (if you can get an APR of 8% during your work years)? 3. In Exercise 1, if you are taxed at a rate of 28%, how much money will you have after taxes?

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 8EB: You put $600 in the bank for 3 years at 15%. A. If Interest Is added at the end of the year, how...

Related questions

Question

Transcribed Image Text:Question 3 is referring back to question 1. Below I

have provided the answer to check work.. please

help me solve

1. Suppose you are paid $2400 per month

and your employer's 401(k) matches

your contributions by 50% up to a

maximum of 10% of your pay.

Assuming you max-out your retirement

savings and you work for 30 years,

how

much will the 401(k) be worth when you

retire (if you can get an APR of 8%

during your work years)?

3. In Exercise 1, if you are taxed at a rate of

28%, how much money will you have

after taxes?

3. $386,301.17

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning